More From Forbes

Apple's rise and nokia's fall highlight platform strategy essentials.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Image via CrunchBase

The theory of disruptive innovation says smaller players get to spot disruptive opportunities, and new value chains, before their bigger brothers. Entrenched companies by way of contrast look to protect the cash they enjoy from their dominant position. Here's why I think that is wrong and how we need to rethink disruption (and innovation!).

First let's rephrase the theory - big companies are comfortable with smaller players taking a small bite out of their breakfast. What they fail to realize is that the nutrition gained at the outset will prime that small critter to take a chunk of their lunch and then to push them out of the way at dinner.

Often, and more and more often, this is not what happens. Nokia is a case study in modern disruption.

Let's go back to 2006 to review the essentials of why.

Apple was about to launch a phone that nobody in the mobile world thought they had much of a chance. The company was just being too ambitious. They were calling it the iPhone and it was due soon.

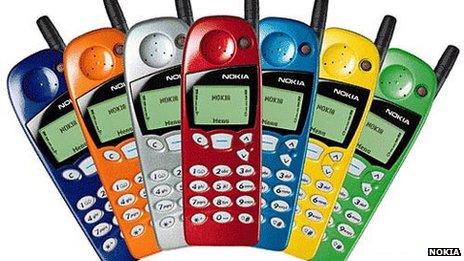

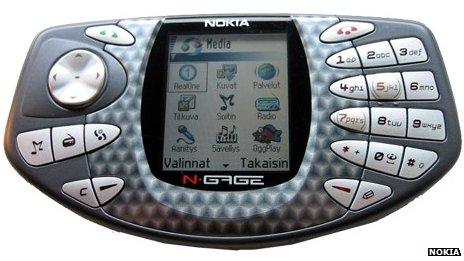

Nokia sold phones in the hundreds of millions, controlled supply chains and had the tightest relationships with carriers. Customers meanwhile had to do mobile computing on a screen the size of their thumb.

While Apple was designing the iPhone and Nokia was selling half a billion phones each year, Google bought a company called Android and announced an Open Handset Alliance , a grouping of industry players who would come together to build an open source OS for smartphones. Nokia was invited to join but refused to demean itself.

Soon afterApple launched an Apps Store that began to take off, attracting tens of thousands of developers, and then customers.

Within two years of these events Nokia was already in crisis. In 2007, Nokia had a market capitalization of €110 billion; by May 2012 this had fallen to €14.8 billion. Those figures illustrate the extent of the decline over 5 years, years in which Apple and Android came to dominate smartphones.

So what are the lessons here for innovation? The first is that neither Apple nor Google were small players. They were hardly start-ups. They are both highly accomplished.

But they were making adjacency moves of a very radical nature - and at that time no company in their right mind made big adjacency moves likes this into totally new markets, like from ads to mobile and computing to mobile.

With the iPhone and Android, a new kind of adjacency was born, one I have called elsewhere radical adjacency . But so too was a new kind of platform business.

Apple had no inkling that its Apps Store would be so successful but it had experience of scaling a platform, with iTunes. That content platform already had the major ingredients for success for all types of platform businesses - intellectual property protection, seamless commerce, great content ingest, high scalability, attraction.

Google too had a platform, with Android, and has evolved it over time into Play. Apple had gone from devices to platforms and ecosystems and Google arrived at the same place, by way of its dominance in search and advertising and a punt on mobile open source.

Nokia's response is where the innovation case study becomes very interesting.

Nokia open sourced its own operating system Symbian - or at least it tried to. In effect it tried to do an Android, grouping together major players like Texas Instruments, Motorola and Samsung in an open source project to develop the Symbian OS as a mutual, open asset.

There were problems - an unwieldy governance structure that left decision making opaque, if you were a developer. A sense that these structures were great for big companies but that as a developer you were in the cold.

Nokia/Symbian also launched an Apps Store, Horizon, now happily forgotten, and after six months it had the sum total of 60 apps in it.

And Nokia launched its own Apps and Content store - Ovi, in 2009. But Nokia had no real platform experience to compare with Apple's. The platform was shaky and it tried to launch simultaneously in 35 countries - because that's what dominant players do. It was a disaster and the tech press called it out as such. Nokia was faced with a gale of criticism for the first time.

Within two years they closed down the Symbian open source project. Symbian had been rushed into the public domain months ahead of schedule. But so what? It didn't have support. It was soon gone and Nokia went looking for a new alternative (even though it had one in its labs). Of course, we now know, it chose windows.

The lessons from this though are that Nokia ignored threats to its business. They are that it made the wrong OS choices and the wrong platform choices. It lacked experience in the latter and it is still faltering over the former. It did not ignore the dangers. It simply did not understand the new skill sets it needed.

One of its key deficits was a lack of experience in platform development - a great engineering company but in 2008 few people had what Apple had - experience through iTunes.

So here is where we need to rethink disruptive innovation.

Disruption comes from the need of companies to make radical adjacency moves - especially in areas of convergence like computing and mobile. Your business is at risk from companies who are not now competitors. That's what the theory of radical adjacency tells you.

The disruptive weapon can be a design or a device but the business will be sustained by good platform choices. And acquiring skills in developing platforms is a must, as central to management as opening an office each morning.

In platform economics, the most important asset is being able to attract other groups and individuals to the platform. Leadership needs to re-orientate around attraction, giving it the same importance they place on investment. That means attracting people, resources and commitments to your project, your platform. That's the same whether you are out on Kickstarter or competing with Apple.

In the case of Nokia, then, disruption was no real surprise. They knew what was coming because they saw it (Apple and Android) and they were countering it (with Symbian open source) but nobody could foresee the rapid evolution of platform economics, nor the skills needed to make platforms work.

This as much as the absence of a good smartphone to compete with the iPhone sank Nokia. In fact with its QT interface it could well have produced phones to compete with the iPhone - what it did not have was the Apps Store platform, a factor critics continue to ignore when assessing Apple's durability and strength.

Since then Nokia has still struggled to make good OS and good platform decisions. As one reader puts it:

Microsoft saw Nokia's weakness, and gave them what they wanted: a robust OS but with some stipulations. The greatest stipulation was that the raw kernel of Windows 8, the Windows NT kernel, which is the sweet-spot for true innovation, would not be accessible to Nokia. Microsoft carefully controls access to this kernel. One must remember that, when Nokia had their piggish Symbian, Nokia had full control over the OS. Not so with Windows Phone 8. It's locked down. Nokia is like the desperate home owner who is behind on mortgage, needs cash fast, finds a generous benefactor, only to discover that they have embraced a loan shark.

There are plenty of OS options out there for Nokia but it has embraced a company whose culture it understands, as a former gorilla in its own right, and, sadly, it lost confidence in its judgment to go it alone.

That is the effect of this kind of disruption. It fillets confidence as well as the share price. But in Nokia's case nobody can say they didn't have a chance to take the same ride that Apple, or indeed Samsung, did. It was there to be taken.

Follow me on Twitter @haydn1701 or join me on Facebook I am here on Google .

- Editorial Standards

- Reprints & Permissions

Apple and Nokia: The Transformation from Products to Services

Cite this chapter.

- Richard Cuthbertson 4 ,

- Peder Inge Furseth 5 &

- Stephen J. Ezell 6

973 Accesses

1 Citations

2 Altmetric

In the mid-to late 2000s, Nokia flourished as the world’s dominant mobile phone — and mobile phone operating software — producer. Founded in 1871 originally as a rubber boots manufacturer, by 2007 Nokia produced more than half of all mobile phones sold on the planet, and its Symbian mobile operating system commanded a 65.6 percent global market share. 1 But within half a decade, Nokia would falter and be surpassed in the smartphone market not only by Apple’s revolutionary iPhone but also by competitors including Google and Samsung. And in September 2013, Nokia would sell its mobile phone business to Microsoft for $7 billion. 2 Apple literally came out of nowhere — it sold exactly zero mobile phones before the year 2007 (the year Nokia held more than half of the global market share) — but by the first quarter of 2013, Apple had captured almost 40 percent of the US smartphone market and over 50 percent of the operating profit in the global handset industry. 3 In fiscal year 2013, Apple would sell five times more smart-phones than Nokia: 150 million iPhones compared to Nokia’s sales of 30 million Lumia Windows phones. 4 In contrast to Nokia, Apple realized it wasn’t just about the mobile device itself, it was about leveraging software to create a platform for developing compelling mobile experiences — including not just telephony but also music, movies, applications, and computing — and then building a business model that allows partners to make money alongside the company (e.g., Apple’s iTunes and AppStore) and, in so doing, perpetuate a virtuous cycle of making the iPhone attractive to customers over multiple life cycles through ever-expanding feature sets.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Durable hardcover edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Unable to display preview. Download preview PDF.

