The marketplace for case solutions.

Amazon Go: Venturing into Traditional Retail – Case Solution

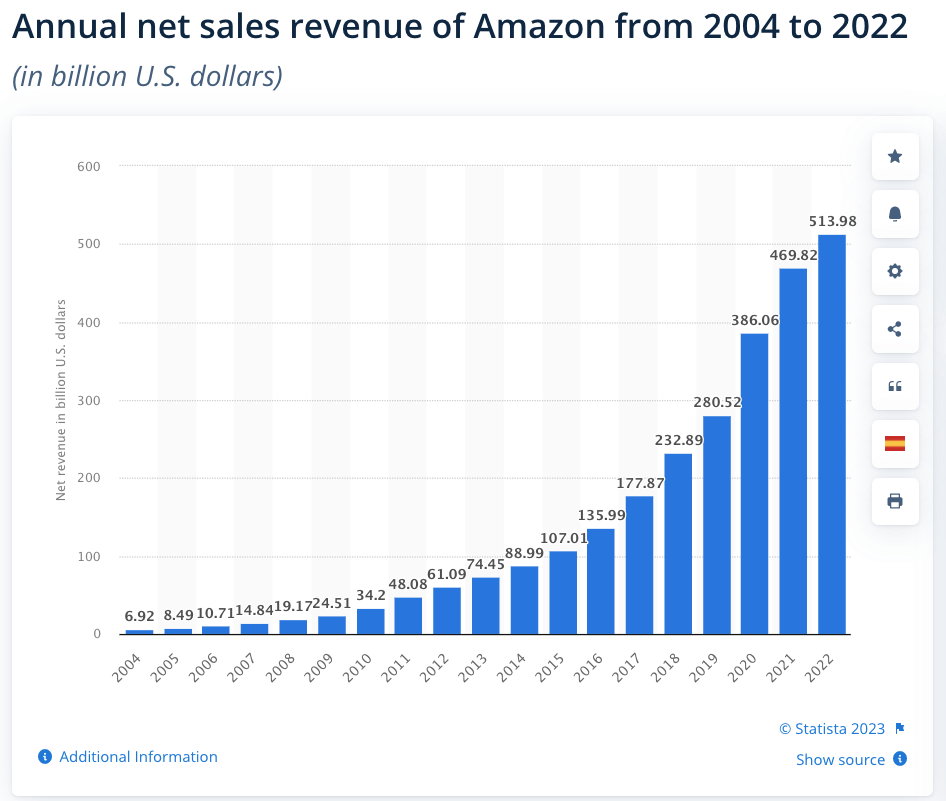

Amazon is known as the largest online retailer. In the past, it expanded its business to include various manufacturing industries related to food, diaper, and housekeeping products by launching the Amazon Elements brand. However, this expansion has not proven successful as it failed to be profitable. In 2015, the company slowly gained traction as it surpassed Walmart as the most valuable online retailer in the United States. And in 2016, it was named the 4th most valuable company in the country. The company is now contemplating moving into the offline markets. At the end of the year 2016, the company established Amazon Go, the company's first offline retailing store in Seattle. Can it reproduce its online retail success in offline retail segments?

Wiboon Kittilaksanawong and Aurelia Karp Harvard Business Review ( W17398-PDF-ENG ) June 28, 2017

Case questions answered:

- Can Amazon reproduce its online retail success in offline retail segments? Will it be able to become one of the biggest offline retail players?

- Being the first mover in a “checkout-free” convenience store, how can Amazon Go maintain its competitive advantages in the long term? How can the company avoid failures such as the diaper brand it introduced in 2014 and make Amazon Elements successful? How should it differentiate the products it offers via Amazon Elements from the products of other suppliers on its platform?

- Could the company’s offline retail marketing concept be developed globally?

Not the questions you were looking for? Submit your own questions & get answers .

Amazon Go: Venturing into Traditional Retail Case Answers

1. can amazon reproduce its online retail success in offline retail segments will it be able to become one of the biggest offline retail players.

From the case “Amazon Go: Venturing into Traditional Retail,” we can assume that the company’s first years will be challenging. This is mainly due to strong competitors and the high capital expenditure required to create its offline presence.

The establishment of non-digital markets nonetheless falls in line with the company’s interests. It is, therefore, an attractive investment.

The company has already started its investment in offline businesses by going against expectations. It has established Amazon Go, Amazon Books, and Amazon Fresh.

Thanks to its competitive advantages in R&D, marketing planning, supply chain efficiency, and customer focus, the company can replicate its online retail success in offline retail.

In addition, to drive the offline market, the company has a strong brand image. It constantly improves and grows public relations. These actions insinuate that customers will tend to shop from the company over competitors due to the brand’s market share in online retail. It has also stood strong amidst the emergence of competitors and has retained its positive popularity.

Furthermore, since Amazon Prime members pay an annual fee, they demonstrate a kind of customer loyalty that will help generate sales in the offline marketplace.

Finally, the idea of Amazon Go and its technological innovations in the offline space saves every customer time. It would make shopping more accessible and efficient.

2. Being the first mover in a “checkout-free” convenience store, how can Amazon Go maintain its competitive advantages in the long term? How can Amazon avoid failures such as the diaper brand it introduced in 2014 and make Amazon Elements successful? How should Amazon differentiate the products it offers via Amazon Elements from the products of other suppliers on its platform?

The company’s main competitive advantage regarding Amazon Go is that they are the…

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster! Michael MBA student, Boston

How do I get access?

Upon purchase, you are forwarded to the full solution and also receive access via email.

Is it safe to pay?

Yes! We use Paypal and Stripe as our secure payment providers of choice.

What is Casehero?

We are the marketplace for case solutions - created by students, for students.

Airport Biometrics: A Primer (2021)

Chapter: appendix a - case study: amazon go cashierless retail experience.

Below is the uncorrected machine-read text of this chapter, intended to provide our own search engines and external engines with highly rich, chapter-representative searchable text of each book. Because it is UNCORRECTED material, please consider the following text as a useful but insufficient proxy for the authoritative book pages.

135Â Â Summary Initiated by Amazon, the Amazon Go retail experience (see Figure A-1 and Figure A-2) uses a combination of cameras, sensors, computer vision techniques, machine learning, and artificial intelligence to create a cashierless retail experience; the first airport location will be at Newark Liberty Inter national Airport (EWR) (Amazon Go 2020). This technology, called âJust Walk Out,â requires customers to identify themselves when they enter the store (Amazon 2020). The customerâs identity is verified either by scanning the Amazon Go mobile app (in the case of an Amazon Go store) or their credit card (for other retailers equipped with the Just Walk Out technology). A biometric variant also exists, where instead of a QR code or credit card, customers enroll at the storefront enrollment kiosk by scanning their 3D hand palm biometric and linking that to their account. The Just Walk Out technology leverages computer vision and machine learning to distinguish between customers and the items picked out and added to their virtual cart. The system does not rely on facial recognition but relies on movement tracking. Each customer is associated with a name, an account, and a consumer profile that reflects all interactions with items on the shelves (which items are stared at, picked up, or bought). Future use of the customerâs data is still undefined. However, the initial patent application included some examples where the customerâs purchase history could be used to confirm which items were picked by the user. The main benefits are significant time savings for customers and financial savings for retailers (reduced to no cashiering cost) (Bishop 2020b). The system architecture relies on Amazonâs A P P E N D I X A Case Study: Amazon Go Cashierless Retail Experience Source: Adapted from Amazon Go 2020. Figure A-1. Amazon Go shopping experience.

136 Airport Biometrics: A Primer What? â Cashierless retail technology â Project implemented by Amazon Where? â 26 Amazon Go stores across the United States (e.g., Chicago, New York, Seattle, San Francisco) â Deployment at a few airports across the United States in stores of retail chain OTG (On-the-Go), including at EWR (OTG Management 2020) Customer process steps â To access Amazon Go stores: â Create an Amazon account â Download Amazon Go app â The Amazon Go mobile app interface will generate a QR code, or the user may add a hand palm scan to the account at an enrollment kiosk. â Customer enters the store by scanning the QR or hand palm (or credit card for other retail stores with Just Walk Out technology) â Just Walk Out technology tracks the customer and the interaction with store items. â Virtual cart validation â Exit Who? â Amazon patented the Just Walk Out technology. It provides the hardware (camera and sensors) along with the software. Why? â Amazonâs goal is to create a seamless shopping experience where customers do not have to wait in line. How? â The concept relies on the combined use of cameras, sensor fusion, computer vision, and deep-learning algorithms to track customers during their time in the store, noting each item picked up, put back, or added to their virtual carts. For the biometric hand palm variant, 3D hand palm scanners and a palm recognition software are used. Enrollment/digital identity creation and verification â An Amazon account can be made online, and enrollment is done in the storefront at the enrollment kiosk. The online Amazon account can be linked to the hand palm biometric by scanning one's hand at the kiosk. Verification of identity how? â Customers are identified by either a QR code generated by the Amazon Go app in Amazon Go stores or their credit card in third-party retail stores where the Just Walk Out environment is available. For? â Amazon account holders Table A-1. Key facts for the Amazon Go case study. Just Walk Out technology and includes the camera and sensor hardware as well as the software system. Table A-1 contains a summary of the Amazon Go case study. How Does It Work? Before the Customer Journey ⢠Amazon Go relies on sensor fusion (analyzing and aggregating data from multiple sensors, including weight and movement sensors), advanced data hosting services through Amazon Web Services, and advanced computer visionâbased machine learning (Amazon 2015). ⢠The hardware includes electronic shelves, cameras, fixtures, and a facility management system. ⢠The inventory management involves data storing and item identification. ⢠In the case of Amazon Go stores, customers create an Amazon account and download the Amazon Go app. ⢠In the case of Just Walk Outâenabled stores, customers access the store with their credit card.

