This device is too small

If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience.

- Small Business

- The Top 10 Accounting Software for Small Businesses

Understanding the Cost Principle Is Important to Your Business

See Full Bio

Our Small Business Expert

There are four basic financial reporting principles governed by generally accepted accounting principles (GAAP). These principles are designed to provide consistency and set standards throughout the financial reporting field. If you wish to be compliant with GAAP, the cost principle should be used.

The cost principle maintains that the cost of an asset must be recorded at historical cost, or its original cost and should not be recorded at fair market value. We’ll explain in greater detail just what the cost principle is and how it may impact your business.

Overview: What is the cost principle?

Even if you’re an accounting newbie, you know the importance of assets. Assets are anything of value that your business owns. Because they are so important to your business, it’s essential to record and report their value accurately and consistently, a relatively easy process if you’re using accounting software .

But whatever process you’re using to record your assets, the cost principle can help maintain consistent balance sheet reporting.

The cost principle, also known as the historical cost principle states that assets should be recorded at their original cost, rather than their current market value.

This is because, in many cases, the cost of an item is subjective and dependent on market conditions. For example, an asset you purchased a year ago may suddenly gain value for a variety of reasons. Maybe the manufacturer stopped making that particular item, or the item has become scarce.

Maybe it has become extraordinarily popular. Whatever the reason, the cost principle maintains that the asset value remains the same as its original, or purchase, cost regardless of later changes in market value.

The cost principle has little impact on current assets like your bank account; they are short-term assets with little opportunity to gain any value. However, assets such as equipment and machinery should be recorded at face value and remain on the balance sheet at their original cost.

Are there exceptions to the cost principle?

There are some exceptions to the cost principle, mainly regarding liquid assets such as debt or equity investments. Investments that will be converted to cash in the near future are shown on your balance sheet at their market value, rather than their historical cost.

The other exception is accounts receivable, which should be displayed on your balance sheet at their net realizable balance, which is the balance that you expect to receive when the accounts receivable balances are paid.

Examples of the cost principle

These examples may help you better understand the cost principle in action.

Cost principle: Example 1

Jim started his business in 2008, constructing a building to house his growing staff. The cost to construct the building was $300,000, but by 2020, the fair market value of the building had increased to $1.1 million. However, on Jim’s balance sheet, the cost of the building remains at $300,000.

Cost principle: Example 2

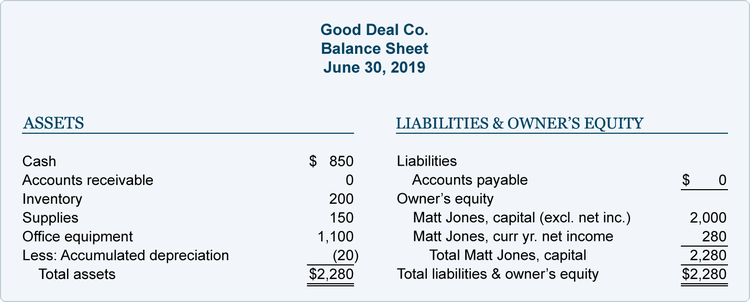

Laura purchased a piece of machinery for her small manufacturing plant in 2017 at a cost of $20,000. Today, Laura’s machinery is worth only $8,000, but it is still recorded on her balance sheet at the original cost, less the accumulated depreciation of $12,000 that has been recorded in the three years since its purchase.

The balance sheet displays the office equipment balance and the accumulated depreciation. Image source: Author

Source: AccountingCoach.com.

Cost principle: Example 3

Scott’s music production company purchases the copyright to a song from an up-and-coming artist. Scott should record the newly purchased asset at the cost he paid to purchase the copyright. Because copyright is an intangible asset, the copyright cost should be amortized, rather than depreciated.

Should you be using the cost principle?

If you currently use accrual accounting in your business and wish to be GAAP compliant, you should be using the cost principle. Since publicly owned companies are required to be GAAP compliant, they should be using the historical cost principle as well.

There are some benefits -- and a few drawbacks -- to using the cost principle, which we’ll examine next.

Benefit of using the cost principle

- Your balance sheet is consistent: Using historical cost principle ensures that your balance sheet is consistent from period to period. This is even more important when sharing that balance sheet with outside entities, such as investors and lenders.

- You can verify costs: One of the most important aspects of accounting is verification. For every transaction you make in your accounting software or your manual ledgers, there should be an originating document that verifies that entry. In other words, if there is ever a question about the assets on your books, you’ll have the original sales document with the cost of the asset available.

- There are no adjustments needed: As long as you consistently handle all your assets using the cost principle, costs will not change, always ensuring that your financial statements are accurate and not based on fluctuating fair values.

It’s important to understand the difference between the historical cost and fair value of your assets and when to use which figure. Image source: Author

Source: WallStreeMojo.com.

Drawbacks of using the cost principle

While it’s clear that using the cost principle has its advantages, there are also a few downsides as well. For instance, if your business has valuable logos or brands, they would not be reported on your balance sheet.

There is an exception for intangible assets purchased from another business. Issues can also arise when selling an asset, since it would likely be sold at fair market value, not historical cost.

Finally, the value of your company may be seriously undervalued based on the historical cost of assets, which can directly affect your credit rating, your ability to obtain a loan, or even your ability to sell the business.

Let’s say you decide to purchase a computer monitor. You have a particular brand and size in mind, so you visit various stores looking for the monitor. During this process, you realize that the exact same monitor varies in pricing from store to store. So how do you determine its fair market value?

What the historical cost principle does is ensure that you record the asset you’ve purchased at its original cost, rather than what the market value. Fair market value will always change, the original cost of the asset will not.

Yes. Using the cost principle will record the asset cost at its original cost, but you will still have to depreciate the asset, as in most cases it will continue to lose value, or depreciate.

Any highly liquid assets you purchase should be recorded at fair market value rather than historical cost. Financial investments that your business makes should also be recorded at fair market value and adjusted after each accounting period to reflect the most current value.

The cost principle offers consistency

When it comes to accounting, small business owners, who often have no background in accounting, prefer simplicity and consistency. Using the cost principle offers both. Rather than recording the value of an asset based on fair market value, which can fluctuate widely, your assets will all be recorded at their actual cost.

This ensures that the asset value reported on your balance sheet is consistent from period to period, that there is a means to verify the cost of the asset, and that asset value is not manipulated.

While there are drawbacks to using the cost principle, in most cases those drawbacks are reserved for larger companies with multiple investments or volatile, short-term securities. If you're looking to make the accounting process easier for your small business, you can start by using historical cost principle accounting.