Kim, R. (2011) “The iPhone Effect: How Apple’s Phone Changed Everything.” GigaOm , June 29, 2011, http://gigaom.com /2011/06/29/the-iphone-effect-how-apples-phone-changed-everything/.

Google Scholar

Ovide, S. (2013) “Deal Is Easy Part for Microsoft and Nokia.” Wall Street Journal , September 3, 2013, http://online.wsj.com /news/articles/SB10001424127887324432404579052112731349626.

Elmer-DeWitt, P. (2013) “Why Doesn’t Apple Cut Its Prices and Sell More iPhones?” Forbes Apple 2.0 (blog), May 25, 2013, http://tech.fortune.cnn.com /2013/05/25/apple-iphone-market-share/.

Miller, D. (2013) “Apple Revenues Up but Net Profits Down in Fourth Quarter.” MacWorld , October 28, 2013, http://www.macworld.com /article/2058332/apple-revenues-up-but-net-profits-down-in-fourth-quarter.html.

Grundberg, S. (2014) “Nokia Handset Sales Decline in the Fourth Quarter.” Wall Street Journal , January 23, 2014, http://online.wsj.com /article/BT-CO-20140123-702876.html.

Saylor, M. (2012) The Mobile Wave: How Mobile Intelligence Will Change Everything (New York: Vanguard Press).

Furseth, P.-I. and Cuthbertson, R. (2013) “The Service Innovation Triangle: A Tool for Exploring Value Creation Through Service Innovation.” International Journal of Technology Marketing , 8(2): 159–176.

Article Google Scholar

Sandstrom, G. (2014) “Growing Pains for the New Nokia.” Wall Street Journal , January 23, 2014, http://blogs.wsj.com /digits/2014/01/23/growing-pains-for-the-new-nokia/.

Lomas, N. (2012) “Innovate or Die: Nokia’s Long-Drawn-Out Decline.” Techcrunch , December 31, 2012, http://techcrunch.com /2012/12/31/nokias-long-drawn-out-decline/.

Isaacson, W. (2011) Steve Jobs (New York: Simon and Schuster).

Ahonen, T. (2011) “Analysis: The Fall of Nokia.” Bright Side of News , January 31, 2011, http://www.brightsideofnews.com /print/2011/1/31/analysis-the-fall-of-nokia.aspx.

McCray, J.P., Gonzalez, J.J., and Darling, J.K. (2010) “Crisis Management in Smart Phones: The Case of Nokia versus Apple.” European Business Review , 23(3): 245, http://www.emeraldinsight.com /journals.htm?articleid=1926076.

Gustin, S. (2011) “Nokia Standing on a ‘Burning Platform,’ CEO Tells Employees.” Wired , February 9, 2011, http://www.wired.com /business/2011/02/nokia-burning-platform/all/.

Ante, S., Grundberg, S., and Stoll, J. (2012) “Nokia, Motorola Race Against Apple,” Wall Street Journal , September 6, 2012, http://online.wsj.com /article/SB10000872396390443819404577633352198554784.html#printMode.

Sorrel, C. (2011) “Nokia Kills Symbian, Teams Up with Microsoft for Windows Phone 7.” Wired , February 11, 2011, http://www.wired.com /gadgetlab/2011/02/microsoft-and-nokia-team-up-to-build-windows-phones/.

Clayton, N. (2012) “Why Nokia Abandoned MeeGo.” Wall Street Journal, Tech Europe , October 15, 2012, http://blogs.wsj.com /tech-europe/2012/10/15/why-nokia-abandoned-meego/.

Kurri, S. (2012) “The Story of Nokia MeeGo.” Taskmuro.com , October 11, 2012, http://taskumuro.com /artikkelit/the-story-of-nokia-meego.

Tofel, K.C. (2012) “Why Nokia Left MeeGo Behind: The Multi-year Backstory.” GigaOm , October 11, 2012, http://gigaom.com /2012/10/11/why-nokia-left-meego-behind-the-multi-year-backstory/.

Perez, S. (2011) “Nokia Discontinues Ovi Brand, Roadmaps Not Changed.” ReadWrite , May 16, 2011, http://readwrite.com /2011/05/16/nokia-discontinues-ovi-brand-roadmaps-not-changed#awesm=~ouc0lAipRfpGBC.

Levine, D. (2012) “Apple U.S. Margins for iPad about Half of iPhone: Filing.” July 26, 2012, http://www.reuters.com /article/2012/07/26/us-apple-margins-idUSBRE86P1NI20120726.

Oldroyd, C. (2012) “Apple Makes Twice the Profit Margins on U.S. iPhone Sales as It Does iPad.” iMore , July 27, 2012, http://www.imore.com /apple-makes-huge-profit-margins-us-iphone-sales-ipad-only-half-good.

Jones, C. (2013) “Apple’s App Store about to Hit 1 Million Apps.” Forbes , February 11, 2013, http://www.forbes.com /sites/chuckjones/2013/12/11/apples-app-store-about-to-hit-1-million-apps/.

Chuck Jones, Apple’s App Store Could Have Generated $1 Billion In Revenue In The December Quarter,” Forbes , January 7, 2014, http://www.forbes.com /sites/chuckjones/2014/01/07/apples-app-store-could-have-generated-1-billion-in-revenue-in-the-december-quarter/print/.

Ingraham, N. (2013) “Apple Announces 1 Million Apps in the App Store, More Than 1 Billion Songs Played on iTunes Radio.” The Verge , October 22, 2013, http://www.theverge.com /2013/10/22/4866302/apple-announces-1-million-apps-in-the-app-store.

Bostic, K. (2013) “Apple’s iTunes Rules Digital Music Market with 63% Share.” Apple Insider , April 16, 2013, http://appleinsider.com /articles/13/04/16/apples-itunes-rules-digital-music-market-with-63-share.

Elmer-DeWitt, P. (2012) “Apple Stores Top Tiffany’s in Sales Per Square Foot, Again.” Forbes Apple 2.0 (blog), November 13, 2012, http://tech.fortune.cnn.com /2012/11/13/apple-stores-tops-tiffanys-in-sales-per-square-foot-again/.

Dilger, D.E. (2013) “Apple Now Adding 500,000 New iTunes Accounts Per Day.” Apple Insider , June 13, 2013, http://appleinsider.com /articles/13/06/14/apple-now-adding-500000-new-itunes-accounts-per-day.

Arthur, C. (2014) “Apple Chief Tim Cook Is Under Pressure to Prove Innovation Flair Is Still There.” The Guardian , May 30, 2014, http://www.theguardian.com /technology/2014/may/30/pressure-tim-cook-innovation-apple.

Hughes, N. (2013) “Apple’s 500M User Accounts Second Only to Facebook, Viewed as Key Driver of Future Growth.” Apple Insider , June 4, 2013, http://appleinsider.com /articles/13/06/04/apples-500m-user-accounts-second-only-to-facebook-viewed-as-key-driver-of-future-growth.

Rooney, B., Grundberg, S., and Jones, S.D. (2012) “Nokia’s New Phones Fail to Impress.” Daily Trends News , September 5, 2012, http://gnewstoday.info /nokias-new-phones-fail-to-impress/.

Agrawal, R. (2012) “Nokia Lumia leads $270 Million Inventory Write-off in Q2.” BGR, July 19, 2012, http://www.bgr.in /manufacturers/nokia/nokia-lumia-leads-270-million-inventory-write-off-in-q2/.

Di Muro, F. (2009) “Strategic Planning at Apple.” Richard Ivey School of Business, University of Western Ontario, 5.

Wilcox, J. (2001) “25 Apple Stores to Sprout This Year.” CNET , May 15, 2001, http://news.cnet.com /25-Apple-stores-to-sprout-this-year/2100-1040_3-257633.html.

Lashinsky, A. (2009) “The Decade of Steve.” CNNMoney.com , November 5, 2009, http://money.cnn.com /2009/11/04/technology/steve_jobs_ceo_decade.fortune/index2.htm.

Mylavarapu, V.K. (2005) “Channel Conflict at Apple,” ICFAI Center for Management Research.

