TAX PLANNING CASE STUDY

Maximizing Tax Returns As An Integral Part Of Comprehensive Financial Planning

When engaging with new clients we have found that they are commonly missing substantial tax saving opportunities because their previous the tax preparer’s approach can be too simple.

Clearstead is able to review a client’s portfolio: drilling down and picking apart every aspect of a client’s finances to find ways to leverage and build income. As part of our process, Clearstead’s tax specialists look at prior tax returns to determine whether a more comprehensive planning and compliance plan could benefit a client. By untangling prior filings, Clearstead could identify undetected savings.

IN SOME CASES WE HAVE OPPORTUNITIES TO EXCLUDE INCOME FROM TAXES IMPOSED BY THE AFFORDABLE CARE ACT. THIS CAN BE AN AREA WHERE PRIVATE EQUITY CLIENTS FREQUENTLY PAY SIGNIFICANT TAXES ON INCOME GENERATED FROM THEIR FIRMS.

By implementing filing strategies that minimize taxes, our clients can potentially keep more assets in their accounts and reduce the amount investments they have to sell to pay taxes. It’s an example of how our firm’s comprehensive, service-focused approach can benefit clients and captures opportunities that can go undetected when different financial planning functions – especially taxes – are outsourced.

Here’s a look at other hidden opportunities and ways our team’s efforts can benefit our clients:

Amended Tax Returns

Other hidden opportunities might include the small business stock capital gains exclusion. In these situations, a client might invest in a small C corporation, hold it for a period of time, and then sell the stock. The IRS code allows for exclusions of 50 to 100 percent of that gain depending on when it was bought and when it was sold. This type of analysis could create savings worth thousands of dollars by amending tax returns.

Income Deductions

Another frequently overlooked opportunity is the Ohio Business Income Deduction. In some situations, Clearstead has identified wage income that qualifies for the deduction but was not excluded in tax returns by the client’s previous accountant.

New Tax Code Deductions

With changes to the tax code enacted in December 2017, the Clearstead team is busy analyzing optimal positioning for clients, such as the 20 percent deduction for pass-through income. Already, Clearstead has identified opportunities under the increased estate tax exclusion to bring assets back into the estate and potentially give clients a stepped-up basis in assets and reduce unrealized capital gains. This strategy could save thousands of dollars in unnecessary tax payments.

We are also looking at itemized deductions that will be lost under the new tax code and creating strategies to help offset those losses.

Tax planning

While all CPAs will prepare quarterly tax estimates for clients, Clearstead prides itself on diving deeper into details. Throughout the year, we are analyzing data, talking to our clients, and working on ways to minimize tax payments. It is a continuous process, and the tax return is a byproduct of a yearlong analysis. But the only way to truly maximize these returns is to have a full understanding of the client’s financial portfolio, which is where Clearstead – and its clients – have realized their greatest success.

YOUR FUTURE IN FOCUS

At Clearstead, we create integrated, prudent, and custom strategies that bring clarity to you or your organization’s financial future.

Clearstead is an independent financial advisory firm serving wealthy families and leading institutions across the country. As a fiduciary, it provides wealth management services and investment consulting to help clients meet their financial objectives, achieve their aspirations, and build stronger futures.

LEGAL STATEMENT

PRIVACY POLICY

INSTITUTIONAL INVESTMENT CONSULTING

MARKET MINUTE

1100 Superior Avenue East Suite 700 | Cleveland, Ohio 44114 216-621-1090

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Missed Tax Day? File as soon as possible to limit penalties. Try our fast, hassle-free tax filing. It's just $50.

Missed Tax Day? Try our fast, hassle-free tax filing. It's just $50.

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Tax Planning: 7 Tax Strategies and Concepts to Know

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Tax planning is the analysis and arrangement of a person's financial situation to maximize tax breaks and minimize tax liabilities in a legal and an efficient manner.

Tax rules can be complicated, but taking some time to know and use them for your benefit can change how much you end up paying (or getting back) when you file on tax day .

Here are some key tax planning and tax strategy concepts to understand before you make your next money move.

Understand your tax bracket

Learn how tax credits and deductions work

Decide between the standard deduction and itemizing

Take advantage of popular tax credits and deductions

Keep good records

Tweak your W-4 if you need to

Leverage tax-advantaged accounts

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

for a NerdWallet account

Transparent pricing

Maximum refund guaranteed

Faster filing

*guaranteed by Column Tax

1. Tax planning starts with understanding your tax bracket

You can’t really plan for the future if you don’t know where you are today. So the first tax planning tip is to figure out what federal tax bracket you’re in.

The United States has a progressive tax system. That means people with higher taxable incomes are subject to higher tax rates, while people with lower taxable incomes are subject to lower tax rates. There are seven federal income tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

No matter which bracket you’re in, you probably won’t pay that rate on your entire income. There are two reasons:

You get to subtract tax deductions to determine your taxable income (that’s why your taxable income usually isn’t the same as your salary or total income).

You don’t just multiply your tax bracket by your taxable income. Instead, the government divides your taxable income into chunks and then taxes each chunk at the corresponding rate.

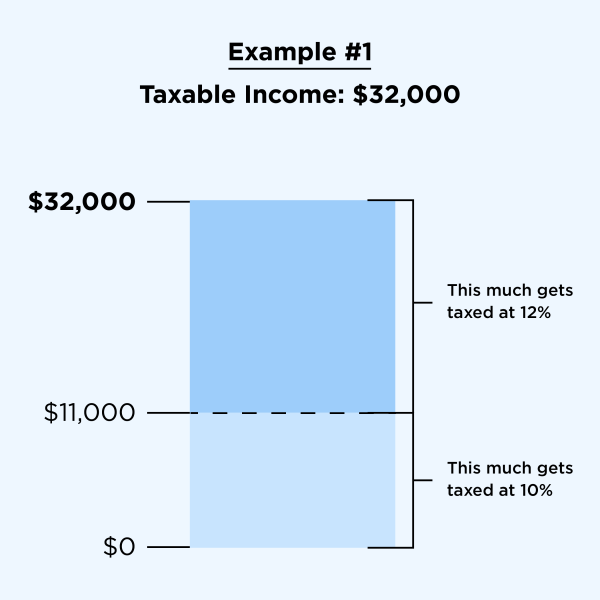

Example: Let’s say you’re a single filer with $32,000 in taxable income. That puts you in the 12% tax bracket for the 2023 tax year (taxes filed in 2024). But do you pay 12% on all $32,000? No. Actually, you pay only 10% on the first $11,000; you pay 12% on the rest.

» MORE: See what tax bracket you’re in

2. The difference between tax deductions and tax credits

Tax deductions and tax credits may be the best part of preparing your tax return. Both reduce your tax bill but in very different ways. Knowing the difference can create some very effective tax strategies that reduce your tax bill.

Tax deductions are specific expenses you’ve incurred that you can subtract from your taxable income. They reduce how much of your income is subject to taxes.

Tax credits are even better — they give you a dollar-for-dollar reduction in your tax bill. For instance, a tax credit valued at $1,000 lowers your tax bill by $1,000.

| . | ||

3. Taking the standard deduction vs. itemizing

Deciding whether to itemize or take the standard deduction is a big part of tax planning because the choice can make a huge difference in your tax bill.

What is the standard deduction?

Basically, it’s a flat-dollar, no-questions-asked tax deduction. Taking the standard deduction makes tax prep go a lot faster, which is probably a big reason why many taxpayers do it instead of itemizing.

Congress sets the amount of the standard deduction, and it’s typically adjusted every year for inflation. The standard deduction that you qualify for depends on your filing status , as the table below shows.

What does 'itemize' mean?

Instead of taking the standard deduction, you can itemize your tax return, which means taking all the individual tax deductions that you qualify for, one by one.