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

Copyright © 2018 - 2024 The Ascent. All rights reserved.

What is the cost principle?

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com.

Read more →

Author: Harold Averkamp, CPA, MBA

Definition of Cost Principle

The cost principle is one of the basic underlying guidelines in accounting. It is also known as the historical cost principle.

The cost principle requires that assets be recorded at the cash amount (or the equivalent) at the time that an asset is acquired. Further, the amount recorded will not be increased for inflation or improvements in market value. (An exception is the change in market value of a short-term investment in the capital stock of a corporation whose shares of stock are actively traded on a major stock exchange.)

Example of Cost Principle

The cost principle means that a long-term asset purchased for the cash amount of $50,000 will be recorded at $50,000. If the same asset was purchased for a down payment of $20,000 and a formal promise to pay $30,000 within a reasonable period of time and with a reasonable interest rate, the asset will also be recorded at $50,000.

A long-term asset that will be used in a business (other than land) will be depreciated based on its cost. The cost will be reported on the balance sheet along with the amount of the asset’s accumulated depreciation . Further, the accumulated depreciation cannot exceed the asset’s cost.

The cost principle prohibits a company from recording an asset that was not acquired in a transaction. Hence, a company cannot report its highly successful management team as an asset nor can it report its highly valuable trademark that it developed over many years. (As a result of the cost principle, some of a company’s most valuable assets will not appear as assets on the company’s balance sheet.) On the other hand, if the company acquires a competitor’s trademark in a $3 million transaction, that trademark will be reported as an asset at its cost of $3 million.

Related Questions

- What is GAAP?

- What are generally accepted accounting principles (GAAP)?

- What is the matching principle?

- What is the cost of goods sold?

- What are the accounting principles, assumptions, and concepts?

- What is principles of accounting?

Related In-Depth Explanations

- Accounting Basics

- Accounting Principles

- Balance Sheet

- Depreciation

Advance Your Accounting and Bookkeeping Career

- Perform better at your job

- Get hired for a new position

- Understand your small business

- Pass your accounting class

Earn Our Certificates of Achievement

- Debits and Credits

- Adjusting Entries

- Financial Statements

- Income Statement

- Cash Flow Statement

- Working Capital and Liquidity

- Financial Ratios

- Bank Reconciliation

- Accounts Receivable and Bad Debts Expense

- Payroll Accounting

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

About the Author

Read 2,651 Testimonials

- 01. Accounting Basics 0%

- 02. Debits and Credits 0%

- 03. Chart of Accounts 0%

- 04. Bookkeeping 0%

- 05. Accounting Equation 0%

- 06. Accounting Principles 0%

- 07. Financial Accounting 0%

- 08. Adjusting Entries 0%

- 09. Financial Statements 0%

- 10. Balance Sheet 0%

- 11. Working Capital and Liquidity 0%

- 12. Income Statement 0%

- 13. Cash Flow Statement 0%

- 14. Financial Ratios 0%

- 15. Bank Reconciliation 0%

- 16. Accounts Receivable and Bad Debts Expense 0%

- 17. Accounts Payable 0%

- 18. Inventory and Cost of Goods Sold 0%

- 19. Depreciation 0%

- 20. Payroll Accounting 0%

- 21. Bonds Payable 0%

- 22. Stockholders' Equity 0%

- 23. Present Value of a Single Amount 0%

- 24. Present Value of an Ordinary Annuity 0%

- 25. Future Value of a Single Amount 0%

- 26. Nonprofit Accounting 0%

- 27. Break-even Point 0%

- 28. Improving Profits 0%

- 29. Evaluating Business Investments 0%

- 30. Manufacturing Overhead 0%

- 31. Nonmanufacturing Overhead 0%

- 32. Activity Based Costing 0%

- 33. Standard Costing 0%

- Explanations

- Practice Quizzes

- Word Scrambles

- Video Training

- Visual Tutorials

- Quick Tests

- Cheat Sheets

- Business Forms

- Printable PDFs

- Certificates

- Search Search Please fill out this field.

- Building Your Business

- Business Financing

What Is Cost Principle?

:max_bytes(150000):strip_icc():format(webp)/femi-21-ZF-5456-02172-1-005-ff73c870144a43c3aacc686177be3ec3-19403711625c404a8ad7061924fb7d73.jpeg)

LaylaBird / Getty Images

Cost principle is the accounting practice stating that any assets owned by a company will be recorded at their original cost, not their current market value. The purpose of using the cost principle method is to maintain reliable information across financial documents and provide consistency in verifying an asset’s cost at the time of purchase.

Definition and Examples of Cost Principle

Cost principle is the accounting practice of recording the original purchase price of an asset on all financial statements. This historic cost of an asset is used to provide reliable and consistent records. A cost principle will also include expenses incurred in purchasing the asset, such as shipping and delivery fees, as well as setup and training fees.

Cost principle is a standard accounting practice for publicly traded companies. Using cost principle follows the Generally Accepted Accounting Procedures (GAAP) , which is established by the Financial Accounting Standards Board (FASB).

Financial assets such as stocks and bonds are excluded from cost principle as these are recorded as fair market value.

- Alternate name : historical cost principle

An example of cost principle is a business purchasing a plot of land for $40,000 in 2019 that it planned to use as a parking lot. By 2022, the plot of land is valued at $80,000. The business would report the original cost of $40,000 on its financial statements, despite the asset appreciating in value.

How Cost Principle Works

When a business owner purchases something of value, such as land, a building, or equipment, it is defined as a business asset . As a business asset, it possesses two values: the original cost that was paid and the fair market value.

Typically, short-term assets and liabilities are recorded using the cost principle method, since a business may not have possession of them long enough for their values to significantly change prior to their liquidation or settlement.

The purpose of the cost principle is to ensure that financial statements record the original cost of a valuable asset. A company may not record what it estimates or thinks the value of the asset is, only what is verifiable.

Cost principle does not take inflation into consideration.

Recording the cost principle is essential because it is:

- Consistent : The value originally recorded will never change despite an asset appreciating in value.

- Comparable : As a business owner, it is important to be able to make decisions concerning your assets. By using the cost principle, you will be able to see the original costs of all assets.

- Verifiable : Using the same value on all financial records is an uncomplicated and straightforward process of knowing a business’s assets. An accountant or bookkeeper will never need to refer to other documents to understand.

Since cost principle is a fundamental concept of accounting for businesses, it is important to understand its purpose in recording assets and how it assists accountants and bookkeepers with verifying information effectively.

Key Takeaways

- Cost principle, also referred to as historical cost principle, is an accounting practice that records the original purchase price of assets on financial statements despite fluctuating market changes.