Segal, D. (2012) “Apple’s Retail Army, Long on Loyalty but Short on Pay.” New York Times , June 23, 2012 http://www.nytimes.com /2012/06/24/busi-ness/apple-store-workers-loyal-but-short-on-pay.html.

BBC (2011) “Chinese Authorities Find 22 Fake Apple Stores.” August 12, 2011, http://www.bbc.co.uk /news/technology-14503724.

Fulton, W. (2012) “If You Want to Build a Great Team, Hire Apple Employees.” Forbes , June 22, 2012, http://www.forbes.com /sites/wadefulton/2012/06/22/if-you-want-to-build-a-great-team-hire-apple-employees/print/.

Paczkowski, J. (2011) “R&D Spending: Nokia Versus Apple Shows Size Doesn’t Matter.” All Things D , February 4, 2011, http://allthingsd.com /20110204/rd-spending-nokia-vs-apple-shows-size-doesnt-matter/.

Lazonick, W., Mazzucato, M., and Tulum, Ö. (2013) “Apple’s Changing Business Model: What Should the World’s Richest Company Do with All Those Profits?” (AIR Working Paper Series #13–07/01, July 19, 2013), https://www.sussex.ac.uk /webteam/gateway/file.php?name=2013-07-swps-lazon-ick-et-al-apple-20130903.pdf&site=25c.

Shankland, S. (2013) “Apple Bumps Coca-Cola to Become World’s Top Brand.” CNET , September 20, 2013, http://news.cnet.com /8301-13579_3-57605207-37/apple-bumps-coca-cola-to-become-worlds-top-brand/.

Mazzucato, M. (2013) The Entrepreneurial State: Debunking Public versus Private Sector Myths (London: Anthem Press), 90.

Thompson, C. (2014) “Apple Won’t Make Investors Happy Until It Innovates Again, Say Pros.” CNBC , January 28, 2014.

Barr, A. (2013) “2014: Apple’s Crunch Year to Prove Innovation Chops.” USA Today , December 23, 2013.

Young, A. “Apple Exec Revs Up Apple Car Rumor, Saying ‘The Car Is The Ultimate Mobile Device’,” International Business Times , May 28, 2015, http://www.ibtimes.com /apple-exec-revs-apple-car-rumor-saying-car-ulti-mate-mobile-device-1940881.

Welch, D. and Hull, D. “Apple’s electric car dreams may bring auto industry nightmares,” Automotive News , February 17, 2015, http://www.autonews.com /article/20150217/OEM06/150219864/apples-electric-car-dreams-may-bring-auto-industry-nightmares.

Download references

Author information

Authors and affiliations.

University of Oxford, UK

Richard Cuthbertson

BI Norwegian Business School, Norway

Peder Inge Furseth

Information Technology and Innovation Foundation, USA

Stephen J. Ezell

You can also search for this author in PubMed Google Scholar

Copyright information

© 2015 Richard Cuthbertson, Peder Inge Furseth and Stephen J. Ezell

About this chapter

Cuthbertson, R., Furseth, P.I., Ezell, S.J. (2015). Apple and Nokia: The Transformation from Products to Services. In: Innovating in a Service-Driven Economy. Palgrave Macmillan, London. https://doi.org/10.1057/9781137409034_9

Download citation

DOI : https://doi.org/10.1057/9781137409034_9

Publisher Name : Palgrave Macmillan, London

Print ISBN : 978-1-137-40901-0

Online ISBN : 978-1-137-40903-4

eBook Packages : Palgrave Business & Management Collection Business and Management (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Apple and Nokia: The Transformation from Products to Services

- January 2015

- In book: Innovating in a Service-Driven Economy (pp.111-129)

- University of Oxford

- BI Norwegian Business School Oslo

- This person is not on ResearchGate, or hasn't claimed this research yet.

Abstract and Figures

Discover the world's research

- 25+ million members

- 160+ million publication pages

- 2.3+ billion citations

- Int J Soc Econ

- Jamaliah Said

- Fauziah Yusof

- Rosalia J.M. van Knippenberg

- Peter C. Young

- RES ORGAN BEHAV

- Alexandre Trigo

- J SERV RES-US

- Kathleen M. Eisenhardt

- A.M. Huberman

- HARVARD BUS REV

- Mark W Johnson

- C.C. Christensen

- Henning Kagermann

- Account Forum

- Recruit researchers

- Join for free

- Login Email Tip: Most researchers use their institutional email address as their ResearchGate login Password Forgot password? Keep me logged in Log in or Continue with Google Welcome back! Please log in. Email · Hint Tip: Most researchers use their institutional email address as their ResearchGate login Password Forgot password? Keep me logged in Log in or Continue with Google No account? Sign up

- iPhone 16 vs. iPhone 16 Pro

- Steam Families sharing is live

- OpenAI o1: Slower but better?

- Nintendo Switch 2: What to expect

- Disney+ deal: $6 for three months

Nokia vs. Apple: the in-depth analysis

There's just something about Apple that makes people go crazy whenever the company's lawyers do even the simplest things -- whether it's filing routine trademark oppositions , getting patents granted , or, uh, defending allegations that the company is in league with the Mafia , Steve and friends just seem to inspire some strong reactions whenever they end up in the courtroom. So of course things got a little wild last Thursday when Nokia announced it was suing Apple over ten patents related to GSM, UMTS (what you know as 3G) and WiFi -- the pundit class immediately set upon the idea that the lawsuit was some sort of reaction to Nokia's diminishing cellphone marketshare and the perceived dominance of the iPhone, perhaps best exemplified by John Gruber's flippant "If you can't beat 'em, sue 'em." Nokia can't compete against Apple, so obviously it's abusing the hopelessly-broken patent system get a little payback, Espoo-style -- right? Well, wrong. As usual, the race to hype this dispute as a bitter standoff between two tech giants desperate to destroy one another has all but ignored the reality of how patents -- especially wireless patents -- are licensed, what Nokia's actually asking for, and how it might go about getting it. And as you know, we just don't do things that way, so we've asked our old friend Mathew Gavronski , a patent attorney in the Chicago office of Michael Best & Friedrich , to help us sort things out and figure out what's really going on here -- read on for more.

First, a preliminary note: we're just not going to get into the specifics of Nokia's ten patents, whether they should have been granted, whether they're valid, or whether the patent system itself is a good thing. Each of the ten patents in question covers a highly technical part of wireless communications, and we simply don't have the time to judge them on their merits -- and even if we did, we have no way of knowing how the iPhone's code and chipsets make use of the patented technology. As for the patent system, well, it's what we've got, this case isn't going to change it, and we're not going to begrudge Nokia for taking advantage of the primary means available to protect its billions in R&D. We doubt Steve Jobs feels any differently about things. So if we can't talk about the patents themselves, what can we talk about? A lot, actually. Contrary to what you may have heard, Nokia isn't after billions of dollars, and it's not trying to stop sales of the iPhone forever. Instead, this case boils down to royalty rates -- Nokia wants Apple to pay a fair price for licensing patents Nokia says are "essential" to using GSM, UMTS, and WiFi. That's all. Nokia isn't even really asking for money damages beyond interest on past due royalties, it just wants a fair license rate for its patents. That may sound simple, but it's really not -- in fact, it's insanely complicated. Wireless standards and essential patents A quick look at Nokia's actual complaint ( PDF ) reveals an impressively tight argument: Nokia says that it committed to licensing several of its patents under "fair, reasonable, and non-discriminatory" terms (or FRAND terms) during the development of the GSM, UMTS, and WiFi standards because those patents are essential to each standard's operation, and since the iPhone uses all three standards, Apple should pay to license the patents. Open and shut, at least if you believe Nokia. Of course, that's not the whole story. Wireless standards like GSM are developed by a standards-setting body with the cooperation of its members -- in the case of GSM and UMTS, it's the European Telecommunications Standards Institute (ETSI), and with WiFi it's the familiar IEEE. These organizations aren't blind to the fact that its members invest billions into R&D and have lots of patents, but they also recognize the need to develop standards that everyone can use -- so while a standard like GSM is under development, member companies are supposed to declare if they own any patents they think are essential to the standard's operation. What Nokia doesn't say is that there's no independent verification of a patent's essentialness during the standards process -- in other words, the ETSI and the IEEE don't maintain some master list of patents that are actually essential. Instead, each company that participates in developing a standard is basically on the honor system, and they all agree to abide by FRAND principles when negotiating licenses. That means there's a tremendous incentive to declare as many patents as possible to be essential, since anyone who wants to use the spec might have to pay license fees on all those patents, and not declaring a patent essential can result in various other unpleasant consequences. (Legal nerds will remember the Rambus case as an example of this: the short and highly-simplified version is that Rambus didn't declare it had patents on certain types of RAM, and years of litigation ensued.) As you might imagine, then, determining whether a given patent is actually essential to a standard is pretty damn important, and it's not an easy or exact science. It takes a ton of time, money and specialized effort to examine patents and standards, and the results are rarely published, since they're worth a fortune to the right clients. However, there are a few studies out there that shed some light on Nokia's patent portfolio and GSM, from a boutique research firm called Fairfield Resources International . Fairfield took every patent declared essential to GSM and assigned it to an expert to judge whether or not it was actually essential. The results? Nokia has far and away the most patents judged essential to the operation of GSM, by more than double.