Case Study: Amazon Go Cashierless Retail Experience 137  The Customer Journey The customer journey can be described by the following: ⢠Each shopper (and that shopperâs party) enters and is identified with a QR code generated by the Amazon Go app, biometric hand palm, or a credit card in the case of stores equipped with the Just Walk Out technology. ⢠The technology tracks the customerâs movements and interactions with the different store items. As customers remove items from the shelves, those items are added to their virtual cart (Kumar et al. 2013). ⢠The customer receives a receipt and is charged when exiting the store. Retention and Storage Account data are saved on Amazonâs own servers. ⢠Cameras track throughout the store in real time using the video feed streaming from a ubiquitous network of cameras (Bacco and Hiatt 2010). ⢠Amazon Go stores retain data on the interactions of individual customers with the items on the shelves. These data are used to further train the artificial intelligence running the architecture. ⢠Account data are retained and stored at Amazon until the passenger opts for the deletion of the account. ⢠Customers can elect to delete their biometric data. System Architecture Flow Diagram The flow diagram for this case study can be found in the Amazon Go Cashierless Retail Experience case study of Chapter 2. Source: Amazon 2020. Figure A-2. Just Walk Out enables seamless store experiences for other retailers as well.

138 Airport Biometrics: A Primer System Specifications The system relies on an artificial intelligence (see Figure A-3) to track the customer in the store. The artificial intelligence architecture relies on Amazon Web Services for streaming services as well as advanced computer visionâbased machine learning. Computer VisionâBased Machine Learning To associate the right items with the right customers, the technology relies on aggregating data from different sensors linked with the location information of the sensors. The artificial intelligence driving the architecture tracks the customers in the store by aggregating data from different sensors through sensor fusion and solving different identification and linking problems to associate customers, their location, and their interactions with items in the store. Person Detection The Just Walk Out technology does not use facial-recognition technology but relies on red- green-blue cameras equipped with depth- and distance-sensing capabilities. Each customer is associated with a general profile and an anonymized 3D point cloud. During the customerâs time in the store, a deep-learning algorithm predicts the customerâs location and associates that location with actions and interactions with store items (see Figure A-4). System Architecture, Pre-Existing Systems, and Databases The following explain the buildup of the system and its processes: ⢠Customer information and biometrics are collected at the entry gate. ⢠The identification of distinctive features on the hand(s) of the customer relies on a propri- etary algorithm, with distinctive features of the hand specific to this proprietary technology architecture (see Figures A-5 through A-7). ⢠Hand biometrics data that are collected are either stored, if the customer has an Amazon account, or are deleted once the customer exits the store. ⢠The customer holds his or her palm over the device to opt in. Source: Amazon 2019. Figure A-3. Amazon artificial intelligence for the Amazon Go retail experience.

Case Study: Amazon Go Cashierless Retail Experience 139  Stakeholders and Responsibilities Stakeholders The main stakeholders of Amazon Go concept are Amazon and the third-party retailers who have purchased Just Walk Out technology services. Responsibilities Amazon owns the Just Walk Out concept, which builds on a series of patents submitted by Amazon Technologies since 2013 (Puerini et al. 2014). Case Study Review Benefits The Just Walk Out technology presents benefits both for the customer and the retailer. Benefits to customers include: ⢠Improved customer experience over time with deep learning allowing for faster tracking and more accurate identification of interaction with store items, ⢠Limited contact and interaction with store employees, ⢠Reduced time spent in the store, and ⢠No use of facial recognition. Benefits for the retailers providing the Just Walk Outâenabled experience include: ⢠Adaptability of the Just Walk Out technology to different store layouts, ⢠Financial savings due to reduced staff cost related to cashiering or inventory, ⢠No use of facial recognition, ⢠Improved customer experience, and ⢠Detailed consumer profile data. Source: Amazon 2019. Figure A-4. Logic structure of Amazon Go and technology components.

140 Airport Biometrics: A Primer Source: Kumar et al. 2018. Note: Numbers in figure are part of the patent application and are not relevant to this discussion. Figure A-5. Hand biometrics identification process.

Case Study: Amazon Go Cashierless Retail Experience 141Â Â Source: Kumar et al. 2018. Note: Numbers in figure are part of the patent application and are not relevant to this discussion. Figure A-6. Hand biometrics characteristics identification.

142 Airport Biometrics: A Primer Source: Kumar et al. 2018. Note: Numbers in figure are part of the patent application and are not relevant to this discussion. Figure A-7. Person detection based on hand biometrics identity.

Case Study: Amazon Go Cashierless Retail Experience 143  Responses From Customers Crowd-sourced reviews for individual stores rate on average more than 4 stars out of 5. A stated choice survey conducted by the Shorr group in 2018 found that â84% of respondents to a survey said that they see Amazon Go as a âtype of grocery shopping experienceâ theyâd enjoy more than traditional grocery shoppingâ and âover 25% of respondents said that they would pay more for grocery products if it meant they didnât have to wait in line at checkoutâ (Shorr 2018). System Performance and Specifications Review The Just Walk Out technology requires an approximately $1 million investment in hard- ware. Customers spending less time in the store allow for higher customer throughput per hour compared to a traditional store (Cheng 2019). The system is designed for 99% accuracy, including during the busiest periods. On average, Amazon Go stores process 550 customers per day and as many as 90 people at any given time. Fall-Back Options ⢠Despite the absence of cashiers, a few store staff members are present to assist customers with any technical issues, answer questions, and process cash transactions. ⢠If customers are incorrectly charged for an item, they can contest the charge and be reimbursed. Concerns ⢠Privacy and use of collected data: There is a lack of transparency on how the collected data factor into the overall Amazon personalized marketing strategy. The architecture relies on deep learning, and data mining of the customerâs activity in the store would improve the experience and accuracy over time. ⢠Lack of transparency around the use of data slowed the adoption of the technology in Europe because of confrontation with GDPR regarding consent to the processing of personal data. In the context of the regulation, every consent request must state the precise purpose for which the data will be processed (Walters 2020). Lessons Learned The Just Walk Out technology initially relied on motion tracking and an anonymized cloud of data to identify individual customers. However, in December 2019, Amazon submitted a patent for a non-contact biometric identification system to identify customers by their hands (Kumar et al. 2018). Introducing hand biometrics as one of the identifying features of each customer is expected to simplify the person-detection component of the Just Walk Out architecture. Findings and Trends Findings The Just Walk Out technology is a potential template for future models of touchless and cashierless retail at airports and other shopping locations. The use of biometrics for identifica- tion, camera tracking devices, image analysis software, and a program that automates product billing has proven to create a new user-friendly experience that is more efficient and is touch free and seamless. Amazon now has several versions of this retail technology in operation, and future revisions of the concept will only improve accessibility. Enrollment challenges may be resolved with biometric palm geometry recognition, which is also being trailed, or with a simple

144 Airport Biometrics: A Primer two-step authentication process. Another option is the use of not just one biometric, but two or more, thereby providing options for customers to choose from. The main benefits behind using this type of software are significant time savings for customers and financial savings for retailers through lower operational expenditures on employees (e.g., labor wages, benefits). Some enrollment challenges may be resolved with simple two-step palm enrollment, which is interesting because it may seem less invasive when compared to a picture of oneâs face. Furthermore, this type of software presents a potential alternative to current and future models for touchless retail for airports and airlines. Future Situation and Broader Implementation Amazon submitted a patent application for a touchless hand scanning system named âAmazon Oneâ and started implementing it in Amazon Go stores in October 2020. Customers scan their hands at the entry gate to enter the store. Trends Identified A trend identified in the Amazon case study is that the use of hand biometrics is aimed to facilitate a more efficient, user-friendly (retail) experience. In the cashierless system, time is saved, shopping requires less fumbling of personal items during payment, and simplicity for the user can bring satisfaction. In this specific case, it is not only the biometric technologies enabling this, but also the camera tracking system and software, which allow for the automatic charging of customers to their accounts. This is a trend that will likely expand to other sectors outside of retail and airports. Similarly, the retail experience removes the need for contact points and human interactions, which has the added benefit of reducing the risk of transmissible diseases, which is especially beneficial in the COVID-19 era. The camera system and the 3D hand geometry scanners allow for tracking and identification without customers needing to touch any surfaces.