- The concept of cost principle is one of the five Generally Accepted Accounting Procedures (GAAP), which is established by the Financial Accounting Standards Board (FASB).

- The purpose of cost principle is to easily identify the original value of an asset on financial documents.

- Exceptions to the cost principle rule of recording assets are stocks and bonds, which are recorded at their fair market values.

Want to read more content like this? Sign up for The Balance’s newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

OpenStax. “ Principles of Accounting, Volume 1: Financial Accounting ,” Page 129.

University of Indiana Office of University Controller. “ Accounting Principles .”

Our Recommendations

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Small Business Resources

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

- Sales & Marketing

- Social Media

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

- Women in Business

- Personal Growth

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

- Salesforce vs. HubSpot: Which CRM Is Right for Your Business?

- Rippling vs Gusto: An In-Depth Comparison

- RingCentral vs. Ooma Comparison

- Choosing a Business Phone System: A Buyer’s Guide

- Equipment Leasing: A Guide for Business Owners

- HR Solutions

- Financial Solutions

- Marketing Solutions

- Security Solutions

- Retail Solutions

- SMB Solutions

Business News Daily provides resources, advice and product reviews to drive business growth. Our mission is to equip business owners with the knowledge and confidence to make informed decisions. As part of that, we recommend products and services for their success.

We collaborate with business-to-business vendors, connecting them with potential buyers. In some cases, we earn commissions when sales are made through our referrals. These financial relationships support our content but do not dictate our recommendations. Our editorial team independently evaluates products based on thousands of hours of research. We are committed to providing trustworthy advice for businesses. Learn more about our full process and see who our partners are here .

What Is the Cost Principle?

Cost accounting makes it easy to track the value of large assets on your books. Here's how to use it in your small business.

Table of Contents

The cost principle is an important part of financial reporting, as it encompasses the value of a business asset. By recording the cash value of an asset when it is acquired, you’ll understand its fixed value rather than mapping its worth over time.

Here’s everything you should know about the cost principle, as well as how to use it for your business.

Editor’s note: Looking for the right accounting software for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

What is the cost principle?

The cost principle is the idea that companies should value large fixed assets, like real estate and machinery, based on what the company paid for them at the time of acquisition, rather than at their current fair market value. The cost principle is one of the four U.S. Generally Accepted Accounting Principles (GAAP) and considered a more conservative (and potentially more accurate) way to value large assets.

Applying the cost principle maintains consistent and conservative values of your business’s assets. Unlike fair market value, which is often subjective and dependent on the market, the original purchase price of an asset remains fixed over time. By applying the cost principle, you can keep your balance sheet consistent between periods and won’t need to update your financial statements with current fair market values.

How is the cost principle used?

The cost principle helps ensure business assets are based on their actual cost rather than their value based on the market’s constant fluctuations. The principle is most often reflected in a company’s balance sheet, which includes values for all of the assets it owns, as well as debts owed to vendors (including for business loans used to acquire assets). [Read related article: 2024’s best business loans ]

Exceptions to the cost principle

The cost principle is one of the most conservative ways to track the values of multiple large assets, but there are some notable cases where cost accounting should not be used.

- Accounts receivable : Money owed to a business by its customers should not be recorded at the original amount owed. To be conservative, companies should use the amount they expect to receive when the account is paid (the net realizable balance).

- Highly liquid assets : If a business owns assets for which there is a ready market (meaning the business can quickly sell the asset and turn it into cash), using the cost principle to value these assets may be too conservative and make the balance sheet inaccurate. This is especially true for assets that, though liquid, may be held on a company’s books for long periods of time. Shares of stock in publicly traded companies, for example, are typically valued at fair market value (plus a possible discount if the company needs to sell at a small loss).

Example of the cost principle

As an illustration of how the cost principle works, consider a small manufacturer that purchased a packing machine for $100,000 in 2018. The asset is added to the company’s balance sheet with a value of $100,000.

In 2024, the fair market value of that equipment has increased to $130,000, due to higher prices for goods that the manufacturer is making and supply chain issues in getting that particular piece of equipment. Under the cost principle, the asset remains on the company’s books with a value of $85,000 ($100,000 minus $15,000 in depreciation) and is not adjusted to reflect the current market conditions.

Similarly, if the same company purchased its manufacturing facility and land for $600,000 in 2000, the real estate will remain on its books for the purchase price rather than its current market value of $3 million.

On the other hand, if the same company invested $200,000 in Tesla stock in 2017, the value of that liquid investment should be updated to reflect its current value after each accounting period. This is because stock in a publicly traded company like Tesla is a highly liquid asset and a common exception to the cost principle.

Pros and cons of cost accounting

Cost accounting enables businesses to detail the actual cost of expenditures and is easy to maintain from period to period. However, this method doesn’t always accurately reflect the current value of assets and may result in your business being undervalued. Familiarize yourself with the pros and cons of cost accounting to better understand how items are reflected on your balance sheet and when to use cost accounting for your business. [Read related article: The Best Accounting Software Providers ]

Advantages of the cost principle

The cost principle is a popular accounting method because it’s simple, straightforward and conservative. It lets businesses easily identify, verify and maintain expenses over time — without having to update the value of assets as often.

It details actual costs for budgeting purposes.

By valuing assets at the price paid when they were acquired, businesses are able to track how the cost to acquire those assets is changing over time. Businesses can also make budgeting decisions based on historical purchases and long-term trends in price. They can see how their assets’ values change over time. This helps them make decisions about whether to buy equipment new or secondhand based on how the value of that equipment is likely to change in the future.

Asset values are objective and can be easily verified.

One of the biggest advantages of cost accounting is its simplicity. All you need to know in order to use cost accounting is how much you paid for an asset. Of course, you can also depreciate any capitalized assets over time. The IRS outlines depreciation schedules for taxpayer use, and a trained accountant can also implement them. Any depreciation of assets creates recurring tax benefits for business, as depreciation can be offset against the business’s income.

It does not require updating from period to period.

Aside from updating the values of depreciating assets, cost accounting means you do not need to bother updating the values of large assets on your balance sheet. This holds true even if the values of the assets fluctuate over time. Cost accounting can also prevent you from overestimating the values of your assets, which is important if you’re seeking financing or considering a merger or acquisition.

Disadvantages of the cost principle

In general, the drawbacks of cost accounting are more significant for larger companies than for small businesses. This is particularly true for businesses with diverse and ever-changing product lines and those that are invested in volatile securities. However, the cost principle does have some shortcomings that may result in even small businesses being undervalued.

It does not accurately reflect an asset’s current value.