Generally, people itemize if their itemized deductions add up to more than the standard deduction. A key part of their tax planning is to track their deductions through the year.

The drawback to itemizing is that it takes longer to do your taxes, and you have to be able to prove you qualified for your deductions.

You use IRS Schedule A to claim your itemized deductions.

Some tax strategies may make itemizing especially attractive. For example, if you own a home, your itemized deductions for mortgage interest and property taxes may easily add up to more than the standard deduction. That could save you money.

You might be able to itemize on your state tax return even if you take the standard deduction on your federal return.

The good news: Tax software or a good tax preparer can help you figure out which deductions you’re eligible for and whether they add up to more than the standard deduction.

» MORE: Find the right tax software for your tax situation this year

4. Keep an eye on popular tax deductions and credits

Hundreds of possible deductions and credits are available, and there are rules about who’s allowed to take them. Here are some big ones (click on the links to learn more).

| for people with incomes below certain thresholds. |

» MORE: See a list of 20 common tax breaks

5. Know what tax records to keep

Keeping tax returns and the documents you used to complete them is critical if you’re ever audited . Typically, the IRS has three years to decide whether to audit your return, so keep your records for at least that long. You also should hang on to tax records for three years if you file a claim for a credit or refund after you've filed your original return.

Keep records longer in certain cases — if any of these circumstances apply, the IRS has a longer limit on auditing you:

Six years: If you underreported your income by more than 25%.

Seven years: If you wrote off the loss from a “worthless security.”

Indefinitely: If you committed tax fraud or you didn’t file a tax return.

| (IRA contributions). | |

» MORE: See more about how long to keep your tax records

6. Tweak your W-4

A W-4 tells your employer how much tax to withhold from your paycheck. Your employer remits that tax to the IRS on your behalf.

Here's how to use the W-4 for tax planning.

If you got a huge tax bill when you filed and don’t want to relive that pain, you may want to increase your withholding. That could help you owe less (or nothing) next time you file.

If you got a huge refund last year and would rather have that money in your paycheck throughout the year, do the opposite and reduce your withholding.

You probably filled out a W-4 when you started your job, but you can change your W-4 at any time. Just download it from the IRS website, fill it out and give it to your human resources or payroll team at work. You may also be able to adjust your W-4 directly through your employment portal if you have one.

» MORE: Learn how FICA and other payroll taxes work

7. Tax strategies to shelter income or cut your tax bill

Deductions and credits are a great way to cut your tax bill, but there are other tax planning strategies that can help with tax planning. Here are some popular strategies.

Put money in a 401(k)

Your employer might offer a 401(k) savings and investing plan that gives you a tax break on money you set aside for retirement.

The IRS doesn’t tax what you divert directly from your paycheck into a 401(k). In 2024, you can funnel up to $23,000 per year into an account. If you’re 50 or older, you can contribute up to $30,500.

While these retirement accounts are usually sponsored by employers, self-employed people can open their own 401(k)s .

If your employer matches some or all of your contribution, you’ll get free money to boot.

» MORE: Calculate how much you should put in your 401(k)

Put money in an IRA

Outside of an employer-sponsored plan, there are two major types of individual retirement accounts : Roth IRAs and traditional IRAs.

You have until the tax deadline to fund your IRA for the previous tax year, which gives you extra time to do some tax planning and take advantage of this strategy.

The tax advantage of a traditional IRA is that your contributions may be tax-deductible. How much you can deduct depends on whether you or your spouse is covered by a retirement plan at work and how much you make. You pay taxes when you take distributions in retirement (or if you make withdrawals prior to retirement).

The tax advantage of a Roth IRA is that your withdrawals in retirement are not taxed. You pay the taxes upfront; your contributions are not tax-deductible.

Earnings on your investments grow tax-free in a Roth and tax-deferred in a traditional IRA.

This table illustrates these accounts in action.

» MORE: How to find the right kind of IRA for you

Open a 529 account

These savings accounts, operated by most states and some educational institutions, help people save for college.

You can’t deduct contributions on your federal income taxes, but you might be able to on your state return if you’re putting money into your state’s 529 plan.

There may be gift-tax consequences if your contributions plus any other gifts to a particular beneficiary exceed $17,000 in 2023 or $18,000 in 2024.

» MORE: Learn more about how 529s work

Fund your flexible spending account (FSA)

If your employer offers a flexible spending account , take advantage of it to lower your tax bill. The IRS lets you funnel tax-free dollars directly from your paycheck into your FSA every year. In 2024, the limit is $3,200.

You’ll have to use the money during the calendar year for medical and dental expenses, but you can also use it for related everyday items such as bandages, sunscreen and glasses for yourself and your qualified dependents. You may lose what you don’t use, so take time to calculate your expected medical and dental expenses for the coming year.

Some employers might let you carry over up to $640 to the next year.

Use dependent care flexible spending accounts (DCFSAs)

This FSA with a twist is another handy way to reduce your tax bill — if your employer offers it.

The IRS will exclude up to $5,000 of your pay that you have your employer divert to a dependent care FSA account, which means you’ll avoid paying taxes on that money. That can be huge for parents, because before- and after-school care, day care, preschool and day camps are usually allowed uses. Elder care may be included, too.

What’s covered can vary among employers, so check out your plan’s documents.

Maximize health savings accounts (HSAs)

Health savings accounts are tax-exempt accounts you can use to pay medical expenses.

Contributions to HSAs are tax-deductible, and the withdrawals are tax-free, too, so long as you use them for qualified medical expenses.

If you have self-only high-deductible health coverage, you can contribute up to $4,150 in 2024. If you have family high-deductible coverage, you can contribute up to $8,300 in 2024. If you're 55 or older, you can put an extra $1,000 in your HSA.

Your employer may offer an HSA, but you can also start your own account at a bank or other financial institution.

» MORE: See the tax benefits of FSAs and HSAs

On a similar note...

Case Study: Tax Planning for Long-Term Capital Gains

Tax planning isn’t always easy. And once you’ve put together a plan, you're tasked with explaining it to your client so they see the value in your work.

Your plans are here to help your clients, but how can you find a way to make them understand?

TaxPlanIQ will help.

In today’s case studies, Sharla will assist Luba with creating different options for her client’s sudden long-term capital gain. Sharla will also meet with Greg and figure out a way to increase his client's yearly income.

Case Study 1

Luba’s client, a 76-year-old woman, received a long-term capital gain of $400,045.

She is married to her 90-year-old husband. The couple doesn’t necessarily need the money because they were doing fine before. They have had enough retirement funds, a pension, and they were getting close to $200,000 a year.

Every year, the couple spends a significant amount on medical expenses from $50,000 to $60,000. This is the only reason they itemize. The woman’s husband is bedbound, and she acts as his caretaker.

The couple is doing well and has good dividends, IRAs, and some stocks which are mostly under the woman’s name. They have paid off their house, and they made some charitable contributions. The house, however, is under the husband’s name only because they married later in life and the house was already under his name. Luba’s client is not in the title nor an owner of the house.

Her husband has children while she has no children or beneficiaries. She suspects that, in her husband’s will, everything will go to his children. She doesn’t think she’s going to get the house. She will be left with her retirement.

Because of this unexpected long-term capital gain, the woman panicked and called Luba. She said she needs to change her estimated taxes. Luba, instead, wants to help her reduce her taxes.

The woman has lived in the house with her husband for 20 years. Luba advised her to go to an attorney. The husband, being in his old age, could suddenly pass away. He is the reason why the number of medical expenses is so high.

The situation with the woman’s house is more of a scenario involving an attorney.

Potentially, the husband could sign the house over to her. Either way, Sharla and Luba both think the woman should go to an attorney and make sure she obtains any possible claim.