Biometrics is one of the most powerful, but misunderstood technologies used at airports today. The ability to increase the speed of individual processes, as well as offer a touch-free experience throughout an entire journey is a revolution that is decades in the making.

The TRB Airport Cooperative Research Program's ACRP Research Report 233: Airport Biometrics: A Primer is designed to help aviation stakeholders, especially airport operators, to understand the range of issues and choices available when considering, and deciding on, a scalable and effective set of solutions using biometrics. These solutions may serve as a platform to accommodate growth as well as addressing the near-term focus regarding safe operations during the COVID-19 pandemic.

READ FREE ONLINE

Welcome to OpenBook!

You're looking at OpenBook, NAP.edu's online reading room since 1999. Based on feedback from you, our users, we've made some improvements that make it easier than ever to read thousands of publications on our website.

Do you want to take a quick tour of the OpenBook's features?

Show this book's table of contents , where you can jump to any chapter by name.

...or use these buttons to go back to the previous chapter or skip to the next one.

Jump up to the previous page or down to the next one. Also, you can type in a page number and press Enter to go directly to that page in the book.

To search the entire text of this book, type in your search term here and press Enter .

Share a link to this book page on your preferred social network or via email.

View our suggested citation for this chapter.

Ready to take your reading offline? Click here to buy this book in print or download it as a free PDF, if available.

Get Email Updates

Do you enjoy reading reports from the Academies online for free ? Sign up for email notifications and we'll let you know about new publications in your areas of interest when they're released.

Reinventing the retail experience: The case of amazon GO

Anil varma 1 , yashswini varde 1 and samrat ray 2, *.

eISSN: 2581-9615 CODEN(USA): WJARAI Impact Factor 7.8 GIF Value 90.12

World Journal of Advanced Research and Reviews (WJARR) is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International license. Permissions beyond the scope of this license may be available at www.wjarr.com This site can be best viewed in modern browser like Google chrome.

Copyright © 2024, World Journal of Advanced Research and Reviews

Designed by VS Infosolution

Amazon Go venturing into Traditional Retail Case Study Solution

Amazon Go venturing into Traditional Retail is an HBR case study based on analyzing entry into new markets. The case can be analyzed from the light of new product development or from a strategic point of view. The Exact HBR Case can be found here . The Amazon Go venturing into a Traditional Retail Case can also be analyzed from the point of view of constrained resources and management’s understanding of the environment to venture into a new business .

Amazon Go venturing into Traditional Retail Question 1: Were Amazon’s diversifications through Amazon Go and Amazon Elements appropriate, given the company’s resources and capabilities? Was such diversification a risky strategic move?

Given the resources and capabilities that Amazon possesses, it was reasonable for the company to diversify its operations by launching Amazon Go and Amazon Elements.

Since the beginning, Amazon has focused on providing customers with outstanding customer support in addition to services and goods that ultimately change the way customers buy products in their day-to-day lives. When considering Amazon, the effectiveness of its supply chain, its research and development team, its focus on the customer, and its highly efficient marketing strategies are its competitive advantages.

These strategic advantages play a critical part in successfully diversifying the business through online and offline sales, as Amazon has diversified into Amazon Go and Amazon Element. Online and offline sales account for 96% of Amazon’s revenue combined in 2016.

Amazon has a significant online presence to market offline retail sales because of the size of its customer base, which resulted in digital revenues of $71.8 million in 2017, followed by Walmart in second place at $13 million. Walmart was in the position of third place in 2017. In addition, Amazon will use the information it has gleaned from its customers’ online shopping behaviors to direct marketing efforts toward those customers.

Amazon was not a conventional retailer before the market for brick-and-mortar stores began to decline, so the company’s diversifications were a risky move. In addition to the infrastructure required for the operation of the automated checkout system, However, because Amazon has such strong brand recognition, it was simple to get the word out about these new products, and customers trusted Amazon’s ability to perform well in all aspects of its business . In addition, the Amazon Go market is only available to customers with an Amazon Prime subscription, which immediately reduces the size of their existing customer base.

However, if the overall price of an Amazon Prime membership were lowered, Amazon would be able to capitalize on its existing online customer base. This, in turn, would result in an increase in the number of customers who utilize particular Amazon Prime services, such as Amazon Go. Amazon Go venturing into Traditional Retail Case tries to answer the question.

For more case studies like Amazon Go venturing into Traditional Retail, please refer to our page here

Amazon Go venturing into Traditional Retail Question 2: Can Amazon reproduce its online retail success in offline retail segments? Will it be able to become one of the biggest offline retail players?

Amazon is able to replicate its success in online retail in the offline retail space thanks to the competitive advantages it possesses in the areas of supply chain quality, research and development, customer centricity, and its marketing plans. In addition, Amazon has a strong brand image, and they are continuously working to improve and expand their public relations, both of which help propel the offline market.

With the cutting-edge point-of-sale system from Amazon that no other grocery store actually possesses or even fantasizes about having one day. They are able to reduce employee expenses in this way as a result of the high level of customer loyalty they enjoy as well as the innovative ways in which they make shopping more straightforward and hassle-free. Amazon has the potential to and will be able to establish itself as a traditional retail location.

Additionally, because Amazon Prime members are required to pay an annual membership fee, this demonstrates a sense of consumer loyalty, which will assist in the growth of revenue in the offline market. The introduction of Amazon Go and the technological advancements it brings to the brick-and-mortar retail sector will continue to simplify and expedite the shopping experience for customers, saving them time in the process.

Amazon Go venturing into Traditional Retail Question 3: As the first mover in its shopping technology, will Amazon Go be able to succeed in the long term?

When Amazon Go was first conceived, its marketing slogan was “No lines, No Checkout, Just Grab and Go.” Amazon, as a corporation, has traditionally discovered a way to generate one-of-a-kind and value-adding customer experiences by maintaining its position of preeminence in its industry. However, Amazon is expanding into a new offline market with the help of its newly developed shopping technology. This new market may turn out to be quite distinct from Amazon’s online market.

Due to the fact that Amazon was the first company to enter the retail space that was powered by technology, the company actually has a niche market that, at least for the time being, has effectively eliminated the red ocean. Additionally, Amazon is a company that thrives on strategic creativity and research and development; as a result, this technological advancement in the shopping industry has put competitors in the lead, but only for the time being. Because of this new shopping technology, Amazon will eventually have a greater number of Prime members, which will make the company’s long-term success somewhat simpler.

Amazon Go venturing into Traditional Retail Question 4: Being the first mover in “check-out free” convenience stores, how can Amazon Go maintain its competitive advantages in the long term? How can Amazon avoid failures such as the diaper brand it introduced in 2014 and make Amazon Elements successful? How should Amazon differentiate the products it offers via Amazon Elements from the products of other suppliers on its platform?

Amazon Go is able to keep its advantage in the market despite the fact that other stores will undoubtedly catch up with it in terms of the technological aspect of store operations by maintaining a very high level of synergy between the online and offline platforms.

- Activities such as ordering a product online and picking it up in a store offline, as well as viewing a product in a store before purchasing it online, can help users become significantly more receptive to using Amazon Go.

- The value proposition of Amazon’s in-house manufactured goods needs to be clearly differentiated from those of competitors.

A strategic agreement needs to be reached with each and every one of the suppliers in order to reduce the amount of product duplication that is being offered.

– Future Customers who shop at Amazon Go may have access to special offerings in the form of technological innovations such as drone delivery.

Amazon Go venturing into Traditional Retail Question 5: Could Amazon’s offline retail marketing concept be developed globally?

It’s possible that Amazon’s offline marketing efforts around the world will face some production limitations. Amazon has always conducted all of its business online, which leads one to believe that the company is only subject to import taxes on its wares because it obtains its supplies from vendors located in other countries. If Amazon plans to open traditional retail stores in other countries, it should pay much more attention to the laws and regulations that govern physical presence in those countries.

It is possible that it could be developed in the UK due to the high level of brand loyalty that Amazon enjoys there; however, there are other countries such as China that have Alibaba and Amazon is not the leading retailer in those countries. In addition, there is a cultural component that is brought into play when establishments similar to supermarkets are established in other nations.