Some business equipment, like computers, are never worth more than what you paid for it. But for many capitalized assets, like real estate or heavy equipment, the opposite is often true. Real estate is a prime example. With values changing all the time, companies that purchased real estate property even five years ago could almost certainly get more for that property now. Yet cost accounting requires they continue to value that asset at the price they paid for it, less any depreciation.

It may result in your business being undervalued.

Because cost accounting often undervalues the assets on a business’s balance sheet, it can lead to the business itself being dramatically undervalued. This can present difficulties when applying for business financing to expand your business, negotiating to merge or sell your business, and so on. This means it’s critical to understand how cost accounting works and how it impacts your specific situation. Being able to explain your business’s finances to lenders and investors is crucial to expansion and success.

It can incur unexpected tax liabilities.

When your business sells an asset, it will typically be sold at fair market value rather than the price you paid for it. This difference is considered a capital gain and is taxable at up to normal corporate income tax rates.

This tax is especially significant for large assets that depreciate over time. If you sell an asset that has been depreciated for more than the value of the asset on your books, the resulting capital gain is called depreciation recapture and can lead to large, unexpected tax liability.

It doesn’t account for inflation or deflation.

One of the biggest drawbacks of cost accounting is that it ignores established long-term pricing trends for many large assets, including real estate. Because of inflation and other factors, the prices of many assets change over time in predictable ways. Cost accounting ignores those trends and instead values assets based on rigid cost principles. While this process can produce short-term tax benefits for your business, it can lead to significant misalignments between your firm’s balance sheet and market prices in the long run.

Cost principle

The cost principle can be a helpful tool when it comes to financial reporting within your business. This ensures your assets are based on their initial costs versus their market value over time. Additionally, it helps with budgeting without requiring consistent updates.

However, as with anything, there are some drawbacks to consider when using the cost principle in your financial reporting. For example, you could potentially undervalue your business or overlook your assets’ current values.

Sammi Caramela contributed to this article.

Building Better Businesses

Insights on business strategy and culture, right to your inbox. Part of the business.com network.

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One CURRENT ARTICLE

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

A business plan is a document that outlines a company's goals and the strategies to achieve them. It's valuable for both startups and established companies. For startups, a well-crafted business plan is crucial for attracting potential lenders and investors. Established businesses use business plans to stay on track and aligned with their growth objectives. This article will explain the key components of an effective business plan and guidance on how to write one.

Key Takeaways

- A business plan is a document detailing a company's business activities and strategies for achieving its goals.

- Startup companies use business plans to launch their venture and to attract outside investors.

- For established companies, a business plan helps keep the executive team focused on short- and long-term objectives.

- There's no single required format for a business plan, but certain key elements are essential for most companies.

Investopedia / Ryan Oakley

Any new business should have a business plan in place before beginning operations. Banks and venture capital firms often want to see a business plan before considering making a loan or providing capital to new businesses.

Even if a company doesn't need additional funding, having a business plan helps it stay focused on its goals. Research from the University of Oregon shows that businesses with a plan are significantly more likely to secure funding than those without one. Moreover, companies with a business plan grow 30% faster than those that don't plan. According to a Harvard Business Review article, entrepreneurs who write formal plans are 16% more likely to achieve viability than those who don't.

A business plan should ideally be reviewed and updated periodically to reflect achieved goals or changes in direction. An established business moving in a new direction might even create an entirely new plan.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. It allows for careful consideration of ideas before significant investment, highlights potential obstacles to success, and provides a tool for seeking objective feedback from trusted outsiders. A business plan may also help ensure that a company’s executive team remains aligned on strategic action items and priorities.

While business plans vary widely, even among competitors in the same industry, they often share basic elements detailed below.

A well-crafted business plan is essential for attracting investors and guiding a company's strategic growth. It should address market needs and investor requirements and provide clear financial projections.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, gathering the basic information into a 15- to 25-page document is best. Any additional crucial elements, such as patent applications, can be referenced in the main document and included as appendices.

Common elements in many business plans include:

- Executive summary : This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services : Describe the products and services the company offers or plans to introduce. Include details on pricing, product lifespan, and unique consumer benefits. Mention production and manufacturing processes, relevant patents , proprietary technology , and research and development (R&D) information.

- Market analysis : Explain the current state of the industry and the competition. Detail where the company fits in, the types of customers it plans to target, and how it plans to capture market share from competitors.

- Marketing strategy : Outline the company's plans to attract and retain customers, including anticipated advertising and marketing campaigns. Describe the distribution channels that will be used to deliver products or services to consumers.

- Financial plans and projections : Established businesses should include financial statements, balance sheets, and other relevant financial information. New businesses should provide financial targets and estimates for the first few years. This section may also include any funding requests.

Investors want to see a clear exit strategy, expected returns, and a timeline for cashing out. It's likely a good idea to provide five-year profitability forecasts and realistic financial estimates.

2 Types of Business Plans

Business plans can vary in format, often categorized into traditional and lean startup plans. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These are detailed and lengthy, requiring more effort to create but offering comprehensive information that can be persuasive to potential investors.

- Lean startup business plans : These are concise, sometimes just one page, and focus on key elements. While they save time, companies should be ready to provide additional details if requested by investors or lenders.

Why Do Business Plans Fail?

A business plan isn't a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections. Markets and the economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All this calls for building flexibility into your plan, so you can pivot to a new course if needed.

How Often Should a Business Plan Be Updated?

How frequently a business plan needs to be revised will depend on its nature. Updating your business plan is crucial due to changes in external factors (market trends, competition, and regulations) and internal developments (like employee growth and new products). While a well-established business might want to review its plan once a year and make changes if necessary, a new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is ideal for quickly explaining a business, especially for new companies that don't have much information yet. Key sections may include a value proposition , major activities and advantages, resources (staff, intellectual property, and capital), partnerships, customer segments, and revenue sources.

A well-crafted business plan is crucial for any company, whether it's a startup looking for investment or an established business wanting to stay on course. It outlines goals and strategies, boosting a company's chances of securing funding and achieving growth.

As your business and the market change, update your business plan regularly. This keeps it relevant and aligned with your current goals and conditions. Think of your business plan as a living document that evolves with your company, not something carved in stone.

University of Oregon Department of Economics. " Evaluation of the Effectiveness of Business Planning Using Palo Alto's Business Plan Pro ." Eason Ding & Tim Hursey.

Bplans. " Do You Need a Business Plan? Scientific Research Says Yes ."

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

Harvard Business Review. " How to Write a Winning Business Plan ."

U.S. Small Business Administration. " Write Your Business Plan ."

