- Bachelor’s Degrees

- Master’s Degrees

- Doctorate Degrees

- Certificate Programs

- Nursing Degrees

- Cybersecurity

- Human Services

- Science & Mathematics

- Communication

- Liberal Arts

- Social Sciences

- Computer Science

- Admissions Overview

- Tuition and Financial Aid

- Incoming Freshman and Graduate Students

- Transfer Students

- Military Students

- International Students

- Early Access Program

- About Maryville

- Our Faculty

- Our Approach

- Our History

- Accreditation

- Tales of the Brave

- Student Support Overview

- Online Learning Tools

- Infographics

Home / Blog

History of Accounting: How It’s Evolved Over Time

October 4, 2022

Tables of Contents

History of Accounting

History of financial accounting, history of forensic accounting, modern accounting methods, history of accounting timeline, accounting: from clay tablets to computers.

Accounting has come a long way from its infancy, both in its practices and in the ways that it’s helped shape society.

Accounting’s earliest days may have come 12,000 years ago, when people likely traded resources while primarily surviving by hunting animals and gathering fruit. By comparison, accounting today involves various electronic processes and is responsible for billions of dollars in sales. The Business Research Company reports that the market size of the global accounting services industry was nearly $588 billion in 2021 and projects that it will increase to $1.7 trillion by 2031.

The changes to accounting since its first days have occurred alongside some of the biggest shifts in society, with the industry influencing responses to technological shifts, financial crises, and ethics questions. Understanding the history of accounting is key to understanding many facets of society’s shifts over time.

Gain a solid foundation in accounting principles, financial reporting, auditing and taxation

The online BS in accounting from Maryville University will equip you with the skills to excel in the world of finance. Graduate in as few as 2.5 years. No residencies or standardized test scores (SAT/ACT) required.

- Prepare for your certified public accountant exam.

- Develop critical-thinking capabilities, strong computer and analytical skills, and the ability to translate accounting into everyday language.

Accounting is the process of tracking financial information, providing a system for recording, verifying, analyzing, and reporting on transactions. In business, the term “accounting” refers to the tracking of income and expenses .

While the practice may have begun centuries earlier, accounting’s first official records are tax information on clay tablets from around 3300 B.C. Archaeologists discovered these artifacts in Egypt and the area that once was Mesopotamia. Around this time, historians believe, Egyptians were also using accounting to monitor their pharaoh’s possessions and uncover fraud.