Source: Fairfield Resources International

Nokia's in a similar position with UMTS and WiFi -- while some of the patents that it's declared essential to those standards might be fluff, it has many that experts have judged to be actually essential. What's more, Nokia's lawyers have cherry-picked just 10 total patents to sue Apple over, so we're inclined to believe that those are the clearest of the clear -- the ones that simply can't be avoided by GSM, UMTS, or WiFi devices. Based on probability alone, it's almost certain that the iPhone infringes at least some of those 10 patents , regardless of our inability to make that determination directly.

Royalty rates and Apple's next move So if Apple's using Nokia's tech, and Nokia's obligated by its agreements with ETSI and IEEE to offer licenses to everyone on fair, reasonable, and non-discriminatory terms, why isn't Apple paying? Would you be surprised if we told you that the answer is incredibly complicated? Because really, you shouldn't be -- especially when a word like "fair" is involved. The nature of the standards process means that when big telecom players (like, say, Nokia and Qualcomm) come to the table to hash out patent licensing agreements, each side has a pretty hefty portfolio of "essential" patents to bargain with, and they can walk away with a cross-licensing agreement instead of having to make huge royalty payments to each other. Cross-licensing agreements are incredibly common in the wireless industry, and we as consumers basically depend on them operating behind the scenes to make all these standards work. Of course, cross-licensing can break down as well -- Nokia and Qualcomm have been suing the pants off each other for years now, after all. But Apple doesn't have a huge portfolio of patents on wireless technologies to cross-license with Nokia -- the majority of its patents are on devices and interactions, and we don't think anyone in Cupertino is too anxious to share those. So it's got to be cash, and even if Apple's willing to pay a straight cash royalty for Nokia's patents, negotiating that price is anything but easy -- FRAND is basically what wireless industry licensing executives have to believe so they can sleep at night. In reality FRAND is nebulous and undefined, with almost no specific rules for determining what a "fair, reasonable, and non-discriminatory" license actually is. Nokia could be asking for $1 per iPhone -- chump change for

Apple -- or it could be asking for $100 per iPhone. As of right now we have no real way of knowing -- but since all Nokia's asked the court to do is set a price, it's clearly willing to simply accept cash and move on. So what's Apple's next move? Well, it has several options: first, it will likely say that it's not infringing the patents at all -- either because it believes the patents aren't actually essential to the standards, or because Apple bought the chips and components that use the patented technology from a licensed supplier. Nokia doesn't get to double-dip and be paid twice if Apple's suppliers have a license to use Nokia's patents and Cupertino's just buying phone components without dictating design. Again, we simply don't know the answer here -- we'll have to wait for Apple's reply to find out what tactic it decides to take, but we'd expect this to be the first line of defense. Second, it can try to to convince the court that Nokia's patents aren't valid, which would be the worst-case scenario for Espoo. Like we've said before, suing over patents is a big gamble because they might end up invalidated and no longer generate lucrative licensing revenue -- another reason we're inclined to believe Nokia's picked 10 rock-solid patents out of its collection of some 11,000. But invalidation doesn't really make tactical sense, considering all Nokia wants is a royalty -- if invalidation is Apple's strategy we'd say we're in for an easy decade of litigation, and that's not going to be cheap. And finally, Apple can just pay. We spoke to several experts in the field during the course of our research into this piece, and almost all of them were surprised that Apple hadn't already coughed up the green. Again, we don't know the royalty rates Nokia's demanding, but it's a little strange that Apple isn't using its enormous cash reserves to just make this disappear. The main issue we can see is that whatever rate gets set in this case will be the basis of all future license negotiations, and Apple's got to be careful with that -- unlike almost every other company in the space, it's become a major player in the phone market virtually overnight, and setting this precedent properly is an important step. That said, Nokia's got to feel pretty good about the rates they've offered Apple here -- filing a lawsuit means Nokia's license agreements with other companies will eventually be examined, so it'll be obvious right away if Espoo's not offering similar terms to Cupertino. Let's just say this: it's not going to happen anytime soon, but we wouldn't be surprised if Steve ends up writing a check somewhere down the line. Wrap-up Okay, that's a lot to think about, but let's just back up a second here and consider the big picture: this has nothing to do with Nokia's handsets versus the iPhone in the marketplace, and everything to do with the fact that Nokia's intellectual property is a critical part of making modern mobile phones work. The real questions are how much of that intellectual property is in the iPhone, and how much Apple's willing to pay -- and neither has a simple answer. Believe it when we say we've just barely scratched the first layer of complexity when it comes to patent licensing and wireless standards, and we've left out a ton of angles and strategies both Apple and Nokia could pursue. And even if we did know everything, at this point it's simply impossible to predict how this case will play out -- it could settle tomorrow, it could go on for two years, or it could linger on for two decades. As always, our hope is that both sides come to the table, figure out a royalty that makes sense, and get on with the business of developing innovative new technology -- like we've said before, the lawyers get paid that way too.

Disclaimer: Although Matt and Nilay are lawyers, they're not your lawyers, and this isn't formal legal advice or analysis. To the extent this article might contain any statements regarding infringement of a particular patent by a particular device or what those patents cover, those statements are attributable to Nilay, not Matt, who still makes a living by giving actual legal advice to actual clients.

- Advertisement

- Harvard Business School →

- Faculty & Research →

- November 2020

- HBS Case Collection

The Rise and Fall of Nokia (Abridged)

- Format: Print

- | Language: English

- | Pages: 24

About The Authors

Juan Alcacer

Tarun Khanna

More from the authors.

- September–October 2024

- Harvard Business Review

Boards Need a New Approach to Technology

- Spring 2024

One Aspirational Future for India’s Higher Education Sector

- March 2024 (Revised May 2024)

- Faculty Research

Alphabet Eyes New Frontiers (B)

- Boards Need a New Approach to Technology By: Tarun Khanna, Mary C. Beckerle and Nabil Y. Sakkab

- One Aspirational Future for India’s Higher Education Sector By: Tarun Khanna

- Alphabet Eyes New Frontiers (B) By: Juan Alcácer, Raffaella Sadun and Kate Stoppiello

To read this content please select one of the options below:

Please note you do not have access to teaching notes, crisis management in smart phones: the case of nokia vs apple.

European Business Review

ISSN : 0955-534X

Article publication date: 17 May 2011

The purpose of this treatise is to present an analysis of the importance of positive transformational crisis management. The analysis relates to the difficulty now being faced by Nokia, historically the world's leading manufacturer of technologically advanced mobile phones, of Apple's innovative combination of its iTunes, iPhone, and applications that deliver internet content to the iPhone.

Design/methodology/approach

A crisis, typically considered to be a negative issue, can be a positive transformational event in the life of a business firm when that firm recognizes a crisis and makes appropriate changes in its operations to facilitate positive growth and development. However, the initial stage of a crisis must be recognized and appropriately responded to. The crisis management paradigm that is the foundation for this case analysis focuses on four stages of a crisis: the preliminary crisis, acute crisis, chronic crisis, and crisis resolution. The case deals with the innovations of Apple that have enabled the firm to become a direct competitor to Nokia in the smart phone market. The preliminary crisis stage was not appropriately recognized by Nokia, and the firm was thrust into an acute crisis that has now evolved into a chronic crisis. A brief overview is presented of the historical development of both Nokia and Apple, and an analysis of the present crisis situation in which Nokia now finds itself is presented in some detail.