SCORE. " When and Why Should You Review Your Business Plan? "

:max_bytes(150000):strip_icc():format(webp)/GettyImages-904536858-c089bc26f4fd4025b23f536345ba73ae.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

What The Cost Principle Is And Why You Need To Know It

A business’s accounts receivable, as they might instead be recorded as realizable value, meaning these assets may not have been paid in full by customers or clients yet. In this article, you will learn what the cost principle is, the advantages and disadvantages of the cost principle and how it can be applied to a business through the use of relevant examples. Capital expenditures for improvements to land or buildings which materially increase their value or useful life is unallowable. This does not apply to cost associated with Capital Improvement Project funds received from the State for that purpose. Allocation of costs based on forecasts, revenues received, budgeted revenues, budgeted costs, or anticipated contract reimbursements are not acceptable or allowable. Is necessary to the overall operation of the provider, although a direct relationship to any particular cost objectives cannot be shown.

Costs incurred by IHEs for, or in support of, alumni/ae activities are unallowable. Program outreach and other specific purposes necessary to meet the requirements of the Federal award. The federally negotiated indirect rate, distribution base, and rate type for a non-Federal entity (except for the Indian tribes or tribal organizations, as defined in the Indian Self Determination, Education and Assistance Act, 25 U.S.C. 450b) must be available publicly on an OMB-designated Federal website. Is necessary to the overall operation of the non-Federal entity and is assignable in part to the Federal award in accordance with the principles in this subpart. Whether the non-Federal entity significantly deviates from its established practices and policies regarding the incurrence of costs, which may unjustifiably increase the Federal award’s cost. Whether the individuals concerned acted with prudence in the circumstances considering their responsibilities to the non-Federal entity, its employees, where applicable its students or membership, the public at large, and the Federal Government. Be necessary and reasonable for the performance of the Federal award and be allocable thereto under these principles.

Per US GAAP, the PPE is recorded at the historical cost and require to change to the value in the financial statements even if the market value of assets is an increase or decrease. The example of the historical cost principle in IFRS, PPE per IFRS requires to record initially at cost, and the value will be subsequently reduced by depreciation or impairment. The cost principle might not reflect a current value of long-term property after so many years. For example, a building could be worth a different price now than it was 50 years ago. For some assets, the price principle doesn’t reflect what the asset is currently worth. If an asset belongs to a market that frequently fluctuates, you might need to look at its fair market value.

Accordingly, recording assets at acquisition cost meets the convention of objectivity. Moreover, the present value of assets constantly undergoes change, meaning that if we were to record assets based on their present value, they would need to be updated practically every day.

Costs incurred for intramural activities, student publications, student clubs, and other student activities, are unallowable, unless specifically provided for in the Federal award. The continuing costs of ownership of the vacant former home after the settlement or lease date of the employee’s new permanent home, such as maintenance of buildings and grounds (exclusive of fixing-up expenses), utilities, taxes, and property insurance. Special emoluments, fringe benefits, and salary allowances incurred to attract professional personnel that do not meet the test of reasonableness or do not conform with the established practices of the non-Federal entity, are unallowable. Whether the service can be performed more economically by direct employment rather than contracting.

Asset Impairment Vs Historical Cost

That chapter includes excise taxes imposed in connection with qualified pension plans, welfare plans, deferred compensation plans, or other similar types of plans. Taxes on real or personal property, or on the value, use, possession or sale thereof, which is used solely in connection with work other than on Government contracts (see paragraph of this section). Items which the contract schedule specifically excludes, shall be allowable only as depreciation or amortization. For miscellaneous costs of the type discussed in paragraph of this subsection, a lump-sum amount, not to exceed $5,000, may be allowed in lieu of actual costs. The difference between the mortgage interest rates of the old and new residences times the current balance of the old mortgage times 3 years.

What are the two basic components of total cost?

It consists of variable costs and fixed costs. Total cost is the total opportunity cost of each factor of production as part of its fixed or variable costs. Calculating total cost: This graphs shows the relationship between fixed cost and variable cost. The sum of the two equal the total cost.

In 2006, Google bought YouTube for $1.65 billion as one of the most significant tech acquisitions in history. As per Cost Principal in the books of Google, the value of YouTube will be shown as $1.65 billion. Accounting PrinciplesAccounting principles are the set guidelines and rules issued by accounting standards like GAAP and IFRS for the companies to follow while recording and presenting the financial information in the books of accounts.

Book Value Of An Asset And Historical Cost

They are to be used in conjunction with the other provisions of this part in termination situations. Meet the definition of “direct cost” as described in the applicable cost principles.

Adjustments for normal wear and tear are usually recorded as annual depreciation, which is then subtracted from the historical cost to calculate the asset’s book value. The book value is an asset’s historical cost less any depreciation and impairment costs. Book value is calculated by subtracting depreciation or amortization from the original cost of that asset. The cost of intangible assets, like copyrights, patents, and trademarks, is recorded as the cost of producing the asset. For example, the cost you paid for someone to create a trademark for your business, added to the cost of having an attorney register the trademark, would be major parts of the cost of that trademark. The cost principle implies that you should not revalue an asset, even if its value has clearly appreciated over time.

The portion of such costs that exceeds the cost of airfare as provided for in paragraph of this section, is unallowable. Under some extraordinary circumstances, where it is in the best interest of the Federal Government and the non-Federal entity to establish alternative costing arrangements, such arrangements may be worked out with the Federal cognizant agency for indirect costs. Where the costs incurred for a service are not material, they may be allocated as indirect (F&A) costs. The costs of each service must consist normally of both its direct costs and its allocable share of all indirect (F&A) costs.

Characteristics Of The Cost Concept Of Accounting

A cost is allocable to a specific grant, function, department, or other component, known as a cost objective, if the goods or services involved are chargeable or assignable to that cost objective in accordance with the relative benefits received or other equitable relationship. A cost is allocable to a grant if it is incurred solely in order to advance work under the grant; it benefits both the grant and other work of the institution, including other grant-supported projects; or it is necessary to the overall operation of the organization and is deemed to be assignable, at least in part, to the grant. A cost is allocable as a direct cost Costs that can be identified specifically with a particular sponsored project, an instructional activity, or any other institutional activity, or that can be directly assigned to such activities relatively easily with a high degree of accuracy. To a grant if it is incurred solely in order to advance work under the grant or meets the criteria for closely related projects determination (see Cost Considerations-Allocation of Costs and Closely Related Work). This subpart provides the principles for determining the cost applicable to work performed by nonprofit organizations under contracts with the Government. Costs incurred by contractor personnel on official company business are allowable, subject to the limitations contained in this subsection.