The manner in which individuals enjoy going shopping varies greatly from nation to nation, and outside of many western countries, Amazon Go does not fit the profile of the typical shopping experience. Amazon Go’s business model is based on the concept of convenience. It’s possible that consumers are more concerned about the cost of living in other countries than the comfort factor. When compared to the online retail space, the offline retail market has a significantly larger number of potential obstacles and risk factors to take into consideration, which may reduce their chances of global expansion.

Amazon Go venturing into Traditional Retail Question 6: Was Jeff Bezos the right person to lead the company in facing the challenges of new offline retail ventures?

Jeff Bezos was the right person to lead Amazon at the time when the company was having trouble competing in the offline retail space. Throughout his career, Bezos maintained his reputation as an innovator and market disruptor, which is essentially what Amazon sought to accomplish in the midst of these challenges.

The fact that Jeff Bezos had a proven track record and a clear vision for his future enabled him to exude an air of self-assurance, which ultimately led to the creation of brand awareness. If Amazon had attempted this venture with a different leader at the helm, the company’s level of self-assurance and creativity, both of which eventually contributed to the company’s success, would not have been the same.

Samrat is a Delhi-based MBA from the Indian Institute of Management. He is a Strategy, AI, and Marketing Enthusiast and passionately writes about core and emerging topics in Management studies. Reach out to his LinkedIn for a discussion or follow his Quora Page

Amazon Go: Venturing into Traditional Retail Case Solution & Answer

Home » Case Study Analysis Solutions » Amazon Go: Venturing into Traditional Retail

Amazon Go: Venturing into Traditional Retail Case Study Analysis

Introduction:

Amazon is one of the leading digital retailer organizationsagainst the competitors which include Google Inc., Facebook Inc., and Apple Inc. It significantly offers its services through the website in about 14 different countries and shipping services in about 75 countries across the world. The online retail sales of Amazon from 2014 to 2015 were far more than the combined sales of Walmart Inc., Apple, Target, and others. In 2016, the launch of Amazon Go tends to be the first brick-and-mortar food store with the use of computer vision, machine learning, and mobile e-commerce. But, it demonstrated a decline of 7 percent in the sales in the third quarter of 2016 which is lower as compared to the expected value.

Furthermore, Amazon was considered to be the fourth most valuable public organization in the U.S. It mainly comprised approximately268,900 employees demonstrating a 47 percent increase in 2016. By the year 2017, Amazon represented 48 different product categories that were created and sold by itself and other firms. Amazon tends to make continuous investments in R&D in terms of bringing improvement in the offers and the development of new market segments.

Assessment of Amazon’s Diversification:

Considering the diversification of Amazon, it started the international expansion of the business through its entrance in Germany and the United Kingdom and then to China, Japan, and France. In the initial stage of the business expansion, shareholders demonstrated dissatisfaction with the performance of the organization i.e. lack of significant growth and profit generation. But, its slow growth saved it from big loss from the dot-com bubble. Since 2001, Amazon had demonstrated significant expansion and diversification of the products and services through increased product offerings.

In termsof product and service innovation, one of the key factor in the product diversification offered by Amazon mainly involved the acquisition of brands which includes GoodReads, LoveFilm, and Kiva Systems. Additionally, the launchAmazon Kindle allows readers with e-books access for the fisrt time was three years before thelaunch of Apple’s iBooks. Due to the significant changes in the market share of Amazon over a period of time, it became successful in surpassing the market capitalization of Walmart.

By the year 2016, Amazon represented the sales equivalent to all the online retail sales in the United States. Therefore, such positive and noticeable growth demonstrates the fact that the products and services diversifications havebeen advantageous for the organization. Based on this reason, it has a large workforce, a significant increase in sales, increased revenue growth, and competitiveness to remain in the competition and be the first leading online retail store. Although it has surpassed Walmart – one of the key competitors of Amazon. But, the changes in technological useand rapidly changing industry dynamics havedemonstrated adecline in sales beyond the expectation.

Strategic Advice:

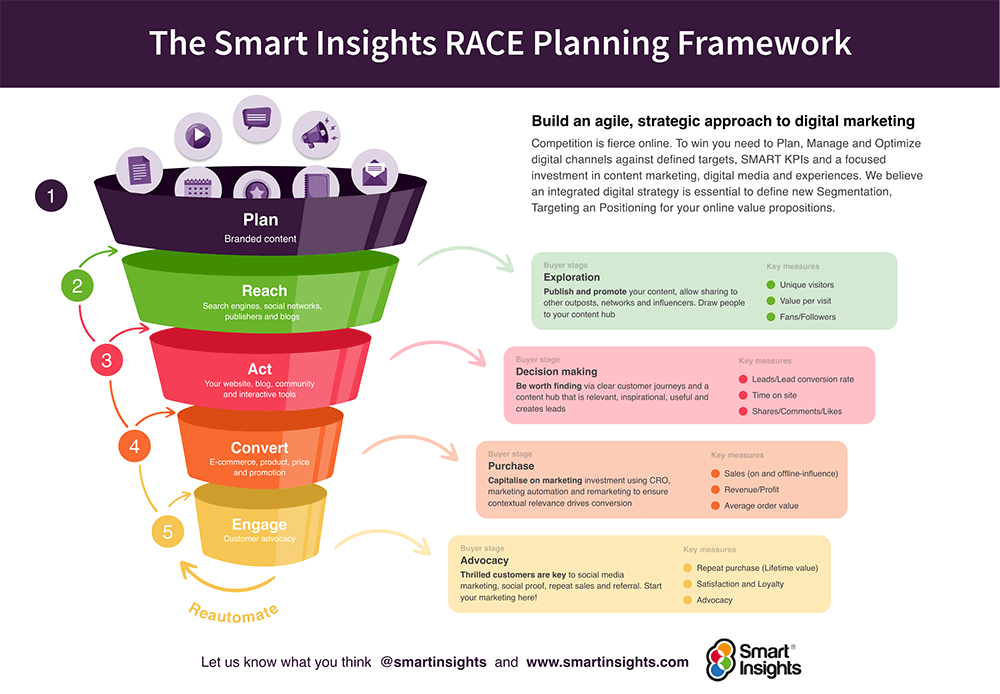

Considering the marketing dynamics and the change in the perception of customers, the trend of shopping from the physical stores has been transforming to online sales. Customers tend to prefer products online rather than spending hours in the physical stores, standing in long queues for billing. But, as the cultural environment at Amazon tendsto be customer-centric which is primarily based on the concept that works hard on efficiency. Based on the reason that Amazon Go is primarily designed to improvethe experience of the customers. As the retail industry has been shifting to the online sales; but the introduction of Amazon Go tend to demonstrate the potential to be competitive in both online and offline retail marketing approach. Similarly, the initiatives that have been taken by Amazon has significantly gained much popularity as same Amazon Go.

Thus, the promotional investment for Amazon Go should be limited as it is already much popular. This is confirmed by the fact that competitors are representing their views on the launch of Amazon Go. In order to ensure the long-term success of Amazon Go, Jeff Bezos is recommended to focus on the customer perception through online feedback right their purchase on the store. In contradiction, it is considered difficult to retain the interest of its customers with the offline sales when there is an availability of an option for online sales.

Therefore, the strategic approachin order to remain competitive in the market, Jeff Bezosis advised to consider the feedbacks given by customers regarding their products and services. Additionlly, despite the online payment system, there is a need of store staff to assist customers at the store in helping them to find the goods and products they want. (Wingfield, 2018)On the other hand, good customer and sales services greatly influence thegrowth of the organization and the product. Thus, increased investment to improve the services at the store to make the online and offline sales a perfect combination is considered important. The increased investment in improving the facilities and services at the store can be done with the use of the advertising amount…………………………….

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.