It was concluded that Nokia is now in a very difficult position regarding Apple due to its failure to engage in a timely transformational response to the competitive innovations of Apple.

Originality/value

This is an excellent example of failure in positive transformational crisis management.

- Organizational change

- Transformational leadership

- Mobile communication systems

McCray, J.P. , Gonzalez, J.J. and Darling, J.R. (2011), "Crisis management in smart phones: the case of Nokia vs Apple", European Business Review , Vol. 23 No. 3, pp. 240-255. https://doi.org/10.1108/09555341111130236

Emerald Group Publishing Limited

Copyright © 2011, Emerald Group Publishing Limited

Related articles

All feedback is valuable.

Please share your general feedback

Report an issue or find answers to frequently asked questions

Contact Customer Support

The Strategic Decisions That Caused Nokia’s Failure

- Share on LinkedIn

- Share on Facebook

- Share on Twitter

- Share via Email

- Download PDF

In less than a decade, Nokia emerged from Finland to lead the mobile phone revolution. It rapidly grew to have one of the most recognisable and valuable brands in the world. At its height Nokia commanded a global market share in mobile phones of over 40 percent. While its journey to the top was swift, its decline was equally so, culminating in the sale of its mobile phone business to Microsoft in 2013.

It is tempting to lay the blame for Nokia’s demise at the doors of Apple, Google and Samsung. But as I argue in my latest book, “ Ringtone: Exploring the Rise and Fall of Nokia in Mobile Phones ” , this ignores one very important fact: Nokia had begun to collapse from within well before any of these companies entered the mobile communications market. In these times of technological advancement, rapid market change and growing complexity, analysing the story of Nokia provides salutary lessons for any company wanting to either forge or maintain a leading position in their industry.

Early success

With a young, united and energetic leadership team at the helm, Nokia’s early success was primarily the result of visionary and courageous management choices that leveraged the firm’s innovative technologies as digitalisation and deregulation of telecom networks quickly spread across Europe. But in the mid-1990s, the near collapse of its supply chain meant Nokia was on the precipice of being a victim of its success. In response, disciplined systems and processes were put in place, which enabled Nokia to become extremely efficient and further scale up production and sales much faster than its competitors.

Between 1996 and 2000, the headcount at Nokia Mobile Phones (NMP) increased 150 percent to 27,353, while revenues over the period were up 503 percent. This rapid growth came at a cost. And that cost was that managers at Nokia’s main development centres found themselves under ever increasing short-term performance pressure and were unable to dedicate time and resources to innovation.

While the core business focused on incremental improvements, Nokia’s relatively small data group took up the innovation mantle. In 1996, it launched the world’s first smartphone, the Communicator, and was also responsible for Nokia’s first camera phone in 2001 and its second-generation smartphone, the innovative 7650.

The search for an elusive third leg

Nokia’s leaders were aware of the importance of finding what they called a “third leg” – a new growth area to complement the hugely successful mobile phone and network businesses. Their efforts began in 1995 with the New Venture Board but this failed to gain traction as the core businesses ran their own venturing activities and executives were too absorbed with managing growth in existing areas to focus on finding new growth.

A renewed effort to find the third leg was launched with the Nokia Ventures Organisation (NVO) under the leadership of one of Nokia’s top management team. This visionary programme absorbed all existing ventures and sought out new technologies. It was successful in the sense that it nurtured a number of critical projects which were transferred to the core businesses. In fact, many opportunities NVO identified were too far ahead of their time; for instance, NVO correctly identified “the internet of things” and found opportunities in multimedia health management – a current growth area. But it ultimately failed due to an inherent contradiction between the long-term nature of its activities and the short-term performance requirements imposed on it.

Reorganising for agility

Although Nokia’s results were strong, the share price high and customers around the world satisfied and loyal, Nokia’s CEO Jorma Ollila was increasingly concerned that rapid growth had brought about a loss of agility and entrepreneurialism. Between 2001 and 2005, a number of decisions were made to attempt to rekindle Nokia’s earlier drive and energy but, far from reinvigorating Nokia, they actually set up the beginning of the decline.

Key amongst these decisions was the reallocation of important leadership roles and the poorly implemented 2004 reorganisation into a matrix structure. This led to the departure of vital members of the executive team, which led to the deterioration of strategic thinking.

Tensions within matrix organisations are common as different groups with different priorities and performance criteria are required to work collaboratively. At Nokia,which had been acccustomed to decentralised initiatives, this new way of working proved an anathema. Mid-level executives had neither the experience nor training in the subtle integrative negotiations fundamental in a successful matrix.

As I explain in my book, process trumps structure in reorganisations . And so reorganisations will be ineffective without paying attention to resource allocation processes, product policy and product management, sales priorities and providing the right incentives for well-prepared managers to support these processes. Unfortunately, this did not happen at Nokia.

NMP became locked into an increasingly conflicted product development matrix between product line executives with P&L responsibility and common “horizontal resource platforms” whose managers were struggling to allocate scarce resources. They had to meet the various and growing demands of increasingly numerous and disparate product development programmes without sufficient software architecture development and software project management skills. This conflictual way of working slowed decision-making and seriously dented morale, while the wear and tear of extraordinary growth combined with an abrasive CEO personality also began to take their toll. Many managers left.

Beyond 2004, top management was no longer sufficiently technologically savvy or strategically integrative to set priorities and resolve conflicts arising in the new matrix. Increased cost reduction pressures rendered Nokia’s strategy of product differentiation through market segmentation ineffective and resulted in a proliferation of poorer quality products.

The swift decline

The following years marked a period of infighting and strategic stasis that successive reorganisations did nothing to alleviate. By this stage, Nokia was trapped by a reliance on its unwieldy operating system called Symbian. While Symbian had given Nokia an early advantage, it was a device-centric system in what was becoming a platform- and application-centric world. To make matters worse, Symbian exacerbated delays in new phone launches as whole new sets of code had to be developed and tested for each phone model. By 2009, Nokia was using 57 different and incompatible versions of its operating system.

While Nokia posted some of its best financial results in the late 2000s, the management team was struggling to find a response to a changing environment: Software was taking precedence over hardware as the critical competitive feature in the industry. At the same time, the importance of application ecosystems was becoming apparent, but as dominant industry leader Nokia lacked the skills, and inclination to engage with this new way of working.

By 2010, the limitations of Symbian had become painfully obvious and it was clear Nokia had missed the shift toward apps pioneered by Apple. Not only did Nokia’s strategic options seem limited, but none were particularly attractive. In the mobile phone market, Nokia had become a sitting duck to growing competitive forces and accelerating market changes. The game was lost, and it was left to a new CEO Stephen Elop and new Chairman Risto Siilasmaa to draw from the lessons and successfully disengage Nokia from mobile phones to refocus the company on its other core business, network infrastructure equipment.

What can we learn from Nokia

Nokia’s decline in mobile phones cannot be explained by a single, simple answer: Management decisions, dysfunctional organisational structures, growing bureaucracy and deep internal rivalries all played a part in preventing Nokia from recognising the shift from product-based competition to one based on platforms.

Nokia’s mobile phone story exemplifies a common trait we see in mature, successful companies: Success breeds conservatism and hubris which, over time, results in a decline of the strategy processes leading to poor strategic decisions. Where once companies embraced new ideas and experimentation to spur growth, with success they become risk averse and less innovative. Such considerations will be crucial for companies that want to grow and avoid one of the biggest disruptive threats to their future – their own success.

About the author(s)

Yves L. Doz

is an Emeritus Professor of Strategic Management and the Solvay Chaired Professor of Technological Innovation, Emeritus at INSEAD.

About the series

Corporate governance, share this post, view comments.

Rahul Tripathi

30/03/2024, 03.42 pm

I found this article on the strategic decisions behind Nokia's failure incredibly insightful! 📉 As someone interested in business strategy and management, understanding the factors that led to Nokia's downfall provides valuable lessons for avoiding similar pitfalls in the future. 💡 The analysis of Nokia's missteps, from failing to adapt to changing market trends to underestimating the competition, highlights the importance of agility and innovation in today's dynamic business landscape. 🔄💡

Moreover, the article offers actionable insights that can be applied to various industries, making it a must-read for anyone involved in strategic decision-making processes. 🌟 Thank you for sharing such informative content! I'll definitely keep these lessons in mind as I navigate my own business endeavors. 👍📚

- Log in or register to post comments

Anonymous User

16/03/2022, 10.44 am

Nokia is the one of the oldest phone and also it is existed until now

17/09/2021, 07.41 pm

Why does Nokia fail

26/06/2021, 09.54 pm

Someone really should dig into the tale of Nokia Music, that of OD2, a successful independent company bought by Nokia in 2007. In less than four years through marketing bodges, strategic failures, interference from gormless management in the USA, and even more nepotistic and mostly incompetent management in the UK, a profitable company with numerous high profile corporate customers was brought to its knees by talent free people who should never have been promoted into the positions they were in. Well worth digging into, just don't interview the management or you will never get to the truth.