Where does the capital gain arise?

The woman invested in things about 30 years ago and forgot over time. Suddenly, she received a call from her financial advisor that a company she invested in had been sold, meaning she got the capital gain.

The social security of everything from last year, 2021, had a total income of $232,000. Sharla said a good idea would be to defer it and put it in a Quality Opportunity Zone (QOZ). She has five years to save 10%.

The woman may not want to go through with this idea. If so, she will have to pay 20% due to her long-term capital gain at this tax rate. Sharla wants to try one of Luba’s strategies to lower the tax rate so she can pay 15% instead.

Goal to Reduce Taxable Income

The couple’s projected taxable income is $648,000. Their income-to-be in the 15% long-term capital gain bracket is $517,000. Subtracting these two numbers results in $131,000. Sharla said that she and Luba would have to come up with $131,000 to reduce and then be able to save at least 5%.

Sharla recommends that the couple donates appreciated stock based on an existing stock that the woman still owns. They could donate $50,000 from this appreciated stock and would have a deduction and save on Federal Income Tax. They will also earn an extra 5% on long-term capital gain savings.

If the couple did a QOZ, they could get a deferral of $60,000. Their income would not include this process. In future years, she may have less income and take this money out. This method would put her into the 15% bracket again. Currently, she’s in the 20% bracket. Sharla is using a strategy called manipulating the rates.

Including Quality Charitable Distributions (QCD) with an approximate amount of $20,000, the total comes to $130,000. Having $20,000 would help her reduce her income and overall put her in a lower category.

For the capital gain, Luba wants to do a planned amount of $300,000. She suggests a $300,000 QOZ investment, but she needs to talk to her client about this plan first. Right now, her client doesn’t need this money. Yet, at the same time, the client is trying to take more of her husband’s money because she doesn’t think she will inherit any of it. She can lower her personal distributions and use this capital in her later years after her husband passes away.

Making Scenarios

The woman’s Federal Income Tax (FIT) savings comes to 37%. Her long-term capital gain rates planning comes to 5%. In Scenario 1, the plan amount for donating appreciated stock is $50,000. Multiplying this by .37%, she can get $18,500 in FIT savings. In her QOZ, she has $60,000. Multiplying this by .2% (due to her immediate 20% in this field), she gets $12,000 in long-term capital gain savings. She has $20,000 in her QCD. Multiplying this by .37%, she gets $7,400 in FIT savings. Altogether, her FIT savings are $25,900.

Her total long-term capital gain is $445,600. $445,600 - the $60,000 from QOZ multiplied by (.02% - .15%) equals to $19,280 saved.

Moving onto Scenario 2, Sharla increased the plan amount for donated appreciated stock to $75,000. This plan amount totals her FIT savings here to $27,750. Sharla also increases her QOZ to $300,000 and makes $60,000 in long-term capital gain savings. Her QCD remains the same.

The first scenario and second scenario help provide different examples/options for the tax planning work needed for Luba’s clients’ long-term capital gain.

Final Strategy

In her last strategy, Sharla uses Capital Gain Offsets. With a long-term capital gain rate difference of 20%-15%, no state rate, using the plan amount from scenario 1 ($385,600), and with FIT savings at $19,280, Luba’s client comes in with a total of $445,600. If the QOZ plan amount changes, then the Capital Gain Offsets plan amount needs to change as well.

Opportunities identified to reduce the annual tax rate include a QOZ reinvestment ($17,580), Capital Gain Offsets ($19,280), QCDs ($16,231), and Charitable Donation of Appreciated Assets ($23,150). This total leads to an estimated year 1 tax savings of $76,241.

Sharla says that a lot of creative thinking is welcome in this case study. Luba now has various options to introduce to her client and several ideas on how to limit her long-term capital gain.

Case Study 2

Greg’s client is an up-and-coming attorney. She started her business in 2019 and is making a little over 6 figures. She is anticipating making roughly 7 figures in profit this year.

She is an incredibly charitably inclined person. Even when she was on a lower income, she still made charitable donations. She is in an S-Corp status .

She runs a law firm and has been a solo office for a couple of years, but she is hiring a couple more attorneys in the next year. She is single with no children. She only took a few thousand dollars in distribution and has $9,000 in mortgage interest on her personal return.

She lives on $48,000 a year, which Sharla thinks is not enough. How can this number be potentially increased?

Family-Limited Partnership

Sharla says Greg’s client is not making that much money. She has barely any distributions. She tasks Greg with:

- Finding out more about his client

- Discovering her resources

- Figuring out her brokerage account

Sharla sees an opportunity to put Greg’s client in a family-limited partnership. The attorney might have heirs or people she considers family. She could be living with others that might qualify as her family. Sharla says they will not limit her from some of this tax planning .

Switching to C-Corp

Right now, Greg’s client is in an S-Corp. Sharla wants to figure out how to do a C-Corp for her.

For Greg’s client, there may be two things that she can do. She can have a family-limited partnership to hold onto her holdings, such as her brokerage account and any of her investments.

This process can pay management fees in a C-Corp. The C-Corp can pay a small salary, so she is technically an employee. One of the benefits for employees is an HRA . S-Corp limits her medical options. Having an HRA can deduct her medical costs.

Greg needs to find out more about his client. He needs to understand her living situation, brokerage accounts, etc. One way Greg can discover more about his client is by having a talking session or a questionnaire.

TaxPlanIQ offers an online questionnaire that Greg can use for his client. This questionnaire will ask his clients questions that may provide more detailed answers than he would get in a regular session and is a great way to learn more about your client.

Sharla was able to help Luba by coming up with various methods that will help her client’s unexpected long-term capital gain. Sharla also developed ideas for Greg as he learns more about his client and how to help her gain more money.

TaxPlanIQ provided the best layout of options for both Luba and Greg. Now, they know how to create beneficial structures for their clients.

If you’re interested in growing your firm, try using TaxPlanIQ ! If you take on the Professional Plan or Elite Plan you’ll also gain access to our Case Study Labs, like this one, where we will help create a tax plan for your clients using TaxPlanIQ .

Popular blogs

Interviews, tips, guides, industry best practices, and news.

The Charitable LLC Tax Plannin...

Business owners and entrepreneurs are always looking for legitimate and easy ways to save ...

The Augusta Rule: How Homeowne...

Picture this… you're out on the golf course, having a blast, when suddenly you stumble upo...

Save On Capital Gains Tax Usin...

When you sell an investment property, the capital gains tax can put a big dent in your pro...

Unlocking Tax Savings: Top 5 S...

In the complex world of tax planning, knowing where to start can be the biggest hurdle. Wi...

TaxPlanIQ: Unveiling Cutting E...

TaxPlanIQ is excited to introduce our most revolutionary enhancement yet: the Optical Char...

Sign up for our newsletter

Tax Plan Advisors

Case Studies

Recent case examples, as is evident with some of our recent cases identified below, our tax savings strategies are equally applicable to all industries, any business structure, any size of company or any level of revenue and net income..

Case Study: Martin, IT Professional

Most financial experts agree the #1 eroding factor to income and wealth generation is taxation. tax planning is a process of looking at various tax options in order to determine when, whether, and how to conduct business and personal transactions so that taxes are eliminated or considerably reduced. the decisions you and your tax advisors make now will either preserve or consume your income and wealth..

Executive Summary

Martin is an IT professional and is the owner of a highly profitable consulting firm that works for several high-profile companies and Department of Defense. Over the past ten years and two CPA’s, Martin has paid over $635,000 in taxes to the IRS, state, and local tax agencies. In 2018, he broke free from the tax matrix and got a tax refund for the first time in twelve years. What changed for Martin?