Related Case Solutions:

LOOK FOR A FREE CASE STUDY SOLUTION

5 Reasons Why Amazon Go Is Already The Greatest Retail Innovation Of The Next 30 Years

LONDON, ENGLAND - MARCH 04: Customers carry their purchases as they leave the UK's first branch of ... [+] Amazon Fresh, on March 04, 2021, in the Ealing area of London, England. Shoppers at the Amazon Fresh store, which stocks hundreds of Amazon-owned products and third-party items, check in with a smartphone app upon entry and are automatically billed when they exit, without needing to scan individual items. The location is Amazon's first "just walk out" shop outside the United States. (Photo by Leon Neal/Getty Images)

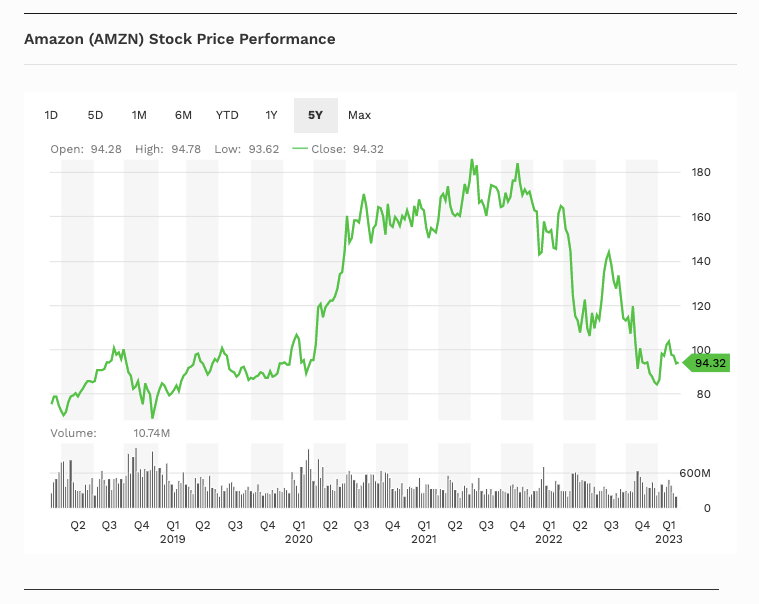

With news this past week that Amazon AMZN AMZN has taken its “Just Walk Out” technology to Whole Foods , it is time to call it like it is.

Amazon’s “Just Walk Out” tech will soon be looked upon as the greatest retail innovation of the next 30 years.

The award won’t go to voice commerce. It won’t go to Zuck’s metaverse. It will go to the technology platform that first debuted inside of a small Amazon Go store in January 2018, forever offering the world a first glimpse of what checkout-free retail could and should look like.

This isn’t to say that voice or the metaverse won’t have their day in the sun at some point, too. It is just that Amazon Go is in the here and the now. What could be coming from either of them is still way too far off in the distance and likely to come, at best, in the next 30 year cycle of retail innovation.

And, make no mistake, the above mentioned “30 year cycle” matters within the context of this conversation.

Because retail innovation cycles like clockwork. Specifically, every 30 to 40 years some new invention comes around that throws retail on its head. It is a pattern that likely goes back to the dawn of time, possibly even as far back as when Jesus Christ himself first overturned the tables in the temple.

Saving the long drawn out history lesson though, one need only look back to the late 1800s to see the cycle clearly. In and around 1890, Sears debuted its first catalog. Then, in the 1920s, following the rise of the American automobile, Sears once again built its first department store in Chicago. In the 1960s, you had the dawn of the mass merchant supercenters, aka the Walmart WMT s, the Kmarts, and the Targets of the world. And then, finally, in the 1990s you had e-commerce, aka Amazon.

Thus, that next “something” is due to shake up retail, and it is absolutely crazy to think that it could be Amazon who leaves its mark for the second 30 year cycle in a row.

One can dismiss the idea all he or she wants, but the case for why Amazon Go and its “Just Walk Out” technology platform will be the next great innovation in retail is about as straightforward and well-defined as Brad Pitt’s abs:

Reason #1 – Math

Physical stores still dominate retail. Despite the pandemic, which forced everyone to shut their doors and to order more goods from e-commerce than ever before, physical stores didn’t go anywhere. They still make up 60% to 70% of overall retail sales.

In contrast, something like the metaverse stands more likely to take a slice out of e-commerce sales than it does out of physical stores. Therefore, when attributing something as “the greatest retail innovation of the next 30 years,” it is important to keep the base of sales that the technology will impact in mind.

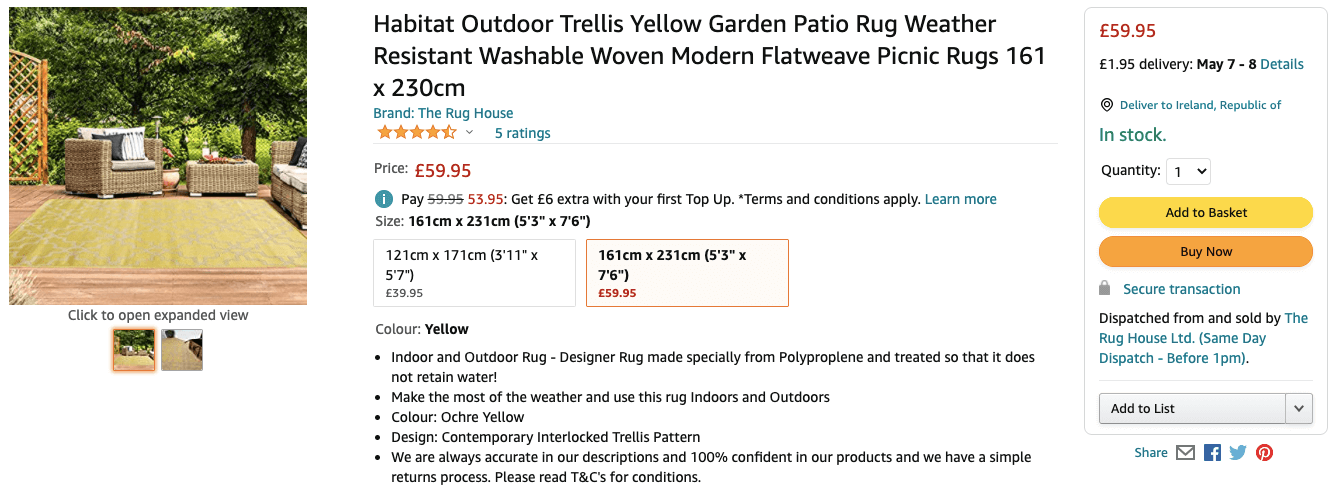

Amazon’s “Just Walk Out” technology (henceforth abbreviated as JWO) stands to impact grocery store shopping, convenience store shopping, and, if Amazon’s latest foray into physical fashion retailing is any indication, apparel shopping as well.

Whether by way of Amazon deploying JWO tech for its own initiatives, licensing the tech to others, or from copycat solutions providers licensing it within these same verticals, the pie is so large that the impacted store sales stand to trump any digitally-oriented shopping innovation hands down.

Reason #2 – It creates a better shopping experience

Amazon’s JWO technology just makes shopping easier and more convenient, plain and simple.

How it works is so intuitive in its design – customers take out their phones, scan a barcode to enter a store, take whatever they want off the shelves, and just walk out and pay electronically, like they are getting out of an Uber UBER or a Lyft LYFT , without ever having to stand in line again.

Or, better yet, in some instances, Amazon even lets you just wave your palm to enter the store, which is about the coolest thing out there, especially when shopping with kids in tow (for a video demonstration of entering an Amazon Go experience with your palm, please see below).

Amazon bets on universal truths, and the idea that no one wants to spend any time waiting in line to pay is about as universal as it gets, like on par with Brad Pitt being handsome.

Don’t agree?

Best Travel Insurance Companies

Best covid-19 travel insurance plans.

Try it. And, then ask yourself, if you had the same experience at your favorite grocery store, say at a Tesco, an Aldi, or even at a Circle K (the companies on the forefront of deploying Amazon-like tech themselves), and all else being equal, wouldn’t you choose the ability to walk out without standing in line every time?

You damn well know you would and are lying to yourself if you think otherwise.

Reason #3 – It leads to better omnichannel operations

One point oftentimes left out of the discussion of JWO technology is that it is, in reality, about far more than the checkout-free experience. It is also about streamlining the retailer’s store operations.

With cameras in the ceilings capturing everything that is going on in a given store, the technology platform gives unprecedented real-time visibility to inventory, at all times. In layman's terms, this statement means that retailers can be more confident in their inventory levels on shelf and also be more secure in knowing if that inventory happens to be in the right place to maximize sales. Studies show that inventory accuracy in physical retail stores averages between 60% and 70% . Whereas with JWO technology, to operate efficiently, that figure has to be in the high 90s.

However, there is another benefit from improved inventory accuracy that goes far beyond just more accurate inventory counts and more assured inventory placement – namely, enhanced omnichannel capabilities.

As retailers look to ship from store or to offer buy online, pickup in store or at curbside to their customers, the inventory inaccuracies discussed above hamstring these efforts. Far too often this situation leads to canceled orders or requests for substitutions.

All of which has the potential to go away in stores where JWO tech is deployed.

Reason #4 – It better aligns supply to demand

Going back to my ECON 101 days, economies are most efficient when supply is appropriately matched to demand, and that is exactly what can happen inside of an Amazon Go-style store relative to any other physical shopping experience.

By knowing what is on shelf at all times and through the use of electronic shelf labels, retailers can see what inventory they have on shelf and adjust prices accordingly. Have too much inventory? Then they can mark items down or place them on promotion. Too little? Then they can also raise prices in real-time.

Net/net – the whole thing should mean more goods in the hands of people when they need them most, and oftentimes at even better prices than they would get normally, too.

In many ways, it is how online works today, just brought to life inside of a physical store for the first time.