03/06/2021, 01.56 am

As I read through many of these comments, the word "dillusional" kept coming to mind. For starters, Windows OS was as good as either Android or iOS. The main thing lacking were just a few more core apps. That was really it.

Sure, they could easily have run Andoid, and as soon as that idea was floated, Microft instantly shuttered their offices.

The fact that Nadella had his trojan horse Elop do the deal on Friday and hand everyone their walking papers on Monday is proof positive that Microsoft never had any good intentions for Nokia.

MS could have easily thrown one of their legions of Devs onto the task of writing apps. which would have solved the app. store issue in a hurry.

Instead, Nadella destroyed Microfts own eco-system by loosing that lucrative and Crucial market sector. A permanent wound that still haunts them to this day, and showcased Nadella as being far Inferior to Ballmer as well as Gates.

While my first inclination is to assume some nefarious reason for this, I do have to acknowledge however the old addage: "Don't attribute to maclice, what can easily be explained by stupidity"

30/10/2020, 04.23 pm

Why only Nokia there are a number of business world wide which have failed because of its own Founders/CEO/COO lapses some of the reasons which I contribute are as follows.... 1. Lack of vision future 2. Innovation in new age computing revolution 3. High Salary package 4. Founders cannot be pushed out or replaced easily. 5. Management Decisions 6. Dysfunctional Hierarchy 7. Growing Bureaucracy 8. Internal rivalry

21/01/2018, 12.17 am

Captain of the ship knows how to sink the boat. Stephen (the first non Finnish CEO in history of Nokia) joined in 2010 from Microsoft and made a deal to use Windows only despite the fact that Android was growing and already captured huge market share. There was a lot of pressure from Nokia employees to move to Android but he ignored all. He fired a lot of people. It was famous in Nokia Espo office (H/Q) that he is a Trojan Horse. He later sold Nokia mobile business to Microsoft and earned millions of dollars in the deal. Later, he joined Microsoft again. Looks like the plan was to promote Windows Mobile at the cost of Nokia (that failed badly)

Sheila Yovita

13/01/2018, 04.20 am

If the company is at crises, what should the managers do? Could it be one of the option go for advices from top management consulting firms or any other third parties that can help to formulate better strategies to save the company? Assuming they went for consulting firms, then the firms were failed to help Nokia as well?

22/12/2017, 02.34 am

I would love to also see something similar about Blackberry. They were the prime brand for many early adopters and business users of cellular phones here in the USA. Similar to Nokia they also had/have secure network platform. I wonder if their demise was also due to strategic mistakes, and if similar to Nokia they also got bogged down with tactical activities and lost sight of overall strategy.

21/12/2017, 05.00 am

I agree with everyone, broadly. Nonetheless we should NEVER FORGET that Nokia would be far far better (as a Smartphone maker), than it is today.

Another illustration of a North American Corporation that did so well from its foundational years in the 19th Century and well into its first centenary is NORTEL Networks... I read a book about the rise, growth and maturity of NORTEL and it became one great role model for me... Unfortunately, NORTEL failed to go the length any longer than the beginning of the 21st Century; NORTEL collapsed for reasons that are too embarrassing to speak openly abbout - or even in privacy!

I'm working on to establish a Corporate and Product Branding Consultancy in town (Accra, Ghana), and this article on Nokia, like others, is what I've been looking out for, to help learn and know how to start and grow an enterprise and keep it growing and succeeding decade after decade, century after century!

I'm learning!

17/12/2017, 07.59 pm

"While Symbian had given Nokia an early advantage, it was a device-centric system in what was becoming a platform- and application-centric world." Well, actually Nokia pioneered the app-centric world. Go check. Only it's User Interface didn't keep up with the emerging competition.

07/12/2017, 05.51 am

Nokia is still alive... and much more than a mobile phone manufacturer. Nokia is the biggest network equipment maker in the world, employees +100k people and ~25 billion € in revenue in 2016...

30/11/2017, 05.40 pm

Good article. Thanks.

Interesting side note: While working in Japan around 2002, I heard "on the street" that Nokia ran a research center in Japan. Intended to tap the vast and growing Japanese mobile market. They saw everything that was coming in the Western world. Good cameras. Apps. Cost effective mobile internet & services. Mobile email messaging on a mass scale. Multi media devices. Long before the iPhone was invented. Nokia deemed the Japanese market too challenging and closed their research center. Turned a blind eye. The competition was already too far ahead.

28/11/2017, 03.21 am

Another consideration is that Nokia stayed committed to hardware-based human-computer factors as differentiation far longer than it should have: optical strip for scrolling, buttons for menus, buttons for navigation, etc. What the iPhone showed is that software-based UX was the more flexible and powerful approach.

26/11/2017, 04.40 pm

Just imagine, if Nokia had seen the future and adopted Android operating systems before 2009-10, perhaps the horizons of the mobile Eco system would have been very different today. Similarly, Blackberry also failed to see the shift in the mobile market from a communicating device to a multi Media device. Phones transcended the mere communication and functional level to take control of our social lives and presence. The social sites and e commerce growth were trends and changes that both these behemoths failed to see or gauge. They still remain extremely hardware centred, building very physically robust devices but perhaps falling short on the imagination part. I think this is entirely a matter of leadership vision and imagination.

25/11/2017, 12.00 am

Unless I am misremembering, I am sure I had a Samsung phone in the early 2000s. It was nothing like the Samsung mobiles of today. It was not user friendly, the operating system was a mess and I soon went back to Nokia but it's not true to say that Samsung hadn't entered the mobile communications market, they just hadn't entered the smart phone market. (Not that I don't agree with the thrust of the article - Nokia's downfall was very much of its own making).

24/11/2017, 11.53 pm

I think a similar story can be told about Microsoft under Ballmer. What Symbian was for Nokia, Windows was for Microsoft at one time. Nadella came in just at the right time to lift the company out of that slumber and made it take a leap of faith in the Cloud world. The results are evident. Microsoft is sailing at its lifetime best share prices. On the contrary, when we look at Apple, they seem to be following the footsteps of Nokia. Slowly but surely they are becoming a victim of their own success.

Leave a Comment

Please log in or sign up to comment., related reads.

How Nokia Bounced Back (With the Help of the Board)

Quy Huy & Timo Vuori

Why Successful Companies Usually Fail

Y. Doz, K. Wilson

Spanning the Boundaries That Limit Organisational Innovativeness

Our website has a lot of features which will not display correctly without Javascript.

Please enable Javascript in your browser

Here how you can do it: http://enable-javascript.com

- May 4, 2023

The rise and fall of Nokia - lessons from failure

Updated: May 8, 2023

One of the pivotal moments in life as we know it today was the emergence of cellular phones. The emergence of this sector gave rise to a plethora of brands, such as Apple, Redmi, Samsung, and the brand that was leading them all - Nokia. But sadly, what was a behemoth then is now just a footnote.

The once iconic cell phone that we saw in the hands of almost every adult, also named the Best selling Mobile Phone Brand in the world (October 1998), is now rarely even spoken about. So what went wrong? What resulted in Nokia’s downfall? Let’s explore the Nokia case study and find out what factors caused its tragic “from success to failure” story.

The following are the major factors that accounted for Nokia’s downfall:

Resistance to the only constant- Change: With the rapid pace of change, especially in technology, Nokia’s resistance didn’t help their brand. It kept producing older versions of its phones as compared to its competitors, who kept upgrading their phones. As a result, their market shifted to these newer, more affordable ones.

No strategic plan: Nokia’s rivals, such as Apple and Samsung, had a successful marketing strategy that kept their customers and potential ones interested and on the lookout for their new products. They both used the umbrella branding strategy (such as Samsung with their Galaxy series) that kept users hooked. Seeing this, Nokia tried to release its own line of hardware and software, but it already existed in the market because of its competitors.