Before working with Tax Plan Advisors, Martin was like most business owners. He worked hard at his business, built a client base, developed a team, worked with CPA’s, became a true entrepreneur, and paid 40% + in taxes every year. To Martin’s disappointment every tax season despite all the progress he was still hemorrhaging money. He knew that things had to change if he really wanted to retire someday. Even if he sold his company for millions, he would still have to overcome the taxes.

"Martin is a true success story. But the reality is, is that this kind of success is par for the course when you develop a cohesive and holistic tax plan. This plan becomes the blueprint for asset protection, wealth creation, and business succession. This is all possible because he has as team of professionals at his back and has learned the old adage of paying himself first, reinvesting in his business, thus avoiding the tax matrix”. Gregory G. Bourque, MTAX, CASL

How our Service Helped

That is when he found us. It was a chance meeting and Martin seized the opportunity. After meeting with Martin, we were able to diagnose his tax exposure and tailor tax savings strategies to reduce and eliminate his tax bills. Reducing Martin’s tax exposure through proper planning was not the only thing that happened. During the process Martin learned how to protect his business and his family, accumulate wealth, secure his retirement, and position his business so when he decides to sell, he can significantly reduce the tax consequences of the sale of his business.

Results, Return on Investment and Future Plans

• Martin paid an average of $63,500 in taxes every year.

• With implementation of nine tax savings strategies, Martin was able to save $65,495 annually.

• These savings will continue every year unless there are significant tax law changes.

• Martin received a tax refund for the first time in twelve years in the amount of $1,513.

• The return on his investment with us has produced a growing and infinite ROI. Even our fee was tax deductible.

• Asset protection measures have been put in place to protect his business and his family.

• Wealth accumulation has begun, saving for his retirement without sacrificing quality of life.

• He has two children in college. His children work for his company (company takes a tax deduction) and the kids are paying their way through college.

• Martin plans to divert some of his retirement savings to grow a portfolio of destination real estate properties to supplement his retirement.

Collaborative Partners' Testimonial

"The Principals at Tax Plan Advisors were totally professional, highly knowledgeable, a pleasure to work with and helped me immensely with my client. Tax Plan Advisors included me in every meeting with my client as well as strategy development and implementation discussions.

Financial Planner

While I thought I was knowledgeable about taxes, Tax Plan Advisors presented several tax strategies that eliminated more than $170,000 of my client’s current year tax payments and for each year in the foreseeable future with estimated tax savings of approximately $1,703,000 over the next ten years. Additionally, Tax Plan Advisors helped my client obtain tax refunds of over $118,000 from amended returns for past years. My client was absolutely thrilled with the results of this engagement and Tax Plan Advisors positioned this in front of my client as me adding additional experts to my team; my client views me as a “hero” and have sent me several referrals (which they never did in the past).

The “found cash flow” obtained through the reduction of taxes utilizing the tax strategies recommended by Tax plan Advisors will be utilized by my client to invest in a new retirement account (added AUM fees for me) and in needed retirement income protection products (added annuity commissions). My client was unwilling to invest in themselves in past years even they agreed they should do so…now they are thrilled to move forward with my retirement planning recommendations. I am amazed by the work of Tax Plan Advisors and I am prioritizing my key clients to receive their tax planning assistance."

- Financial Planner

Client Testimonials

Don't listen to us - listen to our clients.

“We stopped overpaying the IRS.”

- Browse All Articles

- Newsletter Sign-Up

- 15 Dec 2020

- Working Paper Summaries

Designing, Not Checking, for Policy Robustness: An Example with Optimal Taxation

The approach used by most economists to check academic research results is flawed for policymaking and evaluation. The authors propose an alternative method for designing economic policy analyses that might be applied to a wide range of economic policies.

- 31 Aug 2020

- Research & Ideas

State and Local Governments Peer Into the Pandemic Abyss

State and local governments that rely heavily on sales tax revenue face an increasing financial burden absent federal aid, says Daniel Green. Open for comment; 0 Comments.

- 12 May 2020

Elusive Safety: The New Geography of Capital Flows and Risk

Examining motives and incentives behind the growing international flows of US-denominated securities, this study finds that dollar-denominated capital flows are increasingly intermediated by tax haven financial centers and nonbank financial institutions.

- 01 Apr 2019

- What Do You Think?

Does Our Bias Against Federal Deficits Need Rethinking?

SUMMING UP. Readers lined up to comment on James Heskett's question on whether federal deficit spending as supported by Modern Monetary Theory is good or evil. Open for comment; 0 Comments.

- 20 Mar 2019

In the Shadows? Informal Enterprise in Non-Democracies

With the informal economy representing a third of the GDP in an average Middle East and North African country, why do chronically indebted regimes tolerate such a large and untaxed shadow economy? Among this study’s findings, higher rates of public sector employment correlate with greater permissibility of firm informality.

- 30 Jan 2019

Understanding Different Approaches to Benefit-Based Taxation

Benefit-based taxation—where taxes align with benefits from state activities—enjoys popular support and an illustrious history, but scholars are confused over how it should work, and confusion breeds neglect. To clear up this confusion and demonstrate its appeal, we provide novel graphical explanations of the main approaches to it and show its general applicability.

- 02 Jul 2018

Corporate Tax Cuts Don't Increase Middle Class Incomes

New research by Ethan Rouen and colleagues suggests that corporate tax cuts contribute to income inequality. Open for comment; 0 Comments.

- 13 May 2018

Corporate Tax Cuts Increase Income Inequality

This paper examines corporate tax reform by estimating the causal effect of state corporate tax cuts on top income inequality. Results suggest that, while corporate tax cuts increase investment, the gains from this investment are concentrated on top earners, who may also exploit additional strategies to increase the share of total income that accrues to the top 1 percent.

- 08 Feb 2018

What’s Missing From the Debate About Trump’s Tax Plan

At the end of the day, tax policy is more about values than dollars. And it's still not too late to have a real discussion over the Trump tax plan, says Matthew Weinzierl. Open for comment; 0 Comments.

- 24 Oct 2017

Tax Reform is on the Front Burner Again. Here’s Why You Should Care

As debate begins around the Republican tax reform proposal, Mihir Desai and Matt Weinzierl discuss the first significant tax legislation in 30 years. Open for comment; 0 Comments.

- 08 Aug 2017

The Role of Taxes in the Disconnect Between Corporate Performance and Economic Growth

This paper offers evidence of potential issues with the current United States system of taxation on foreign corporate profits. A reduction in the US tax rate and the move to a territorial tax system from a worldwide system could better align economic growth with growth in corporate profits by encouraging firms to invest domestically and repatriate foreign earnings.

- 07 Nov 2016

Corporate Tax Strategies Mirror Personal Returns of Top Execs

Top executives who are inclined to reduce personal taxes might also benefit shareholders in their companies, concludes research by Gerardo Pérez Cavazos and Andreya M. Silva. Open for comment; 0 Comments.

- 18 Apr 2016

Popular Acceptance of Morally Arbitrary Luck and Widespread Support for Classical Benefit-Based Taxation

This paper presents survey evidence that the normative views of most Americans appear to include ambivalence toward the egalitarianism that has been so influential in contemporary political philosophy and implicitly adopted by modern optimal tax theory. Insofar as this finding is valid, optimal tax theorists ought to consider capturing this ambivalence in their work, as well.

- 20 Nov 2015

Impact Evaluation Methods in Public Economics: A Brief Introduction to Randomized Evaluations and Comparison with Other Methods

Dina Pomeranz examines the use by public agencies of rigorous impact evaluations to test the effectiveness of citizen efforts.

- 07 May 2014

How Should Wealth Be Redistributed?

SUMMING UP James Heskett's readers weigh in on Thomas Piketty and how wealth disparity is burdening society. Closed for comment; 0 Comments.