Reason #5 – It creates better advertising relevancy

Finally, the last reason why JWO technology is so powerful is that it digitizes a retailer’s understanding of the physical store much in the same way that retailers currently understand e-commerce.

In e-commerce, retailers know every page their customers browse, every item they add to their carts, which items they actually buy, and so on and so on. In physical retail stores, retailers know none of this information. All they know is what happens at the end of the experience as items are rung up at the till.

JWO tech changes the dynamics of the game because it knows everything a customer does in a physical store, e.g. what aisles they go down, what items they pick up off the shelf and don’t buy, and even how long they might take to look at the local Sunday circular on display in the entry vestibule.

All of which means that this data can make the advertising retailers serve up to their customers at home, out of home, or in the store itself more relevant to their customers in the moments they want it most. The customer wins in this situation and so, too, does the retailer.

And, side note, this discussion is also why Amazon’s recently released ad revenue figures of $31 billion annually is just the tip of the iceberg.

Final thoughts

So there you have it – better operations, better pricing, better relevancy, and an overall better experience bolstered by math on the side of progress.

While the preceding sentence may sound like the tagline to a Papa John’s commercial, it should be taken as seriously as a heart attack because the retail industry will be hard pressed to find another retail innovation that checks as many boxes as Amazon’s JWO tech does.

In the end, it is funny how history repeats itself.

Sears went from leading the way with its catalog in the late 1800s to rolling out department stores in the 1920s, and one could argue that e-commerce, roughly 100 years later, was just a better, refashioning of a catalog shopping experience, one which Amazon played a huge role in defining.

Will Amazon similarly define the technological foundations of physical retailing for the rest of the century? Will Amazon Go’s “Just Walk Platform” be the standard by which all physical retail shopping experiences are eventually judged?

Is Brad Pitt good looking?

Enough said.

- Order Status

- Testimonials

- What Makes Us Different

AMAZON GO: JUST-WALKOUT-TECHNOLOGY Harvard Case Solution & Analysis

Home >> Business Case Studies >> AMAZON GO: JUST-WALKOUT-TECHNOLOGY

AMAZON GO: JUST-WALKOUT-TECHNOLOGY Case Solution

Offline market is not dead and this the interaction Amazon wishes to send out to the market. By introducing a brand-new technology for the retail market , they are showing themselves as a leader in disruptive development. It will be fascinating to that how the e-Commerce business will respond to this just-walk-out technology.

This is just an excerpt . This case is about Business

Related Case Solutions & Analyses:

Hire us for Originally Written Case Solution/ Analysis

Like us and get updates:.

Harvard Case Solutions

Search Case Solutions

- Accounting Case Solutions

- Auditing Case Studies

- Business Case Studies

- Economics Case Solutions

- Finance Case Studies Analysis

- Harvard Case Study Analysis Solutions

- Human Resource Cases

- Ivey Case Solutions

- Management Case Studies

- Marketing HBS Case Solutions

- Operations Management Case Studies

- Supply Chain Management Cases

- Taxation Case Studies

More From Business Case Studies

- FIJI Water and Corporate Social Responsibility - Green Makeover or "Greenwashing"?

- Armscor: Life After Apartheid?

- Update on Zia Yusuf

- Aiding or Abetting? The World Bank and the 1997 Judicial Reform Project: Epilogue

- Mason Instrument Inc.--1986 (C): Electronics Guidance System for the Cherokee Missile

- Blue River Technology A

- McDonalds Corp.

Contact us:

Check Order Status

How Does it Work?

Why TheCaseSolutions.com?

Translate this article into 20 different languages!

If you log in through your library or institution you might have access to this article in multiple languages.

Get access to 20+ different citations styles

Styles include MLA, APA, Chicago and many more. This feature may be available for free if you log in through your library or institution.

Looking for a PDF of this document?

You may have access to it for free by logging in through your library or institution.

Want to save this document?

You may have access to different export options including Google Drive and Microsoft OneDrive and citation management tools like RefWorks and EasyBib. Try logging in through your library or institution to get access to these tools.

- Preview Available

- Scholarly Journal

- More like this

Amazon Go: Disrupting retail?

No items selected.

Please select one or more items.

Select results items first to use the cite, email, save, and export options

This is a limited preview of the full PDF

Try and log in through your library or institution to see if they have access.

It appears you don't have support to open PDFs in this web browser. To view this file, Open with your PDF reader

Suggested sources

- About ProQuest

- Terms of Use

- Privacy Policy

- Cookie Policy

Don't have an account? Sign up now

Already have an account login, get 10% off on your next order.

Subscribe now to get your discount coupon *Only correct email will be accepted

(Approximately ~ 0.0 Page)

Total Price

Thank you for your email subscription. Check your email to get Coupon Code.

Amazon Go Venturing into Traditional Retail Case Analysis and Case Solution

Posted by Peter Williams on Aug-09-2018

Introduction of Amazon Go Venturing into Traditional Retail Case Solution

The Amazon Go Venturing into Traditional Retail case study is a Harvard Business Review case study, which presents a simulated practical experience to the reader allowing them to learn about real life problems in the business world. The Amazon Go Venturing into Traditional Retail case consisted of a central issue to the organization, which had to be identified, analysed and creative solutions had to be drawn to tackle the issue. This paper presents the solved Amazon Go Venturing into Traditional Retail case analysis and case solution. The method through which the analysis is done is mentioned, followed by the relevant tools used in finding the solution.

The case solution first identifies the central issue to the Amazon Go Venturing into Traditional Retail case study, and the relevant stakeholders affected by this issue. This is known as the problem identification stage. After this, the relevant tools and models are used, which help in the case study analysis and case study solution. The tools used in identifying the solution consist of the SWOT Analysis, Porter Five Forces Analysis, PESTEL Analysis, VRIO analysis, Value Chain Analysis, BCG Matrix analysis, Ansoff Matrix analysis, and the Marketing Mix analysis. The solution consists of recommended strategies to overcome this central issue. It is a good idea to also propose alternative case study solutions, because if the main solution is not found feasible, then the alternative solutions could be implemented. Lastly, a good case study solution also includes an implementation plan for the recommendation strategies. This shows how through a step-by-step procedure as to how the central issue can be resolved.

Problem Identification of Amazon Go Venturing into Traditional Retail Case Solution

Harvard Business Review cases involve a central problem that is being faced by the organization and these problems affect a number of stakeholders. In the problem identification stage, the problem faced by Amazon Go Venturing into Traditional Retail is identified through reading of the case. This could be mentioned at the start of the reading, the middle or the end. At times in a case analysis, the problem may be clearly evident in the reading of the HBR case. At other times, finding the issue is the job of the person analysing the case. It is also important to understand what stakeholders are affected by the problem and how. The goals of the stakeholders and are the organization are also identified to ensure that the case study analysis are consistent with these.

Analysis of the Amazon Go Venturing into Traditional Retail HBR Case Study

The objective of the case should be focused on. This is doing the Amazon Go Venturing into Traditional Retail Case Solution. This analysis can be proceeded in a step-by-step procedure to ensure that effective solutions are found.

- In the first step, a growth path of the company can be formulated that lays down its vision, mission and strategic aims. These can usually be developed using the company history is provided in the case. Company history is helpful in a Business Case study as it helps one understand what the scope of the solutions will be for the case study.

- The next step is of understanding the company; its people, their priorities and the overall culture. This can be done by using company history. It can also be done by looking at anecdotal instances of managers or employees that are usually included in an HBR case study description to give the reader a real feel of the situation.

- Lastly, a timeline of the issues and events in the case needs to be made. Arranging events in a timeline allows one to predict the next few events that are likely to take place. It also helps one in developing the case study solutions. The timeline also helps in understanding the continuous challenges that are being faced by the organisation.

SWOT analysis of Amazon Go Venturing into Traditional Retail

An important tool that helps in addressing the central issue of the case and coming up with Amazon Go Venturing into Traditional Retail HBR case solution is the SWOT analysis.

- The SWOT analysis is a strategic management tool that lists down in the form of a matrix, an organisation's internal strengths and weaknesses, and external opportunities and threats. It helps in the strategic analysis of Amazon Go Venturing into Traditional Retail.

- Once this listing has been done, a clearer picture can be developed in regards to how strategies will be formed to address the main problem. For example, strengths will be used as an advantage in solving the issue.

Therefore, the SWOT analysis is a helpful tool in coming up with the Amazon Go Venturing into Traditional Retail Case Study answers. One does not need to remain restricted to using the traditional SWOT analysis, but the advanced TOWS matrix or weighted average SWOT analysis can also be used.