Innovation: As the demand for their phones increased, Nokia focused most of its resources on its manufacturing rather than its innovation. Even with the release of their Nokia Lumia phone, they provided the most basic features with the dullest visuals compared to their competitors.

Overestimated strength: Nokia’s management believed that their market would wait for them and buy their phones regardless of what they produced and hence, didn’t focus much on what their competitors put out. They got stuck with outdated hardware and buggy software which resulted in Nokia’s downfall.

Check out these links to know more about the rise and fall of Nokia:

https://www.doersempire.com/why-nokia-failed/#:~:text=Initially%2C%20the%20new%20technology%2C%20urge,company%20on%20the%20strategic%20level -The history, fall and what we can learn from it.

https://www.feedough.com/why-did-nokia-fail/ -The rise, timeline of Nokia’s failure and its reasons.

https://startuptalky.com/reasons-why-nokia-failed/ -Reasons for Nokia’s failure and FAQs.

- Curated Business Stories

Recent Posts

Uber vs Sidecar: A Ride Sharing Business Case Study on how Uber overtook sidecar

How Myspace became a has been from an It brand

The rise and rise of Airbnb

The Brand Hopper

All Brand Stories At One Place

The Rise and Fall of Nokia – Why and How Nokia Failed?

The Rise and Fall of Nokia – Why and How Nokia Failed? 12 min read

During the early 2000s, Nokia reigned supreme in the mobile phone market, boasting a significant global market share. Back then, Nokia faced little competition as it offered highly acclaimed and popular products like the Nokia 1280, Nokia 5300, Nokia N91, and Nokia N95. However, the brand’s fortunes took a nosedive as it witnessed a gradual decline in market share, eventually ceding ground to rivals such as Apple and Samsung. In 2014, acknowledging its inability to sustain a presence in the mobile phone market, Nokia made the decision to sell its mobile phone business to Microsoft. What led to the downfall of this once mighty mobile industry leader in a mere span of ten years? This article delves into the events that unfolded at Nokia and the valuable insights garnered from its story.

Table of Contents

The rise of Nokia

1865: nokia was found.

Established in 1865 by Fredrik Idestam, an esteemed engineer in Tempere, Finland, the company we now know as Nokia had humble beginnings. Initially, the business focused on operating a pulp mill and producing paper goods. In 1871, a second factory was opened alongside the banks of the Nokianvirta river, providing the inspiration for the company’s eventual name, Nokia Ab. It was not until 1979 that Nokia ventured into telecommunications research and manufacturing.

Initially, their offerings predominantly consisted of radio equipment, desk phones, and televisions. In the same year, Nokia made the strategic decision to merge with Salora Oy, an enterprise specializing in electrical equipment. Subsequently, the mobile device business was separated from the merged entity, establishing Nokia – Mobira Oy as a distinct entity. This significant development marked Nokia’s official entry into the mobile phone manufacturing industry.

1984: Nokia’s first mobile phone

In 1984, Nokia made its debut in the mobile phone industry by introducing the Mobira Cityman 900 to the public. This mobile phone operated on the NMT-900 network, offering improved signal strength compared to existing networks. Additionally, with a weight of only 800g, it was significantly lighter than other portable products available at the time, such as the Mobira Senator weighing 9.8kg and the Talkman weighing under 5kg. During this era, mobile phones were considered luxury devices reserved for the elite, including aristocrats and royalty. However, due to the sleek design and advancements of the Mobira Cityman 900, it quickly became highly coveted among affluent individuals.

In 1987, a noteworthy incident occurred when a reporter spotted Soviet leader Mikhail Gorbachev using a Mobira Cityman in Helsinki. This occurrence led to the phone earning the nickname “Gorba,” further enhancing its reputation and desirability.

Recognizing the immense potential of the mobile phone market, Nokia-Mobira Oy underwent a name change in 1989, adopting the name “Nokia Mobile Phones.” The company remained dedicated to significant investments in research and development, aiming to continuously innovate and introduce new products to the market.

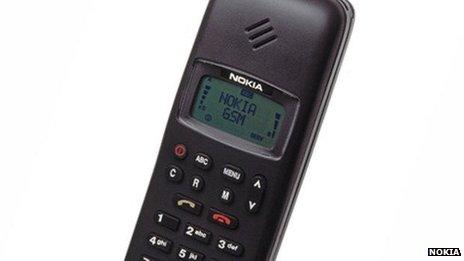

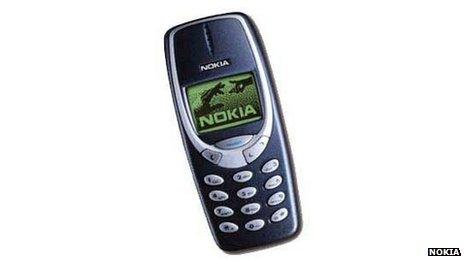

The Nokia 1011 marked the next major milestone in Nokia’s journey of innovation

In 1987, Nokia achieved a significant breakthrough with the introduction of a groundbreaking phone, known as ‘The Brick’ or the Nokia 1011. This remarkable device became the first mass-produced GSM (Global System for Mobile Communications) phone, catapulting Nokia to new heights in the telecommunications industry. The Nokia 1011 boasted a compact design, measuring 195 x 60 x 45 mm, which was notably smaller compared to other phones available at the time. It featured a monochrome LCD display and an expandable antenna, offering users enhanced functionality and convenience.

Moreover, the Nokia 1011 showcased innovative features, including the ability to store up to 99 phone numbers in its memory and the capability to send SMS messages. These features, along with its compact design, made the Nokia 1011 an instant success upon its release, elevating Nokia’s reputation and influence in the telephony and telecommunications market. It is worth noting that although mobile phones were not yet widely accessible during this period, the Nokia 1011 garnered substantial acclaim and contributed to Nokia’s growing prominence.

1996: Nokia 9000 Communicator & Nokia 8110

In 1996, Nokia unveiled the Nokia 9000 Communicator, a groundbreaking phone that signaled the company’s strategic advancement. Priced at $800, this product ushered in a new era of capabilities, enabling users to access email, fax, and web browsing, while also providing word processing and spreadsheet functionalities. Despite industry recognition, the Nokia 9000 Communicator faced challenges due to its less user-friendly design and suboptimal user experience. Consequently, it did not achieve significant commercial success. Nonetheless, this product stood as a testament to Nokia’s commitment to technological innovation and breakthroughs, as the industry continually values advancements that push the boundaries of possibility.

That same year, the company also released the Nokia 8110 slider phone. The product was also nicknamed the “banana phone”, appearing in the popular 1999 sci-fi action film The Matrix.

1998: Dominating the global mobile phone market

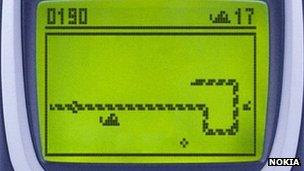

In 1988, Nokia introduced the highly anticipated Nokia 6100 series, marking the dawn of a new era in mobile phone technology. This innovative product line showcased Nokia’s prowess and propelled the company into the global spotlight. The Nokia 6100 series featured a compact design, user-friendly buttons, and an LCD screen, offering consumers a seamless and enjoyable mobile experience. Additionally, the inclusion of the legendary Snake game, pre-installed on the phones, ignited a wave of enthusiasm within the user community. The exceptional popularity of the Nokia 6100 series translated into remarkable sales figures, with nearly 41 million units sold by 1998. This exceptional achievement propelled Nokia ahead of Motorola, solidifying its position as the world’s leading mobile phone manufacturer that year.

Besides the Nokia 6100 series, Nokia 8810 was also launched by Nokia in the same year. This is the first flagship phone without an external antenna with a sliding chrome cover.

With two groundbreaking and commercially successful new product lines, Nokia saw a jump in business results as the company’s net revenue increased by more than 50% year-on-year, operating profit increased. nearly 75% and the stock price skyrocketed 220%, resulting in an increase in market capitalization from nearly $21 billion to about $70 billion.

2000 – 2006: King of the early digital era

The year 2000 marked a significant milestone in the global shift towards the digital era, witnessing the emergence of groundbreaking technological advancements such as digital cameras, mp3 players, CDs, DVDs, and the advent of 2G and 3G networks. Amidst this transformative period, Nokia displayed remarkable adaptability by introducing new product lines that aligned with the changing technological landscape.