- 08 Sep 2009

The Height Tax, and Other New Ways to Think about Taxation

The notion of levying higher taxes on tall people—an idea offered largely tongue in cheek—presents an ideal way to highlight the shortcomings of current tax policy and how to make it better. Harvard Business School professor Matthew C. Weinzierl looks at modern trends in taxation. Key concepts include: Studies show that each inch of height is associated with about a 2 percent higher wage among white males in the United States. If we as a society are uncomfortable taxing height, maybe we should reconsider our comfort level for taxing ability (as currently happens with the progressive income tax). For Weinzierl, the key to explaining the apparent disconnect between theory and intuition starts with the particular goal for tax policy assumed in the standard framework. That goal is to minimize the total sacrifice borne by those who pay taxes. Behind the scenes, important trends are evolving in tax policy. Value-added taxes, for example, are generally seen as efficient by tax economists, but such taxes can bear heavily on the poor if not balanced with other changes to the system. Closed for comment; 0 Comments.

- 02 Mar 2007

What Is the Government’s Role in US Health Care?

Healthcare will grab ever more headlines in the U.S. in the coming months, says Jim Heskett. Any service that is on track to consume 40 percent of the gross national product of the world's largest economy by the year 2050 will be hard to ignore. But are we addressing healthcare cost issues with the creativity they deserve? What do you think? Closed for comment; 0 Comments.

N22 W27847 EDGEWATER DRIVE, SUITE 101, PEWAUKEE, WI 53072-5260 | 262-814-1600 | EMAIL US

Shakespeare Blog: View from the Lake

“Tax planning” sounds like something mysterious done only for the Rockefellers or Carnegies. In reality, it’s an important part of every financial plan. In an effort to make this typically opaque topic a little more real, we’ve created a case study that helps demonstrate how real people can save money throughout their lifetime using readily available strategies.

Tax Planning Clients

Meet Bob & Mary Ann. Bob and Mary Ann were recently referred to Shakespeare by their attorney after mentioning their pending retirement in two years. They want to make sure their ‘financial house’ is in order before they sail off into their retirement sunset. Let’s take a look at their tax situation and potential tax saving strategies as they prepare for life before and during retirement.

Note: Although Bob and Mary Ann’s situation is similar to many clients we work with, they are fictitious people. Any similarities to you or anyone else you know are purely coincidental.

Retirement Income Planning Data

Bob is Vice President of a local company and Mary Ann is a nurse working 30 hours a week at a local hospital. They both plan to retire in two years, although Bob plans on working 20-30 hours a week for a few years with one of his key customers, who has been trying to recruit him for years. He expects to make $50,000 in his ‘retirement’ job.

Demographics

- Bob: DOB 4/1/1957

- Mary Ann: DOB 7/4/1961

- Bob Salary: $175,000

- Mary Ann Salary: $45,000

- Consulting Income: $50,000

- Bob IRA: $50,000

- Mary Ann IRA: $250,000

- JT Brokerage Assets: $350,000

- Bob 401k: $600,000

- Mary 401k: $160,000

- JT Bank Assets: $100,000

- Deferred Comp: $150,000

Real Estate

- Home Value: $450,000

- Property Taxes: $6,000

- Mortgage: $200,000

- Cottage ‘Up North’: $250,000

- Property Taxes: $3,000

- HELOC: $18,000

Net-worth :

- Mortgage Interest: $8,000

- Charitable Contributions: $6,000

Tax Planning Strategies

Based on the facts listed above, let’s review a few tax saving strategies.

401k Deferral

Bob and Mary Ann have been contributing 10% to their 401ks since their kids were in high school, and have never revisited their saving strategy. After further review, each of them is able to contribute the maximum to their retirement plans. By boosting their savings to the maximum contribution limit, they will reduce their taxable income by over $30,000. In doing so, they will defer almost $7,000 in federal taxes plus any state income taxes. When they retire and are expected to be in a lower tax bracket, we’ll facilitate needed withdrawals to take advantage of this tax arbitrage opportunity.

Tax Deductions

Their current tax deductions are $26,000. This includes State and local taxes = $10,000 (capped) + Mortgage Interest $8,000 + Charity $8,000 = $26,000. With a standard deduction of $27,700 in 2023, they aren’t receiving any tax benefit from making charitable contributions (nor from any of their other deductible expenses). If they double up on their charitable contributions (shift charitable contributions from year 2 into year 1), they will boost their itemized deductions to $34,000. In year 2, they will use the standard deduction of $27,700. By shifting next year’s charitable contributions into year 1, they have created $6,300 more tax deductions and will save approximately $1,400 in federal taxes.

Brokerage Assets

After reviewing their brokerage account, we learned they owned several individual securities that were at a loss. By selling these securities, we realized $20,000 of capital losses. We used these losses to sell several of their mutual funds which were at a gain. These funds were generating unwanted year-end capital gain distributions and were adding $10,000 to their taxable income each year. We invested the proceeds of these sales into Exchange Traded Funds, which are more tax efficient and provide greater tax control. We will leverage this tax control as they enter retirement and we need to begin structuring their income sources. See Householding below. The potential tax savings from this strategy is approximately $1,500 – $2,000 per year.

Social Security Planning

Although Bob has reached full retirement age, we elected to defer his social security benefit until he reaches age 70 (year 4). This was done for two reasons. First, the added income from Social Security would increase their tax liability while they are still working and would likely push them into the 24% federal income tax bracket. By deferring the benefit until Bob’s age 70, they will likely be in a lower tax bracket and keep more of this income. In addition, the benefit will grow by 8% each year he waits to file. That larger amount will also be the survivor benefit, which will be paid out over both their lives. This provides longevity protection, in addition to tax planning benefits, in the event one of them lives well into their 80s or 90s. Mary Ann will begin her benefit as soon as she retires or reaches full retirement age, whichever comes first.

Charitable Planning

Mary Ann’s deferred compensation plan is slated to payout six months after her retirement (year 3). This windfall will increase their tax liability in year 3 and was also a factor that influenced the deferral of Bob’s Social Security Benefit (above) to age 70 (year 4). Much like we accelerated charitable contributions from year 2 into year 1, so too will we accelerate charitable contributions into year 3. After reviewing all future income sources and deductions, it was determined that we should accelerate charitable contribution for several years (4-8) into year 3 using a Donor Advised Fund. This was done because year 3 should be the highest tax year for the foreseeable future and Bob and Mary Ann are expected use the standard deduction in all other years.

RMD Planning

In year 6, Bob turns 72 and would need to begin taking Required Minimum Distributions (RMDs). This would generate approximately $25,000 – $30,000 of additional taxable income. As Bob would still be working, it was identified his new employers plan accepts 401k rollovers. Because he’s not a 5% or greater owner of the company and he’s still employed, he’s able to defer all of his RMDs in his 401k until he’s fully retired. This deferral provides for greater tax planning opportunities, both now and in the future. We’ll use Mary Ann’s retirement accounts for Roth Conversion opportunities (see below) and will take her RMDs when she turns 72.

Roth Conversions and Capital Gains

We’ll be evaluating Bob and Mary Ann’s taxable income each year relative to their tax bracket. In low tax years, if they have room between their taxable income and the top of their respective tax bracket, we’ll accelerate income by doing Roth Conversions or harvesting Capital Gains. Although it may sound counterintuitive to generate additional taxes through these techniques, so long as they are in a similar to lower bracket than future years, this strategy may make sense.

Householding

A sophisticated strategy to lower lifetime taxes entails the placement of tax inefficient assets such as bonds into retirement accounts first, and then allocate tax efficient assets such as equity ETFs into brokerage accounts. This is a complex strategy, but when coupled with the other strategies above, is another tool in controlling taxes. Note, sophisticated software and a knowledgeable financial advisor are required to implement this strategy efficiently.