What is cost center accounting in ERP?

You use Cost Center Accounting for controlling purposes within your organization. The costs incurred by your organization should be transparent. This enables you to check the profitability of individual functional areas and provide decision-making data for management.

The qualifications of the individual or concern rendering the service and the customary fees charged, especially on non-federally funded activities. The past pattern of such costs, particularly in the years prior to Federal awards. Costs of membership in any civic or community organization are allowable with prior approval by the Federal awarding agency or pass-through entity.

Should You Be Using The Cost Principle?

The costs of deferred compensation awards are unallowable if the awards are made in periods subsequent to the period when the work being remunerated was performed. Costs of bonding required by the contractor in the general conduct of its business are allowable to the extent that such bonding is in accordance with sound business practice and the rates and premiums are reasonable under the circumstances. “Advertising” means the use of media to promote the sale of products or services and to accomplish the activities referred to in paragraph of this subsection, regardless of the medium employed, when the advertiser has control over the form and content of what will appear, the media in which it will appear, and when it will appear. Advertising media include but are not limited to conventions, exhibits, free goods, samples, magazines, newspapers, trade papers, direct mail, dealer cards, window displays, outdoor advertising, radio, and television.

For individuals looking to take out homeowner insurance, they need to know the difference between replacement cost vs actual cash value. Short Term AssetsShort term assets are the assets that are highly liquid in nature and can be easily sold to realize money from the market. They have a maturity of fewer than 12 months and are highly tradable and marketable in nature. If a company wants to sell its asset at that time of selling, there can be some confusion arise, because the market value of that asset, at which company wants to sell, will be quite different than the book value of the asset. Since asset price will be changed over the years, so this method is not the accurate one as it is not showing the fair value of the asset.

This is not entirely the case under Generally Accepted Accounting Principles, which allows some adjustments to fair value. The cost principle is even less applicable under International Financial Reporting Standards, which not only permits revaluation to fair value, but also allows you to reverse an impairment charge if an asset subsequently appreciates in value. The cost principle is also known as the historical cost principle and the historical cost concept.

Costs incurred for the same purpose in like circumstances must be treated consistently as either direct or indirect costs. Where an institution treats a particular type of cost as a direct cost of sponsored awards, all costs incurred for the same purpose in like circumstances shall be treated as direct costs of all other activities of the institution. No final cost objective shall have allocated to it as a direct cost any cost, if other costs incurred for the same purpose in like circumstances have been included in any indirect cost pool to be allocated to that or any other final cost objective. All costs specifically identified with other final cost objectives of the contractor are direct costs of those cost objectives and are not to be charged to the contract directly or indirectly.

Historical Cost Principle Limitations

This provision does not restrict the authority of the Federal awarding agency to identify taxes where Federal participation is inappropriate. Where the identification of the amount of unallowable taxes would require an inordinate amount of effort, the cognizant agency for indirect costs may accept a reasonable approximation thereof. When conditions in paragraph and of this section are met, non-Federal entities are not required to establish records to support the allowability of claimed costs in addition to records already required or maintained.

The assets shall be segregated in the trust, or otherwise effectively restricted, so that they cannot be used by the employer for other purposes. Exclude Federal income taxes, whether incurred by the fund or the contractor , unless the fund holding the plan assets is tax-exempt under the provisions of 26 USC 501. Terminal funding occurs when the entire PRB liability is paid in a lump sum upon the termination of employees (or upon conversion to such a terminal-funded plan) to an insurer or trustee to establish and maintain a fund or reserve for the sole purpose of providing PRB to retirees. Any compensation represented by dividend payments or which is calculated based on dividend payments is unallowable. Any compensation which is calculated, or valued, based on changes in the price of corporate securities is unallowable.

- Except for nonqualified pension plans using the pay-as-you-go cost method, to be allowable in the current year, the contractor shall fund pension costs by the time set for filing of the Federal income tax return or any extension.

- Over the last five years, the Brazilian currency has been in double-digit inflation and the investment is not worth nearly what Bill paid for it.

- See the definition of indirect (facilities & administrative (F&A)) costs in § 200.1 of this part.

- Direct selling efforts are those acts or actions to induce particular customers to purchase particular products or services of the contractor.

- The allowance for operating costs may include costs for such items as fuel, filters, oil, and grease; servicing, repairs, and maintenance; and tire wear and repair.

An asset’s book value is a mathematical calculation, whereas its market value is based on perceived value in the market, which is generally based on supply and demand for such an asset. For example, the cost of the building and land, plus payments to a realtor and attorney to close the sale. The fact that everyone is using the same system makes it easier for everyone to know the exact value of business assets. The amount of depreciation or amortization is shown on the business income statement as an expense. An operating lease is a contract that permits the use of an asset but does not convey ownership rights of the asset. An impairment in accounting is a permanent reduction in the value of an asset to less than its carrying value. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Identification with the Federal award rather than the nature of the goods and services involved is the determining factor in distinguishing direct from indirect (F&A) costs of Federal awards. Typical costs charged directly to a Federal award are the compensation of employees who work on that award, their related fringe benefit costs, the costs of materials and other items of expense incurred for the Federal award. If directly related to a specific award, certain costs that otherwise would be treated as indirect costs may also be considered direct costs. Examples include extraordinary utility consumption, the cost of materials supplied from stock or services rendered by specialized facilities, program evaluation costs, or other institutional service operations. There is no universal rule for classifying certain costs as either direct or indirect (F&A) under every accounting system. A cost may be direct with respect to some specific service or function, but indirect with respect to the Federal award or other final cost objective. Therefore, it is essential that each item of cost incurred for the same purpose be treated consistently in like circumstances either as a direct or an indirect (F&A) cost in order to avoid possible double-charging of Federal awards.

The historical cost principle forms the foundation for an ongoing trade-off between usefulness and reliability of an asset. The value of an asset is likely to deviate from its original purchase price over time.

An asset’s market value is different than the amount recorded with the price principle. With the cost principle, you record the initial purchase amount in your accounting books for small business. When you buy assets for your small business, you need to account for them in your books. The cost principle is a simple method for managing the value of your long-term assets.