The Nokia 7650 represents Nokia’s initial response to the evolving mobile phone landscape. Released in 2001, it was the company’s pioneering device featuring an integrated camera capable of capturing and storing photos, accompanied by a vibrant color screen.

In the subsequent year, 2002, Nokia further expanded its product offerings with two notable releases. The Nokia 6650 was unveiled as the company’s first 3G phone, introducing users to the capabilities of this advanced network technology. Simultaneously, Nokia introduced the Nokia 3650, marking its entry into the Symbian software phone line. Notably, the Nokia 3650 featured a built-in camera with video recording functionality, adding an exciting new dimension to mobile phone photography.

In addition to its focus on the high-end market, Nokia also aimed to capture the popular segment. This led to the introduction of the Nokia 1100 in 2003, a budget-friendly phone renowned for its compact, user-friendly, and robust design that catered to essential functionalities like calling, messaging, and reliable connectivity across various telecommunications bands worldwide. The Nokia 1100 quickly gained traction, with approximately 250 million units sold in its debut year alone. This remarkable achievement earned it a place among the world’s best-selling consumer electronics products. By 2005, the cumulative sales of the Nokia 1100 surpassed an astounding 1 billion units.

In 2005, Nokia introduced its highly anticipated flagship series consisting of the N70, N90, and N91. These devices showcased significant advancements in design, camera functionality, storage capacity, memory, battery life, and speakers. At that time, these products were widely regarded as the epitome of technological excellence.

By 2007, Nokia’s business report revealed its commanding position in the global mobile phone market, boasting a market share of nearly 50%. The company’s revenue stood at approximately $150 billion, and its workforce consisted of around one million employees.

The downfall of Nokia

2006: a major change in nokia’s leadership and business strategy.

In 2006, a significant change occurred at Nokia as Olli-Pekka Kallasvuo assumed the role of chief executive officer, succeeding Mr. Jorma Ollila. Alongside this leadership transition, several new board members were appointed. Under this new leadership structure, Nokia made the decision to consolidate its smartphone and feature phone operations, emphasizing a focus on traditional phones rather than venturing into untested technologies. This strategic shift indicated a move towards prioritizing profitability over the pursuit of groundbreaking technological innovations.

Mr. Olli-Pekka Kallasvuo himself was known for his conservative approach to business strategy, often rejecting ideas for new products and technologies in favor of safer options that could generate revenue and profit in the near term. However, this strategic direction unexpectedly led Nokia into a downward spiral in the subsequent years, a decline that the company had not anticipated.

2007: Steve Jobs introduced the first iPhone

In 2007, Apple’s launch of the iPhone, a competitor significantly trailing behind Nokia in terms of brand recognition, market share, and scale, captivated the world. The iPhone represented a revolutionary product in the mobile phone industry, signaling the end of the era of digital phones and heralding the arrival of the smartphone era. Its design diverged entirely from existing mobile phone models, featuring a minimalistic layout with only a Home button, power button, and volume controls, while all other operations were performed on a single touch screen. Powered by the innovative iOS operating system, the iPhone also introduced an application store that enabled users to easily download and install various applications via the internet.

In response to the iPhone’s remarkable success, Nokia initially responded with indifference, derision, and laughter, dismissing the new technologies of the iPhone as impractical and asserting that consumers had to pay an exorbitant price to own one.

Despite the introduction of the iPhone, Nokia initially experienced a marginal 3% loss in market share by the end of 2007. Nokia had valid reasons for its initial dismissal, such as the iPhone’s limited 2G connectivity in contrast to Nokia phones equipped with 3G connectivity. However, Nokia’s executives basked too long in their victories, leading to a series of subsequent missteps and challenges that ultimately plagued the company.

2008: Android OS was released

Following the triumphant release of the iPhone, Google made its foray into the smartphone market in 2008 with the introduction of Android, an operating system designed for mobile devices. Despite the potential opportunity to rival Apple by embracing Android, Nokia’s management remained steadfast in their confidence in the Symbian operating system. They pursued plans to develop their own operating system, MeeGo, underestimating the significance of Google and considering it to be an inconsequential player in the market.

In an effort to compete with its rivals, Nokia introduced the 5800 Express series in 2018, featuring a spacious and responsive touchscreen. However, the company faced a critical drawback—its Symbian software, serving as an operating system, proved to be inadequate and significantly lagged behind the more advanced iOS and Android platforms available at the time.

In contrast, the iPhone experienced a surge in popularity, with Apple witnessing a steady growth in revenue.

2010: Olli-Pekka Kallasvuo was replaced by Stephen Elop

During the period from 2008 to 2010, Nokia encountered a series of product launches that failed to resonate with consumers and achieve commercial success. Concurrently, manufacturers of Android smartphones like Samsung and Huawei experienced substantial growth, further intensifying the competitive landscape. Faced with these challenges, Nokia came to the realization that significant changes were necessary to avoid stagnation and potential decline. Consequently, the company made the decision to replace Olli-Pekka Kallasvuo with Stephen Elop, who was recruited from Microsoft.

2011: Nokia partnered with Microsoft

In 2011, Nokia unveiled the N9 smartphone, which operated on its self-developed operating system called MeeGo. Regrettably, due to a rushed development process and a lack of expertise in operating systems, MeeGo encountered widespread issues, including security concerns and a limited selection of applications, which made it less appealing to developers. Consequently, the N9 faced an untimely demise, despite Nokia’s investment in a marketing campaign to promote the new product.

Following the disappointing outcome of MeeGo and the N9, Nokia sought a partnership with Microsoft to produce smartphones running on the Windows Phone operating system. Little did Nokia anticipate that this decision would become yet another misstep for the company’s management.

Following a collaborative effort, Nokia ventured into the Android market with its Nokia Lumia product line . This strategic move aimed to counter the decline in market share, leveraging the user-friendly interface design offered by the Windows Phone operating system. However, the Windows Phone platform still lagged significantly behind iOS and Android in terms of application stores. In an attempt to address this weakness, Microsoft made various efforts to attract developers, but these initiatives failed to yield substantial results, as Google and Apple had already established a stronger foothold in this aspect. Consequently, despite initial hopes, Nokia continued to experience a decline in market position approximately six months later.

2014: Nokia was on the verge of bankruptcy

In 2014, Nokia was on the verge of bankruptcy. With no other choice, Nokia had to sell its mobile phone business to Microsoft for just $7 billion.

After a period of time, Microsoft introduced the Nokia X and Nokia XL models, which ran on the Android operating system. However, these Nokia devices were criticized for their limited development time, resulting in a noticeable lag compared to other phone manufacturers, such as Samsung and Huawei, who had extensively optimized their devices for the Android ecosystem.

In subsequent years, Microsoft shifted its focus away from phone production, allocating fewer resources to the manufacturing of mobile devices. Instead, the company redirected its investments towards other product lines, including Windows, Office, Xbox, and Surface.

Now: Nokia is only a memory

Also Read: Case Study | How Nokia Built A Powerful Technology Brand

To read more content like this, subscribe to our newsletter

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Related Posts

List of Top Goldman Sachs Competitors: Wall Street’s Rivals

A Case Study on Doritos’ “Crash the Super Bowl” Campaign

A Case Study on BMW’s “The Ultimate Driving Machine” Campaign

Terms and Conditions

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Marketing Process and Nokia vs Apple Case Study

Related Papers

ramanajaneyulu pokathota

Nokia was a synonym for the mobile phone industry for a long time; however, when it came into the era of smart phones, the former leader was under an awkward situation. Nokia sold its mobile phone business to Microsoft on September 3, 2013. A company following Kodak with the legendary color failed in the impact of the new technology revolution. This was a typical case of the subversion of an industry; therefore, the author believed that it was necessary to analyze the process. This paper studied Nokia's decline mainly from the three parts. First of all, looking back Nokia's development process from the glory to the decline, it can be divided into three stages: the transition period, the peak period and the decline period, followed by analyzing the reasons of its decline from three parts: Nokia executives' grasp for the market, the company's business strategy and business cooperation, and finally analyzing its inspiration for modern enterprises from the marketing perspective.

Loading Preview

Sorry, preview is currently unavailable. You can download the paper by clicking the button above.

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

For a better experience, please use a modern browser like Chrome, Firefox, Safari or Edge.

London Business School Publishing

- Create a profile

- Browse cases

- How to order

Preview case

Click Preview case to review the first page of this case

The Rise and Fall of Nokia

By julian birkinshaw , lisa duke.