Medicare Planning

Bob is on Medicare and Mary Ann has health insurance coverage through work until she turns 65. Their Medicare premiums will be a function of their previous years Modified Adjusted Gross Income (MAGI). There are several income thresholds that will determine their premium. If they exceed a given threshold by $1, their premium jumps to the next higher amount. As a married couple on Medicare, if their MAGI exceed the $194,000 threshold (2023) by $1, their overall Medicare premium will increase by almost $1,900 per year. We consider this premium increase to be a tax that should be avoided if possible. It will be important for Bob and Mary Ann to avoid exceeding these thresholds, which can happen when they or their advisor unnecessarily realize capital gains, own tax inefficient assets in brokerage accounts, or take unneeded IRA withdrawals.

The Future of Tax Planning

Keep in mind our current tax code is in effect until December, 2025. After that point, we revert to a more onerous tax structure, so any tax saving strategies that we can do between now and then will be amplified when the tax law changes. Each of the above strategies does not exist in a vacuum, but rather they are intertwined together. Using multiple strategies together accentuates the benefits of tax planning but requires great skill and planning to achieve the best results. To learn more, give us a call at 262-814-1600.

To read this content please select one of the options below:

Please note you do not have access to teaching notes, a tax planning case using a taxpayer life-cycle approach.

Advances in Accounting Behavioral Research

ISBN : 978-1-78350-445-9

Publication date: 22 August 2014

This chapter presents a seven-part case developed for use in a graduate-level tax planning class. The case is organized in a taxpayer/business “life-cycle” approach. Over the semester the case follows a married couple as they consider a number of investments, start a business, and expand the business. As the case progresses, the couple faces increasingly complex tax and business issues. The couple eventually winds down their involvement in the business and begins to plan for their retirement years. This chapter also provides a review of behavioral tax research published in the top accounting journals over the period 2004–2013. The chapter concludes with a discussion of how the case could be adapted by behavioral tax researchers in their research programs and perhaps by accounting firms in their training programs.

- Tax planning

- Case analysis

- Taxpayer life-cycle approach

- Behavioral tax research

Acknowledgements

Acknowledgment.

I would like to thank long-time colleague and friend Dale Bandy, Professor Emeritus, University of Central Florida for his help in developing this tax planning case.

Kelliher, C.F. (2014), "A Tax Planning Case Using a Taxpayer Life-Cycle Approach", Advances in Accounting Behavioral Research ( Advances in Accounting Behavioural Research, Vol. 17 ), Emerald Group Publishing Limited, Leeds, pp. 119-160. https://doi.org/10.1108/S1475-148820140000017004

Emerald Group Publishing Limited

Copyright © 2014 by Emerald Group Publishing Limited

All feedback is valuable

Please share your general feedback

Report an issue or find answers to frequently asked questions

Contact Customer Support

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

- CAMPUS TO CLIENTS

Lessons learned: Incorporating data analytics in tax curricula

Editor: Annette Nellen, Esq., CPA, CGMA

Data analytics is a valuable tool that is used to gain insights from ever - increasing volumes of data. To help students become familiar with how to apply this method of analysis to tax data, educators should teach data analytics in the classroom. They can do so by mirroring a process currently being used by entry - level accounting professionals called "extract, transform, and load" (ETL) and focusing on developing students' data analysis and visualization skills. These educational experiences will give students a better foundation for a successful career in tax, no matter what career path in the profession they may pursue.

While it is important to incorporate analytics into the tax curriculum, the implementation may seem daunting. To help, this column identifies ways that educators can overcome four major challenges: (1) What specific tools should be taught?; (2) What data analytics processes should be taught?; (3) How can data analytics be incorporated into a course that is already packed?; and (4) How can data analytics cases that are already available be adapted to meet specific needs?

Along the way, this column highlights new tax data analytics cases that can enhance students' learning experiences.

Should you teach A2019, Access, Alteryx, Azure, Blue Prism, Java, C++, Excel, Gephi, Knime, Power BI, Python, R, SAS, SQL, Tableau, and/or UiPath? The anticlimactic answer is that the specific tool you choose to teach is less important than the data analytics process. However, before discussing the data analytics process, this column offers some practical advice for selecting data analytics tools.

First, teach the tools that are used by the firms that hire your students. Your program's advisory board members, firm recruiters, and recent graduates can provide valuable insight as to the needs of your particular job market. It may be useful to inquire if there are tooling transitions underway, particularly with the increasing use of cloud - based analytical applications.

Second, do not underestimate the importance of fundamental Excel skills. Excel remains a staple for employers, partially because clients, managers, and partners commonly feel comfortable with Excel. However, employer feedback continues to indicate that students' Excel skills fall short of expectations. Since the student population is diverse, ranging from tech - dependent to tech - savvy , instructors must be mindful of covering the basics (e.g., file management, copy and paste, formulas, cell labeling, formatting), in addition to identifying projects that allow students to develop advanced skills (e.g., VLOOKUP, conditional formatting, PivotTables, and visualizations). One case that may help with Excel skills is Christine Cheng, Pradeep Sapkota, and Amy J.N. Yurko's "A Case Study of Effective Tax Rates Using Data Analytics," a forthcoming article in Issues in Accounting Education and the winner of the 2019 ATA/Deloitte Teaching Innovation Award. The casefocuses on developing students' data evaluation, PivotTable, and data visualization skills using Excel. The support material for this case includes custom instructional videos that address basic and more advanced Excel skills.

Educators who are ready to introduce a more powerful data analytics tool can quickly move students from Excel to Power BI, since the functions used in Power BI are similar to Excel's. Using an add - on approach (such as beginning with Excel and then introducing Power BI) can ensure that you educate students at all levels along the technology spectrum while helping students understand that they can adapt skills learned in one tool to other tools.

Third, while Excel and Power BI are powerful, these tools are not universally ideal for data analytics. In response to the need for more advanced tools, Alteryx (built around the ETL process) and Tableau (designed for effective data visualization) are increasing in importance in the accounting profession. Further, there is continued convergence among these tools in an effort to become the preferred data analytics tool (for example, Tableau now offers data transformation capabilities, and Alteryx now offers data visualization capabilities). Both programs offer cost - free licenses to students and faculty. The low - code characteristic of these tools is particularly appealing to students. Alteryx's repeatable workflow and ability to track data transformations throughout the ETL process is particularly appealing to employers. Alteryx or other Windows - based data analytics tools can be run on iOS - based operating systems if the student uses VMware, such as Boot Camp.

Lastly, instructors should consider incorporating at least an introduction to a code - based tool, for example, Python, R, or SAS. Code - based software programs are powerful tools that provide comprehensive data cleaning, manipulation, and analysis capabilities. Much of the stress can be reduced by providing students the appropriate code and incorporating class demonstrations. An introduction will not make students fluent in coding, but it may help students overcome their aversion to code - based analysis and be the spark that motivates further development. In introducing coding, the authors' recommendation based on experience is to avoid providing students code in a format that is easy to copy and paste. It is important that the students key in the code to help them learn the process.

Tax and accounting professionals typically use the ETL process to evaluate data. Readers can learn more about the ETL process from James Zhang, Snigdha Porwal, and Tim V. Eaton's article, " Data Preparation for CPAs: Extract, Transform, and Load ," 230 - 6 Journal of Accountancy 50 (December 2020).

Efficient data analysis has a purpose. Before tax professionals can begin the ETL process, they need to have a good question in mind. There are varied approaches to teaching students how to ask a good question. Cases, for example, mimic the process where a client or senior colleague might give an associate a task to investigate. Faculty can also work on advanced critical thinking by having students identify their own research questions to investigate. However, the latter may require that the faculty act as a sounding board, especially if students have limited experience in critical thinking.