Porter Five Forces Analysis for Amazon Go Venturing into Traditional Retail

Another helpful tool in finding the case solutions is of Porter's Five Forces analysis. This is also a strategic tool that is used to analyse the competitive environment of the industry in which Amazon Go Venturing into Traditional Retail operates in. Analysis of the industry is important as businesses do not work in isolation in real life, but are affected by the business environment of the industry that they operate in. Harvard Business case studies represent real-life situations, and therefore, an analysis of the industry's competitive environment needs to be carried out to come up with more holistic case study solutions. In Porter's Five Forces analysis, the industry is analysed along 5 dimensions.

- These are the threats that the industry faces due to new entrants.

- It includes the threat of substitute products.

- It includes the bargaining power of buyers in the industry.

- It includes the bargaining power of suppliers in an industry.

- Lastly, the overall rivalry or competition within the industry is analysed.

This tool helps one understand the relative powers of the major players in the industry and its overall competitive dynamics. Actionable and practical solutions can then be developed by keeping these factors into perspective.

PESTEL Analysis of Amazon Go Venturing into Traditional Retail

Another helpful tool that should be used in finding the case study solutions is the PESTEL analysis. This also looks at the external business environment of the organisation helps in finding case study Analysis to real-life business issues as in HBR cases.

- The PESTEL analysis particularly looks at the macro environmental factors that affect the industry. These are the political, environmental, social, technological, environmental and legal (regulatory) factors affecting the industry.

- Factors within each of these 6 should be listed down, and analysis should be made as to how these affect the organisation under question.

- These factors are also responsible for the future growth and challenges within the industry. Hence, they should be taken into consideration when coming up with the Amazon Go Venturing into Traditional Retail case solution.

VRIO Analysis of Amazon Go Venturing into Traditional Retail

This is an analysis carried out to know about the internal strengths and capabilities of Amazon Go Venturing into Traditional Retail. Under the VRIO analysis, the following steps are carried out:

- The internal resources of Amazon Go Venturing into Traditional Retail are listed down.

- Each of these resources are assessed in terms of the value it brings to the organization.

- Each resource is assessed in terms of how rare it is. A rare resource is one that is not commonly used by competitors.

- Each resource is assessed whether it could be imitated by competition easily or not.

- Lastly, each resource is assessed in terms of whether the organization can use it to an advantage or not.

The analysis done on the 4 dimensions; Value, Rareness, Imitability, and Organization. If a resource is high on all of these 4, then it brings long-term competitive advantage. If a resource is high on Value, Rareness, and Imitability, then it brings an unused competitive advantage. If a resource is high on Value and Rareness, then it only brings temporary competitive advantage. If a resource is only valuable, then it’s a competitive parity. If it’s none, then it can be regarded as a competitive disadvantage.

Value Chain Analysis of Amazon Go Venturing into Traditional Retail

The Value chain analysis of Amazon Go Venturing into Traditional Retail helps in identifying the activities of an organization, and how these add value in terms of cost reduction and differentiation. This tool is used in the case study analysis as follows:

- The firm’s primary and support activities are listed down.

- Identifying the importance of these activities in the cost of the product and the differentiation they produce.

- Lastly, differentiation or cost reduction strategies are to be used for each of these activities to increase the overall value provided by these activities.

Recognizing value creating activities and enhancing the value that they create allow Amazon Go Venturing into Traditional Retail to increase its competitive advantage.

BCG Matrix of Amazon Go Venturing into Traditional Retail

The BCG Matrix is an important tool in deciding whether an organization should invest or divest in its strategic business units. The matrix involves placing the strategic business units of a business in one of four categories; question marks, stars, dogs and cash cows. The placement in these categories depends on the relative market share of the organization and the market growth of these strategic business units. The steps to be followed in this analysis is as follows:

- Identify the relative market share of each strategic business unit.

- Identify the market growth of each strategic business unit.

- Place these strategic business units in one of four categories. Question Marks are those strategic business units with high market share and low market growth rate. Stars are those strategic business units with high market share and high market growth rate. Cash Cows are those strategic business units with high market share and low market growth rate. Dogs are those strategic business units with low market share and low growth rate.

- Relevant strategies should be implemented for each strategic business unit depending on its position in the matrix.

The strategies identified from the Amazon Go Venturing into Traditional Retail BCG matrix and included in the case pdf. These are either to further develop the product, penetrate the market, develop the market, diversification, investing or divesting.

Ansoff Matrix of Amazon Go Venturing into Traditional Retail

Ansoff Matrix is an important strategic tool to come up with future strategies for Amazon Go Venturing into Traditional Retail in the case solution. It helps decide whether an organization should pursue future expansion in new markets and products or should it focus on existing markets and products.

- The organization can penetrate into existing markets with its existing products. This is known as market penetration strategy.

- The organization can develop new products for the existing market. This is known as product development strategy.

- The organization can enter new markets with its existing products. This is known as market development strategy.

- The organization can enter into new markets with new products. This is known as a diversification strategy.

The choice of strategy depends on the analysis of the previous tools used and the level of risk the organization is willing to take.

Marketing Mix of Amazon Go Venturing into Traditional Retail

Amazon Go Venturing into Traditional Retail needs to bring out certain responses from the market that it targets. To do so, it will need to use the marketing mix, which serves as a tool in helping bring out responses from the market. The 4 elements of the marketing mix are Product, Price, Place and Promotions. The following steps are required to carry out a marketing mix analysis and include this in the case study analysis.

- Analyse the company’s products and devise strategies to improve the product offering of the company.

- Analyse the company’s price points and devise strategies that could be based on competition, value or cost.

- Analyse the company’s promotion mix. This includes the advertisement, public relations, personal selling, sales promotion, and direct marketing. Strategies will be devised which makes use of a few or all of these elements.

- Analyse the company’s distribution and reach. Strategies can be devised to improve the availability of the company’s products.

Amazon Go Venturing into Traditional Retail Blue Ocean Strategy

The strategies devised and included in the Amazon Go Venturing into Traditional Retail case memo should have a blue ocean strategy. A blue ocean strategy is a strategy that involves firms seeking uncontested market spaces, which makes the competition of the company irrelevant. It involves coming up with new and unique products or ideas through innovation. This gives the organization a competitive advantage over other firms, unlike a red ocean strategy.

Competitors analysis of Amazon Go Venturing into Traditional Retail

The PESTEL analysis discussed previously looked at the macro environmental factors affecting business, but not the microenvironmental factors. One of the microenvironmental factors are competitors, which are addressed by a competitor analysis. The Competitors analysis of Amazon Go Venturing into Traditional Retail looks at the direct and indirect competitors within the industry that it operates in.

- This involves a detailed analysis of their actions and how these would affect the future strategies of Amazon Go Venturing into Traditional Retail.

- It involves looking at the current market share of the company and its competitors.

- It should compare the marketing mix elements of competitors, their supply chain, human resources, financial strength etc.

- It also should look at the potential opportunities and threats that these competitors pose on the company.

Organisation of the Analysis into Amazon Go Venturing into Traditional Retail Case Study Solution

Once various tools have been used to analyse the case, the findings of this analysis need to be incorporated into practical and actionable solutions. These solutions will also be the Amazon Go Venturing into Traditional Retail case answers. These are usually in the form of strategies that the organisation can adopt. The following step-by-step procedure can be used to organise the Harvard Business case solution and recommendations:

- The first step of the solution is to come up with a corporate level strategy for the organisation. This part consists of solutions that address issues faced by the organisation on a strategic level. This could include suggestions, changes or recommendations to the company's vision, mission and its strategic objectives. It can include recommendations on how the organisation can work towards achieving these strategic objectives. Furthermore, it needs to be explained how the stated recommendations will help in solving the main issue mentioned in the case and where the company will stand in the future as a result of these.

- The second step of the solution is to come up with a business level strategy. The HBR case studies may present issues faced by a part of the organisation. For example, the issues may be stated for marketing and the role of a marketing manager needs to be assumed. So, recommendations and suggestions need to address the strategy of the marketing department in this case. Therefore, the strategic objectives of this business unit (Marketing) will be laid down in the solutions and recommendations will be made as to how to achieve these objectives. Similar would be the case for any other business unit or department such as human resources, finance, IT etc. The important thing to note here is that the business level strategy needs to be aligned with the overall corporate strategy of the organisation. For example, if one suggests the organisation to focus on differentiation for competitive advantage as a corporate level strategy, then it can't be recommended for the Amazon Go Venturing into Traditional Retail Case Study Solution that the business unit should focus on costs.

- The third step is not compulsory but depends from case to case. In some HBR case studies, one may be required to analyse an issue at a department. This issue may be analysed for a manager or employee as well. In these cases, recommendations need to be made for these people. The solution may state that objectives that these people need to achieve and how these objectives would be achieved.

The case study analysis and solution, and Amazon Go Venturing into Traditional Retail case answers should be written down in the Amazon Go Venturing into Traditional Retail case memo, clearly identifying which part shows what. The Amazon Go Venturing into Traditional Retail case should be in a professional format, presenting points clearly that are well understood by the reader.