Back To Top

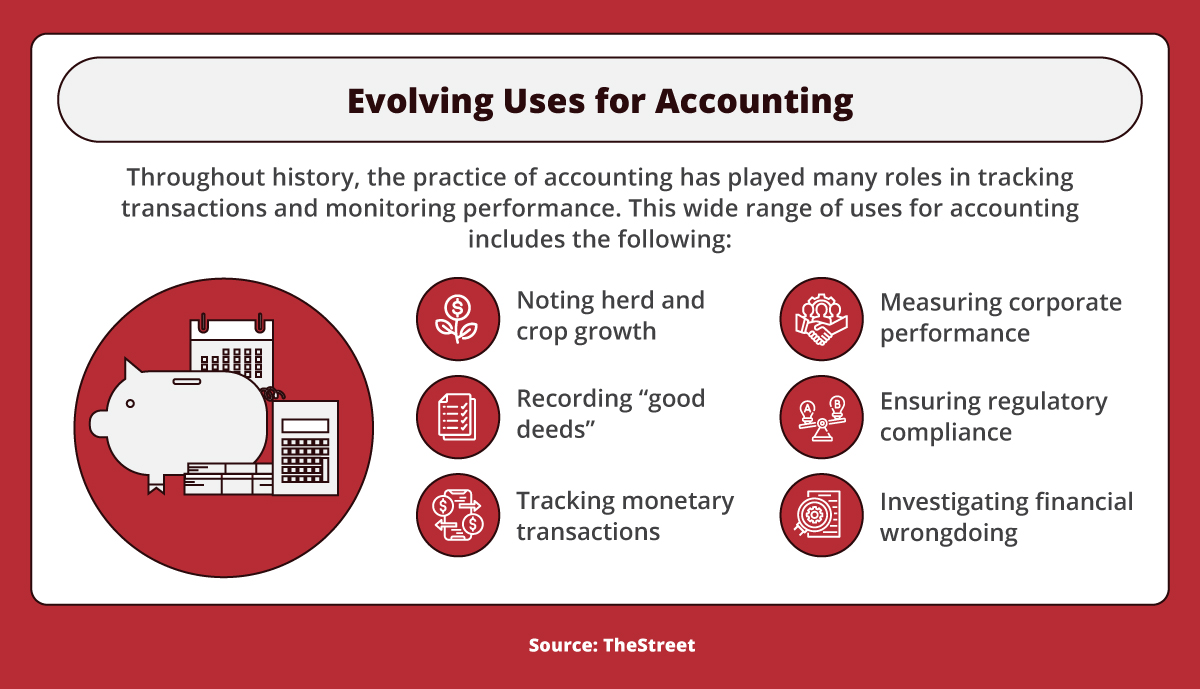

Throughout history, the practice of accounting has played many roles in tracking transactions and monitoring performance. This wide range of uses for accounting includes, according to TheStreet: noting herd and crop growth, recording “good deeds,” tracking monetary transactions, measuring corporate performance, ensuring regulatory compliance, and investigating financial wrongdoing.

Four Stages of Accounting History

The history of accounting incorporates four stages with distinct developments and processes. The first stage began in primitive times and ended in the 15th century, and the most recent stage began in 1951 and has lasted to the present. The stages follow:

The first stage of accounting dates to the primitive days of civilization. Although historians haven’t uncovered a record of accounting practices during this time, they point to the first exchange of goods or services as the likely start of some form of record keeping. This period lasted until 1494, with the publication of the first book to describe double-entry accounting, a system using debit and credit entries.

Accounting practices that took place during the overall historic periods within this time frame include the following:

- Stone age — Marking ticks on cave walls and mountains, and in the jungle to record goods collected and loaned

- Primitive — Noting symbols on walls and making rope knots to designate transactions

- Barter — Recording deals made through barter for agricultural or other property

- Currency — Tracking monetary transactions, originally in Europe, related to transactions that bank loans financed

Preanalytic

The period between 1495 and 1799 in the history of accounting is called the preanalytic period. This span of time saw the introduction of some key accounting concepts:

- Going concern — A business’s ability to stay afloat

- Periodic inventory — The practice of recording financial entries at the end of each given accounting period

- Money measurement — A system that records only transactions that have monetary value

Development

The development, or explanatory, period in accounting dates from 1800 to 1950. This time frame includes two key shifts in business, with the industrial revolution moving much of the world to a manufacturing-based economy and the emergence of joint-stock companies bringing multiple business shareholders to the table.

The impact of these changes and others in the development period includes the following:

- Industrial revolution — Required tracking the large amounts of capital involved in establishing new corporations and railroads

- Joint-stock companies — Added complexity to doing business, with the financial concerns of shareholders and other business partners becoming factors

- Government regulation — Led to the development of uniform accounting practices to accommodate tax laws

From 1951 to the present day, accounting has been in its modern period, with accounting methods continuing their shift to meet uniform standards. The growing demand for long-term financial forecasting led to calls for accounting methods that accurately report current finances and project future conditions.

To accommodate the need for true and fair reporting, the U.S. accounting industry adopted generally accepted accounting principles (GAAP). These rules, standards, and procedures dictate the way that the nation’s public companies compile and report financial statements.

Some key issues in the global economy drove accounting developments in this period as well, including the following:

- Stock market crash of 1929 — Led to the enforcement of accounting standards and the establishment of the U.S. Securities and Exchange Commission (SEC)

- Ethics investigations — Helped to shape the profession’s standards and oversight, following high-profile instances of illegal accounting practices ranging from gangster Al Capone to energy company Enron

Recognition of Accounting as a Profession

The recognition of accounting as a profession occurred with the first organizations focused on the career. Established in Scotland in 1854, the Institute of Accountants and Actuaries in Glasgow and the Edinburgh Society of Accountants were the first professional organizations for accountants. The groups’ members called themselves “chartered accountants,” and the Glasgow organization petitioned Queen Victoria for a royal charter recognizing the role as independent from solicitors, a legal profession.