The process of extracting data

Once the student has a research question, he or she must extract the appropriate data. Fortunately, there is ample data, particularly in tax, thanks to the plethora of data published by the IRS and state and local governments. For example, Cheng and Anu Varadharajan's "Using Data Analytics to Evaluate Policy Implications of Migration Patterns: Application for Analytics, AIS, and Tax Classes," a forthcoming article in Issues in Accounting Education , presents a case that relies on the migration data from the IRS Statistics of Income department (available at www.irs.gov ).

Faculty can also rely on data obtained from data aggregators, like Compustat or directly from the SEC's XBRL files. Cheng et al.'s "A Case Study of Effective Tax Rates Using Data Analytics," which focuses on effective tax rates (ETRs), has students use either Compustat data or the SEC's XBRL data available at www.sec.gov . While there is an initial learning curve required for using XBRL data, the case study describes the process of gathering tax information using the XBRL tags. Students exposed to the use of XBRL tags will have several valuable opportunities. First, they can gather data in an "as reported" format and better learn the process for financial reporting for tax expenses. Additionally, recent research by Casey Schwab, Bridget Stomberg, and Junwei Xia, "How Well Do Effective Tax Rates Capture Tax Avoidance?" (2020) (working paper available at www.semanticscholar.org ), found that SEC data is more accurate than Compustat for important information like tax footnotes. Finally, instructors can use information published by XBRL US to highlight issues related to data quality by having students consider how the validation rules help ensure data quality (visit xbrl.us ) and investigate recent filing results and quality checks (visit xbrl.us ).

There are distinct data benefits in both "A Case Study of Effective Tax Rates Using Data Analytics" and "Using Data Analytics to Evaluate Policy Implications of Migration Patterns: Application for Analytics, AIS, and Tax Classes" cases, which instructors should consider when selecting a case. One, the cases do not require that the students work with extremely large datasets. An extremely large dataset may create problems for students who lack access to a quality computer and/or reliable internet for remote access or cloud - based applications. You do not need "big data" to teach analytics because the tools and ETL process are the same regardless of the size of the dataset. Two, these cases provide options for free data. Three, the data for these cases changes every year. Therefore, you can reassign the case yearly, and students will get results that differ from the prior year's. Four, the data can be divided so that different students or teams evaluate different data. For the ETR (migration) project, students can be assigned different industries (states). If you develop your own case, these are some of the data factors that you must consider.

You may also obtain data by asking alumni if they would be willing to provide data or to check fictitious data you create for authenticity. Using data provided or validated by alumni comes with a potential additional benefit of promoting real - world interactions between students and businesses.

The process of transforming the data

After extracting the data, students must transform the data to prepare for evaluation. Data analytics tools continue to advance to deal with unstructured data. However, data transformation will remain a vital part of the ETL process because data is typically not collected or stored perfectly, without any blanks or miscoding issues. Additionally, data transformation can be required because of the lag between the creation and use of the data. The current pandemic provides a perfect example of this. Who would have anticipated that critical information regarding individual location preferences, data that has been collected and reported electronically since the early 1990s, would be important to state and local governments as they project budget shifts arising from the rapid shift to remote - work arrangements during the COVID - 19 pandemic? This location preference data must be transformed and potentially combined with other, imperfect sources of data to provide the best insights in the current business environment. The old adage still rules — "garbage in, garbage out" — so quality transformation is essential.

Tax professionals who have an intimate knowledge of the complex interactions among taxpayers, tax law, and regulators are best positioned to perform the most important parts of data analytics, including asking the right questions, identifying relevant data, understanding how to transform the data to answer current questions, and completing the ETL process by loading the transformed data into the appropriate programs for predictive analytics or for creating effective visualizations. The quality of the analysis for decision - making is intimately tied to the capacity for critical thinking and problem - solving . Fortunately, the latest tools put data analytics into the hands of a group of individuals extremely skilled at critical thinking: tax professionals.

Thus, tax courses should continue to focus on teaching tax first. With major tax reforms and shifting business environments, there is never a shortage of material to cover in tax courses. But it is important to recognize the opportunities afforded by incorporating data analytics tools and processes into tax classes. Teaching the ETL process develops the analytics mindset and analysis skills. Linking tax accounting to analytics develops students' understanding of the core tax concepts explored in the analytics case. A well - designed analytics case that explores an interesting research question will develop students' research, critical - thinking , and communication skills. Further, an interesting tax question will engage students and show them how fascinating tax accounting can be as a profession.

One of the best tips that can be provided for incorporating data analytics into your tax course is to focus on a topic that has always been challenging for students to understand. Several recent tax data analytics cases can help you get started.

Examples of tax data analytics cases

Faye Borthick and Lucia Smeal's case, "Data Analytics in Tax Research: Analyzing Worker Agreements and Compensation Data to Distinguish Between Independent Contractors and Employees Using IRS Factors," 35 Issues in Accounting Education 1-23 (2020), requires students to use Access to evaluate the IRS facts - and - circumstances tests for whether workers should be classified as independent contractors or employees. In the gig economy, where students often drive for ride shares, for instance, this case can help students gain a better understanding of what facts and circumstances mean while connecting to a topic they are already familiar with.

Cheng et al.'s "A Case Study of Effective Tax Rates Using Data Analytics" is an excellent resource to help students learn about ETRs. This is always an important topic for businesses, but it is particularly important at this time of remote working, when businesses may be evaluating the tax laws of alternative jurisdictions. This case is particularly helpful in a corporate tax class because the evaluation firms with outlier ETRs develop students' understanding of book - tax differences. This case primarily uses Excel, but it also includes instructions that introduce Tableau for data visualizations and Alteryx to run predictive analytics so that students can use linear regressions to explore factors that are associated with ETRs.

A basic component of tax planning is to understand how taxes can influence taxpayer decisions. The migration case by Cheng and Varadharajan mentioned earlier can help students see this, by investigating whether taxpayer location decisions are driven by tax law changes. This case allows students to learn the top 10 most used tools in Alteryx to engage in the ETL process and in Tableau to visualize the results.

A related case by Roby Sawyers, Tom Dow, and Lynn Jones titled "Tax Reform: A Case Using Data Analytics," published by Van - Griner Learning in 2020, helps highlight that congressional leaders are concerned about the impact of new tax provisions on their constituents. This case requires students to use Excel and Tableau to analyze how the new state and local tax deduction limitation imposed by the law known as the Tax Cuts and Jobs Act, P.L. 115 - 97 , may affect taxpayers within a metropolitan statistical area.

There are also several cases that help highlight the influence of taxes on small businesses. Cheng, John Eagan, and Yurko's "ChicagoLand Popcorn — Examining Online Retailer Nexus Following Wayfair Using Data Visualization and Robotics Process Automation" (2020), available from the authors upon request, provides students with the opportunity to combine legal tax research with data analytics to help students understand how tax reform may affect small online retailer expansion decisions. In this case, students researched state - specific economic nexus requirements using online tax research tools such as CCH and RIA and used either Tableau exclusively or Automation Anywhere's A2019 robotics process automation tool along with Tableau to evaluate whether an online retailer had established economic nexus in particular states, and the subsequent tax consequences.

Lauren Cooper, Kimberly Key, and Mollie Mathis's "S Corporations and IRC Section 199A: Incorporating Excel Into Tax Planning Scenarios," a forthcoming article in Issues in Accounting Education , discusses how Excel can be used to help students understand the intersection of S corporations and the Sec. 199A deduction. Since the new qualified business income deduction rules are complex, this case may provide an ideal resource for helping students gain a better understanding of the rules and the tax implications of these rules in a small business decision - making context.