How To Create A Unique Instagram Aesthetic That Fits Your Brand

Content Creating An Attractive & Unique Aesthetic On Instagram & In Your Business (to Attract Millennials & Gen Z) Related Aesthetics Post Content That Reflects Your Brands Core Value Step 5 Dont Just Stop At Your Feed They make good use of one or two filters, post simple images, and show women living their best […]

Project Accounting Software

Amid rapid industry changes, professional services businesses still want to deliver great results on time and on budget, keeping customers happy and successful. Make that vision reality with best-in-class services automation and ERP from FinancialForce. Centralize revenue streams in a single revenue recognition and forecasting solution. Get …

Bookkeeping for hair stylist: Complete Self-Employed Hairdresser Bookkeeping Guide

With the help of salon accounting software solutions, it is also possible to acquire supplies online, manage staff schedules, and do other great deals. With information about your income, you can start to budget for your taxes. Depending on how much you make, you can determine what your tax bracket is and then budget how […]

How to Write a Business Plan: Step-by-Step Guide + Examples

Noah Parsons

24 min. read

Updated July 29, 2024

Writing a business plan doesn’t have to be complicated.

In this step-by-step guide, you’ll learn how to write a business plan that’s detailed enough to impress bankers and potential investors, while giving you the tools to start, run, and grow a successful business.

- The basics of business planning

If you’re reading this guide, then you already know why you need a business plan .

You understand that planning helps you:

- Raise money

- Grow strategically

- Keep your business on the right track

As you start to write your plan, it’s useful to zoom out and remember what a business plan is .

At its core, a business plan is an overview of the products and services you sell, and the customers that you sell to. It explains your business strategy: how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

Most business plans also include financial forecasts for the future. These set sales goals, budget for expenses, and predict profits and cash flow.

A good business plan is much more than just a document that you write once and forget about. It’s also a guide that helps you outline and achieve your goals.

After completing your plan, you can use it as a management tool to track your progress toward your goals. Updating and adjusting your forecasts and budgets as you go is one of the most important steps you can take to run a healthier, smarter business.

We’ll dive into how to use your plan later in this article.

There are many different types of plans , but we’ll go over the most common type here, which includes everything you need for an investor-ready plan. However, if you’re just starting out and are looking for something simpler—I recommend starting with a one-page business plan . It’s faster and easier to create.

It’s also the perfect place to start if you’re just figuring out your idea, or need a simple strategic plan to use inside your business.

Dig deeper : How to write a one-page business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- What to include in your business plan

Executive summary

The executive summary is an overview of your business and your plans. It comes first in your plan and is ideally just one to two pages. Most people write it last because it’s a summary of the complete business plan.

Ideally, the executive summary can act as a stand-alone document that covers the highlights of your detailed plan.

In fact, it’s common for investors to ask only for the executive summary when evaluating your business. If they like what they see in the executive summary, they’ll often follow up with a request for a complete plan, a pitch presentation , or more in-depth financial forecasts .

Your executive summary should include:

- A summary of the problem you are solving

- A description of your product or service

- An overview of your target market

- A brief description of your team

- A summary of your financials

- Your funding requirements (if you are raising money)

Dig Deeper: How to write an effective executive summary

Products and services description

This is where you describe exactly what you’re selling, and how it solves a problem for your target market. The best way to organize this part of your plan is to start by describing the problem that exists for your customers. After that, you can describe how you plan to solve that problem with your product or service.

This is usually called a problem and solution statement .

To truly showcase the value of your products and services, you need to craft a compelling narrative around your offerings. How will your product or service transform your customers’ lives or jobs? A strong narrative will draw in your readers.

This is also the part of the business plan to discuss any competitive advantages you may have, like specific intellectual property or patents that protect your product. If you have any initial sales, contracts, or other evidence that your product or service is likely to sell, include that information as well. It will show that your idea has traction , which can help convince readers that your plan has a high chance of success.

Market analysis

Your target market is a description of the type of people that you plan to sell to. You might even have multiple target markets, depending on your business.

A market analysis is the part of your plan where you bring together all of the information you know about your target market. Basically, it’s a thorough description of who your customers are and why they need what you’re selling. You’ll also include information about the growth of your market and your industry .

Try to be as specific as possible when you describe your market.

Include information such as age, income level, and location—these are what’s called “demographics.” If you can, also describe your market’s interests and habits as they relate to your business—these are “psychographics.”

Related: Target market examples

Essentially, you want to include any knowledge you have about your customers that is relevant to how your product or service is right for them. With a solid target market, it will be easier to create a sales and marketing plan that will reach your customers. That’s because you know who they are, what they like to do, and the best ways to reach them.

Next, provide any additional information you have about your market.

What is the size of your market ? Is the market growing or shrinking? Ideally, you’ll want to demonstrate that your market is growing over time, and also explain how your business is positioned to take advantage of any expected changes in your industry.

Dig Deeper: Learn how to write a market analysis

Competitive analysis

Part of defining your business opportunity is determining what your competitive advantage is. To do this effectively, you need to know as much about your competitors as your target customers.

Every business has some form of competition. If you don’t think you have competitors, then explore what alternatives there are in the market for your product or service.

For example: In the early years of cars, their main competition was horses. For social media, the early competition was reading books, watching TV, and talking on the phone.

A good competitive analysis fully lays out the competitive landscape and then explains how your business is different. Maybe your products are better made, or cheaper, or your customer service is superior. Maybe your competitive advantage is your location – a wide variety of factors can ultimately give you an advantage.

Dig Deeper: How to write a competitive analysis for your business plan

Marketing and sales plan

The marketing and sales plan covers how you will position your product or service in the market, the marketing channels and messaging you will use, and your sales tactics.

The best place to start with a marketing plan is with a positioning statement .

This explains how your business fits into the overall market, and how you will explain the advantages of your product or service to customers. You’ll use the information from your competitive analysis to help you with your positioning.

For example: You might position your company as the premium, most expensive but the highest quality option in the market. Or your positioning might focus on being locally owned and that shoppers support the local economy by buying your products.

Once you understand your positioning, you’ll bring this together with the information about your target market to create your marketing strategy .

This is how you plan to communicate your message to potential customers. Depending on who your customers are and how they purchase products like yours, you might use many different strategies, from social media advertising to creating a podcast. Your marketing plan is all about how your customers discover who you are and why they should consider your products and services.

While your marketing plan is about reaching your customers—your sales plan will describe the actual sales process once a customer has decided that they’re interested in what you have to offer.

If your business requires salespeople and a long sales process, describe that in this section. If your customers can “self-serve” and just make purchases quickly on your website, describe that process.

A good sales plan picks up where your marketing plan leaves off. The marketing plan brings customers in the door and the sales plan is how you close the deal.

Together, these specific plans paint a picture of how you will connect with your target audience, and how you will turn them into paying customers.

Dig deeper: What to include in your sales and marketing plan

Business operations

The operations section describes the necessary requirements for your business to run smoothly. It’s where you talk about how your business works and what day-to-day operations look like.