Alternate solution to the Amazon Go Venturing into Traditional Retail HBR case study

It is important to have more than one solution to the case study. This is the alternate solution that would be implemented if the original proposed solution is found infeasible or impossible due to a change in circumstances. The alternate solution for Amazon Go Venturing into Traditional Retail is presented in the same way as the original solution, where it consists of a corporate level strategy, business level strategy and other recommendations.

Implementation of Amazon Go Venturing into Traditional Retail Case Solution

The case study does not end at just providing recommendations to the issues at hand. One is also required to provide how these recommendations would be implemented. This is shown through a proper implementation framework. A detailed implementation framework helps in distinguishing between an average and an above average case study answer. A good implementation framework shows the proposed plan and how the organisations' resources would be used to achieve the objectives. It also lays down the changes needed to be made as well as the assumptions in the process.

- A proper implementation framework shows that one has clearly understood the case study and the main issue within it.

- It shows that one has been clarified with the HBR fundamentals on the topic.

- It shows that the details provided in the case have been properly analysed.

- It shows that one has developed an ability to prioritise recommendations and how these could be successfully implemented.

- The implementation framework also helps by removing out any recommendations that are not practical or actionable as these could not be implemented. Therefore, the implementation framework ensures that the solution to the Amazon Go Venturing into Traditional Retail Harvard case is complete and properly answered.

Recommendations and Action Plan for Amazon Go Venturing into Traditional Retail case analysis

For Amazon Go Venturing into Traditional Retail, based on the SWOT Analysis, Porter Five Forces Analysis, PESTEL Analysis, VRIO analysis, Value Chain Analysis, BCG Matrix analysis, Ansoff Matrix analysis, and the Marketing Mix analysis, the recommendations and action plan are as follows:

- Amazon Go Venturing into Traditional Retail should focus on making use of its strengths identified from the VRIO analysis to make the most of the opportunities identified from the PESTEL.

- Amazon Go Venturing into Traditional Retail should enhance the value creating activities within its value chain.

- Amazon Go Venturing into Traditional Retail should invest in its stars and cash cows, while getting rid of the dogs identified from the BCG Matrix analysis.

- To achieve its overall corporate and business level objectives, it should make use of the marketing mix tools to obtain desired results from its target market.

Baron, E. (2015). How They Teach the Case Method At Harvard Business School. Retrieved from https://poetsandquants.com/2015/09/29/how-they-teach-the-case-method-at-harvard-business-school/

Bartol. K, & Martin, D. (1998). Management, 3rd edition. Boston: Irwin McGrawHill.

Free Management E-Books. (2013a). PESTLE Analysis. Retrieved from http://www.free-management-ebooks.com/dldebk-pdf/fme-pestle-analysis.pdf

Gupta, A. (2013). Environment & PEST analysis: an approach to the external business environment. International Journal of Modern Social Sciences, 2(1), 34-43.

Hambrick, D. C., MacMillan, I. C., & Day, D. L. (1982). Strategic attributes and performance in the BCG matrix—A PIMS-based analysis of industrial product businesses. Academy of Management Journal, 25(3), 510-531.

Hill, C., & Jones, G. (2010). Strategic Management Theory: An Integrated Approach, Ninth Ed. Mason, OH: South-Western, Cengage Learning.

Hussain, S., Khattak, J., Rizwan, A., & Latif, M. A. (2013). ANSOFF matrix, environment, and growth-an interactive triangle. Management and Administrative Sciences Review, 2(2), 196-206.

IIBMS. (2015). 7 Effective Steps to Solve Case Study. Retrieved from http://www.iibms.org/c-7-effective-steps-to-solve-case-study/

Kim, W. C., & Mauborgne, R. (2004). Blue ocean strategy. If you read nothing else on strategy, read thesebest-selling articles., 71.

Kotler, P., & Armstrong, G. (2010). Principles of marketing. Pearson education.

Kulkarni, N. (2018). 8 Tips to Help You Prepare for the Case Method. Retrieved from https://www.hbs.edu/mba/blog/post/8-tips-to-help-you-prepare-for-the-case-method

Lin, C., Tsai, H. L., Wu, Y. J., & Kiang, M. (2012). A fuzzy quantitative VRIO-based framework for evaluating organizational activities. Management Decision, 50(8), 1396-1411.

Nixon, J., & Helms, M. M. (2010). Exploring SWOT analysis – where are we now?: A review of academic research from the last decade. Journal of Strategy and Management, 3(3), 215-251.

Panagiotou, G. (2003). Bringing SWOT into Focus. Business Strategy Review, 14(2), 8-10.

Pickton, D. W., & Wright, S. (1998). What's swot in strategic analysis? Strategic Change, 7(2), 101-109.

Porter, M. E. (2001). The value chain and competitive advantage. Understanding Business Processes, 50-66.

Porter, M. E. (1985). Competitive advantage: creating and sustaining superior performance (Vol. 2). New York: Free Press.

Porter, M.E. (1979, March). Harvard Business Review: Strategic Planning, How Competitive Forces Shape Strategy. Retrieved July 7, 2016, from https://hbr.org/1979/03/how-competitive-forces-shape-strategy

Rastogi, N., & Trivedi, M. K. (2016). PESTLE Technique–a Tool to Identify External Risks in Construction Projects. International Research Journal of Engineering and Technology (IRJET), 3(1), 384-388.

Rauch, P. (2007). SWOT analyses and SWOT strategy formulation for forest owner cooperations in Austria. European Journal of Forest Research, 126(3), 413-420.

Warning! This article is only an example and cannot be used for research or reference purposes. If you need help with something similar, please submit your details here .

9416 Students can’t be wrong

PhD Experts

Vincent Francisco

It would be good if the heading format would be increased. Thanks a lot for all the help! Best Wishes!

The assignment that I got from here seemed not an assignment but a miracle because I got an A+ due to it.

Kelly Edward

The reference surprised me. The introduction and the conclusion was also detailed. Highly recommended!

I’m pleased that the assignment was accurately conducted and I didn’t find the need to proofread it. Waiting for the grades and hopeful for the outstanding outcome.

Calculate the Price

(approx ~ 0.0 page), total price €0, next articles.

- Goodbye IMF Conditions, Hello Chinese Capital: Zambia's Copper Industry And Africa's Break With Its Colonial Past Case Analysis

- Apigee: People Management Practices And The Challenge Of Growth Case Analysis

- Deloitte And KPMG: The War For Talent Case Analysis

- Paper Stone: Building A Bakery Industry Luxury Brand Case Analysis

- BKash: Financial Technology Innovation For Emerging Markets Case Analysis

- ShopClues.com: Turning Logistics Into A Competitive Advantage Case Analysis

- Suncrest Agribusiness Company: Optimizing Seed Production Case Analysis

- Finolex: Developing An Integrated Corporate Social Responsibility Strategy Case Analysis

- Dividend Policy At SRF Limited: Buyback Of Shares Case Analysis

- Building A Community Organizing Organization: Serbia On The Move Case Analysis

Previous Articles

- BNP Paribas Fortis: The "James" Banking Experience Case Analysis

- Earth's General Store: Balancing People, Planet, And Profit In Organic Food Retailing Case Analysis

- Audio Advice: From Retail To E Tail Case Analysis

- Hamilton's Electronics Services, Inc.: The Second Year Case Analysis

- A Sharper Look At Zero Tolerance: Reports Of Sexual Assault Rock The United States Air Force Academy (Sequel) Case Analysis

- Veolia: Resourcing The World Case Analysis

- Money & Morals: The Minimum Wage And The American South Case Analysis

- Philippines: From Sick Man To Strong Man Case Analysis

- Sales Misconduct At Wells Fargo Community Bank Case Analysis

- Organizing For Performance: Four Vignettes Case Analysis

Be a great writer or hire a greater one!

Academic writing has no room for errors and mistakes. If you have BIG dreams to score BIG, think out of the box and hire Case48 with BIG enough reputation.

Our Guarantees

Zero plagiarism, best quality, qualified writers, absolute privacy, timely delivery.

Interesting Fact

Most recent surveys suggest that around 76 % students try professional academic writing services at least once in their lifetime!

Allow Our Skilled Essay Writers to Proficiently Finish Your Paper.

We are here to help. Chat with us on WhatsApp for any queries.

Customer Representative

- Digital Marketing Strategy and Planning

- Content Marketing

- Digital Experience Management (Desktop/mobile website)

- Email Marketing

- Google Analytics

- Marketing Campaign Planning

- Search Engine Optimisation (SEO)

- Social Media Marketing

- Agency growth

- Business-to-Business

- Charity and Not-for-profit

- E-commerce / Retail