Using the cases

Several of these cases come with short ( 5 - to 10 - minute ) videos that demonstrate the data analytics skills. For example, you can check out Cheng's YouTube channel at www.youtube.com . Her custom videos walk faculty and students through the data skills that are required in each of the tools to complete the data analytics cases she co - authored .

It is important to determine how much time to allocate to introducing data analytics into your tax course. The authors have found that the best approach is to provide some in - class time focusing on the tax technical and critical - thinking components of the case. For those instructors who want to ensure individual students are completing their own project, consider requiring students to add their name to a variable. This time does not take away from what you are already teaching, since it is a different approach to teaching the same tax technical process. However, you may also want to allocate some time to demonstrating the tools to help students become comfortable with them.

The authors caution against spending too much time in class on the tools demonstration. It may take too much class time, and the live demonstrations will inevitably be too slow for some students and too fast for others. The authors recommend referring students to videos already created and/or creating your own custom videos. The videos mitigate the problems that arise from having a varied student base, allowing students who are reluctant or unfamiliar to watch the video multiple times, while allowing students who are familiar to skip the videos for steps they can confidently complete.

The authors also recommend that you think about which case might be best introduced in an accounting information systems course, or an introductory tools course. This suggestion serves several purposes. First, in order to help students understand tax careers, your program should introduce a case that demonstrates how data analytics can be used to solve interesting tax problems as early as possible. Second, students benefit from seeing the data analytics tools multiple times to help them maximize their learning and comfort level in working with data analytics tools. Finally, the cases help you work on building the most important skills that will be required of students if they enter careers as tax data analytics professionals: critical thinking, problem - solving , and communication.

It may be the case that none of the data analytics cases highlighted in this column align with topics that you already cover. You might consider adapting an existing case to fit your needs, instead of trying to reinvent the wheel completely. Your adaptations of a case can focus on tailoring the tax topics and critical - thinking components to those topics and level of critical thinking that are best suited to your class. For example, consider the migration case by Cheng and Varadharajan, which was developed prior to the COVID - 19 pandemic. One adaptation is a consideration of how the pandemic might impact these migration patterns and what effect that could potentially have on state or local tax revenues. While the data for 2020 is not yet available, students can evaluate whether current media reports of migration trends are similar to trends that occurred pre - pandemic and/or use predictive analytics to project future trends. Predictive analytics could also be used to evaluate how migration trends are associated with state tax revenues and use these results to predict the expected impact of migration trends occurring in the present on state and local tax revenues. Future students could then compare the actual data, when it becomes available, to the predictions made by prior classes.

Another adaptation of this case is to have students focus on tax liability. For example, adapt the case to an internal audit perspective, where companies are trying to figure out their exposure to income tax reporting requirements. Alternatively, adapt the case to a merger - and - acquisition due diligence perspective where an acquirer is trying to figure out the potential unaccounted tax liability that has developed due to the targets' remote - work arrangements. Finally, this perspective could stem from a state tax audit perspective, either just based on confirming amounts reported for salary apportionment in light of remote - work arrangements or evaluating employment requirements that are often tied to special tax incentives provided to corporations.

There are other opportunities to expose students to data analytics and manipulation in the area of tax compliance. Often, tax practitioners upload client trial balances into tax software for the preparation of partnership or corporate tax returns. This data needs to be coded so the tax software can put each trial balance item on the correct return line. These codes are sometimes referred to as tax return codes (TRCs). The assigning of TRCs can be very time - consuming and repetitive.

Cheng, Shaw, and Luke Watson are in the process of developing a case study that provides students with a trial balance that needs to be coded with TRCs using Alteryx. This project could be expanded to illustrate the benefits of ETL by requiring them to code multiple trial balances. Students would quickly realize the benefits of data tools when they see how much work can be saved over a manual process. Another benefit of this project is that it can be incorporated into an existing tax compliance project. The coded trial balance can be used with tax preparation software to complete a tax return project. The importance of this project as a teaching case that mimics real - world professional experience for tax compliance is underscored by the announcement of a partnership between Alteryx and Thomson Reuters this past summer (see tax.thomsonreuters.com ). The authors expect that the case will be ready for limited distribution by the end of the spring 2021 semester.

While these are just a few examples, hopefully, this helps spur thoughts about how you can adapt the tax topic areas and critical - thinking components to best suit your course. If not, continue to monitor the education journals, as there are several additional tax data analytics cases on the horizon. Whatever case you select, the authors strongly recommend that you complete the project yourself from start to finish. This will develop your technical skills, prepare you for student questions, and potentially inspire ideas for future analytics projects.

The Securities and Exchange Commission disclaims responsibility for any private publication or statement of any SEC employee or commissioner.This article expresses the author's (Christine Cheng's) views and does not necessarily reflect those of the commission, the commissioners, or other members of the staff.

| |

| , Esq., CPA, CGMA, is a professor in the Department of Accounting and Finance at San José State University in San José, Calif. , Ph.D., is an assistant professor of accountancy and a visiting scholar with the SEC's Office of Structured Disclosure, and , Ph.D., is an associate professor of accountancy, both at the University of Mississippi in Oxford, Miss. , Ph.D., is an associate professor of accounting at Duquesne University in Pittsburgh. To comment on this article or to suggest an idea for another article, contact .

|

Recapture considerations for Inflation Reduction Act credits

Electing the unicap historic absorption ratio under the modified simplified production method, revisiting firpta and return-of-capital distributions, partners’ basis on the liquidation of an insolvent partnership, the bba’s ‘ceases-to-exist’ rule in partnership termination transactions.

This article discusses the history of the deduction of business meal expenses and the new rules under the TCJA and the regulations and provides a framework for documenting and substantiating the deduction.

EMPLOYEE BENEFITS & PENSIONS

Case Study: Global Tax Deal

- Resource Type:

What is the OECD Global Tax A tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Deal and what impact will it have on U.S. and foreign multinationals?

Global taxation.

Global taxes in this case study refer to taxes levied on U.S. and foreign multinational companies. These companies my be headquartered in one country (and tax jurisdiction) but have operations such as manufacturing or sales in other countries and tax jurisdictions.

Some multinationals strategically place their operations in a way that minimizes their tax burden, or how much they owe in corporate income taxes (CIT) to the countries they operate in. Oftentimes, low-tax jurisdictions are part of these strategies to minimize CIT liability. This is what the term tax haven refers to.

The Base Erosion and Profit Shifting (BEPS) project in 2015 and later Digital Services Tax (DST) proposals which came on the scene in 2018 were attempts to change tax rules for multinational corporations and address cross-border tax avoidance.

Cross-border tax avoidance occurs when multinational companies seek low-tax jurisdictions or exploit mismatches between tax systems to reduce their overall tax burden. Countries that are reliant on the CIT suffer more from this type of avoidance, and the issue can only be fully addressed by countries working together to close gaps in their tax codes and limit the use of tax havens.

The OECD and G20 countries worked together to adopt an action plan to combat BEPS, with a focus on limiting the ability to avoid taxation. The 15-point plan also sought to avoid introducing double taxation Double taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. as a remedy to the tax avoidance.

DSTs were meant as temporary policies targeted at large, digitalized business models. By targeting the digital presence of a multinational tech company instead of the location of its physical offices (think streaming services, social media, or online retailers), governments saw an opportunity to catch lost global corporate income tax A corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses , with income reportable under the individual income tax . revenue generated by companies that operate worldwide but only technically owe taxes in a home country.

These tactics proved to fall short in targeting global taxation and instead created new trade conflicts.

In the last few years, the Organisation for Economic Co-operation and Development (OECD) has discussed a more permanent and effective plan to change tax rules for large companies and continue to limit targeted tax planning by multinationals. This plan was broken into two pillars: Pillar 1 is focused on changing where companies pay taxes, and Pillar 2 would establish a global minimum tax .

The OECD Global Tax Deal