Depending on how your business is structured, your operations plan may include elements of the business like:

- Supply chain management

- Manufacturing processes

- Equipment and technology

- Distribution

Some businesses distribute their products and reach their customers through large retailers like Amazon.com, Walmart, Target, and grocery store chains.

These businesses should review how this part of their business works. The plan should discuss the logistics and costs of getting products onto store shelves and any potential hurdles the business may have to overcome.

If your business is much simpler than this, that’s OK. This section of your business plan can be either extremely short or more detailed, depending on the type of business you are building.

For businesses selling services, such as physical therapy or online software, you can use this section to describe the technology you’ll leverage, what goes into your service, and who you will partner with to deliver your services.

Dig Deeper: Learn how to write the operations chapter of your plan

Key milestones and metrics

Although it’s not required to complete your business plan, mapping out key business milestones and the metrics can be incredibly useful for measuring your success.

Good milestones clearly lay out the parameters of the task and set expectations for their execution. You’ll want to include:

- A description of each task

- The proposed due date

- Who is responsible for each task

If you have a budget, you can include projected costs to hit each milestone. You don’t need extensive project planning in this section—just list key milestones you want to hit and when you plan to hit them. This is your overall business roadmap.

Possible milestones might be:

- Website launch date

- Store or office opening date

- First significant sales

- Break even date

- Business licenses and approvals

You should also discuss the key numbers you will track to determine your success. Some common metrics worth tracking include:

- Conversion rates

- Customer acquisition costs

- Profit per customer

- Repeat purchases

It’s perfectly fine to start with just a few metrics and grow the number you are tracking over time. You also may find that some metrics simply aren’t relevant to your business and can narrow down what you’re tracking.

Dig Deeper: How to use milestones in your business plan

Organization and management team

Investors don’t just look for great ideas—they want to find great teams. Use this chapter to describe your current team and who you need to hire . You should also provide a quick overview of your location and history if you’re already up and running.

Briefly highlight the relevant experiences of each key team member in the company. It’s important to make the case for why yours is the right team to turn an idea into a reality.

Do they have the right industry experience and background? Have members of the team had entrepreneurial successes before?

If you still need to hire key team members, that’s OK. Just note those gaps in this section.

Your company overview should also include a summary of your company’s current business structure . The most common business structures include:

- Sole proprietor

- Partnership

Be sure to provide an overview of how the business is owned as well. Does each business partner own an equal portion of the business? How is ownership divided?

Potential lenders and investors will want to know the structure of the business before they will consider a loan or investment.

Dig Deeper: How to write about your company structure and team

Financial plan

Last, but certainly not least, is your financial plan chapter.

Entrepreneurs often find this section the most daunting. But, business financials for most startups are less complicated than you think, and a business degree is certainly not required to build a solid financial forecast.

A typical financial forecast in a business plan includes the following:

- Sales forecast : An estimate of the sales expected over a given period. You’ll break down your forecast into the key revenue streams that you expect to have.

- Expense budget : Your planned spending such as personnel costs , marketing expenses, and taxes.

- Profit & Loss : Brings together your sales and expenses and helps you calculate planned profits.

- Cash Flow : Shows how cash moves into and out of your business. It can predict how much cash you’ll have on hand at any given point in the future.

- Balance Sheet : A list of the assets, liabilities, and equity in your company. In short, it provides an overview of the financial health of your business.

A strong business plan will include a description of assumptions about the future, and potential risks that could impact the financial plan. Including those will be especially important if you’re writing a business plan to pursue a loan or other investment.

Dig Deeper: How to create financial forecasts and budgets

This is the place for additional data, charts, or other information that supports your plan.

Including an appendix can significantly enhance the credibility of your plan by showing readers that you’ve thoroughly considered the details of your business idea, and are backing your ideas up with solid data.

Just remember that the information in the appendix is meant to be supplementary. Your business plan should stand on its own, even if the reader skips this section.

Dig Deeper : What to include in your business plan appendix

Optional: Business plan cover page

Adding a business plan cover page can make your plan, and by extension your business, seem more professional in the eyes of potential investors, lenders, and partners. It serves as the introduction to your document and provides necessary contact information for stakeholders to reference.

Your cover page should be simple and include:

- Company logo

- Business name

- Value proposition (optional)

- Business plan title

- Completion and/or update date

- Address and contact information

- Confidentiality statement

Just remember, the cover page is optional. If you decide to include it, keep it very simple and only spend a short amount of time putting it together.

Dig Deeper: How to create a business plan cover page

How to use AI to help write your business plan

Generative AI tools such as ChatGPT can speed up the business plan writing process and help you think through concepts like market segmentation and competition. These tools are especially useful for taking ideas that you provide and converting them into polished text for your business plan.

The best way to use AI for your business plan is to leverage it as a collaborator , not a replacement for human creative thinking and ingenuity.

AI can come up with lots of ideas and act as a brainstorming partner. It’s up to you to filter through those ideas and figure out which ones are realistic enough to resonate with your customers.

There are pros and cons of using AI to help with your business plan . So, spend some time understanding how it can be most helpful before just outsourcing the job to AI.

Learn more: 10 AI prompts you need to write a business plan

- Writing tips and strategies

To help streamline the business plan writing process, here are a few tips and key questions to answer to make sure you get the most out of your plan and avoid common mistakes .

Determine why you are writing a business plan

Knowing why you are writing a business plan will determine your approach to your planning project.

For example: If you are writing a business plan for yourself, or just to use inside your own business , you can probably skip the section about your team and organizational structure.

If you’re raising money, you’ll want to spend more time explaining why you’re looking to raise the funds and exactly how you will use them.

Regardless of how you intend to use your business plan , think about why you are writing and what you’re trying to get out of the process before you begin.

Keep things concise

Probably the most important tip is to keep your business plan short and simple. There are no prizes for long business plans . The longer your plan is, the less likely people are to read it.

So focus on trimming things down to the essentials your readers need to know. Skip the extended, wordy descriptions and instead focus on creating a plan that is easy to read —using bullets and short sentences whenever possible.

Have someone review your business plan

Writing a business plan in a vacuum is never a good idea. Sometimes it’s helpful to zoom out and check if your plan makes sense to someone else. You also want to make sure that it’s easy to read and understand.

Don’t wait until your plan is “done” to get a second look. Start sharing your plan early, and find out from readers what questions your plan leaves unanswered. This early review cycle will help you spot shortcomings in your plan and address them quickly, rather than finding out about them right before you present your plan to a lender or investor.

If you need a more detailed review, you may want to explore hiring a professional plan writer to thoroughly examine it.

Use a free business plan template and business plan examples to get started