The American Association of Public Accountants (AAPA) followed in 1887. In 1896, the first accountants took the standardized test that designated them as certified public accountants (CPAs). In 1957, the organization that awards the CPA designation became the American Institute of Certified Public Accountants (AICPA).

Financial accounting is a branch of accounting involving the recording, summarizing, and reporting of the many transactions related to business operations over a period of time. These materials typically assist accountants with compiling financial information for outside parties. To record these transactions, accounting professionals use financial statements, including the following:

- Balance sheet — Reports assets , liabilities, and shareholder equity

- Income statement — Notes revenue , expenses, gains, and losses

- Cash flow statement — Summarizes the movement of cash into and out of a company

History of Financial Accounting Practices

Tokens and bookkeeping are evident from the history of financial accounting’s earliest recorded days thousands of years ago — but it was in 1458 when Benedetto Cotrugli invented the double-entry accounting system that established the foundation for modern accounting. He was a merchant, an economist, a scientist, and a diplomat from what was then the Republic of Ragusa.

However, Luca Bartolomeo de Pacioli, who was an Italian mathematician and a Franciscan monk, became known as the father of accounting . His 1494 book, The Collected Knowledge of Arithmetic, Geometry, Proportion, and Proportionality , includes a 27-page section about bookkeeping. It describes the double-entry system that Venetian merchants used.

The book was also the first to use plus and minus signs.

The accounting system that de Pacioli outlined called for tracking assets, liability, capital, income, and expense accounts — similar to the entries that appear on modern balance sheets and income statements. He warned that individuals shouldn’t go to sleep at night until their debits matched their credits.

Evolution of Financial Accounting Technology

Tools and technology have further revolutionized financial accounting, with professionals in various industries inventing processes to speed bookkeeping. Advancements that changed financial accounting include the following:

Adding Machine

One of the earliest advances in financial accounting tools was in the 1880s, when American inventor William Burroughs invented the adding machine . This tool allowed accountants to calculate more accurately and efficiently than previous methods, such as tokens, clay balls, and abaci .

Spreadsheet Software

Introduced in 1978, VisiCalc was the first spreadsheet software to allow financial modeling on the computer. That same year saw Peachtree Software launch an accounting software package for the personal computer. These developments, along with the 1998 introduction of QuickBooks for day-to-day bookkeeping, made financial accounting tasks easier to perform than relying on mainframe computers.

Forensic accounting combines skills in accounting, auditing, and investigation to examine individuals’ or businesses’ finances. Forensic accounting often plays a role in legal proceedings in fraud and embezzlement cases, with uses in situations such as:

- Criminal investigations — Determining whether a crime occurred and identifying intent in cases such as employee theft or securities fraud

- Litigation support — Providing insight into the amount of damages to award in legal disputes

- Insurance claims — Using historical data to calculate economic damages from claims such as those for accidents or medical malpractice

Origins of Forensic Accounting

The earliest days of the history of accounting likely included forms of forensic accounting. Historians believe Egyptians monitored for fraud by tracking their kingdom’s possessions.

By the 1800s, accountants were serving as witnesses in court cases. In 1824, a Glasgow advertising circular was the first to refer to forensic accounting.

Some credit the understanding of fraud to a 1934 study by the authors of the book Principles of Criminolog y. However, Frank Wilson, an accountant for the IRS, may have played the biggest role in the history of forensic accounting. He established the modern version of forensic accounting when he helped convict Al Capone of tax evasion in the 1930s.

Today’s Financial Accounting

By the mid-1990s, forensic accounting had become its own distinct form of accounting. Regulations had placed much of the responsibility for anti-fraud protections in the hands of CPAs, with scandals in the financial world driving many of these new requirements.

For example, the savings and loan (S&L) crisis, which led to the failure of hundreds of savings and loan associations between 1986 and 1995, led Congress to pass the Financial Institutions Reform, Recovery, and Enforcement Act of 1989. The legislation revamped industry regulations to help curb the fraud that contributed to the crisis. Since that time in financial accounting history, forensic accounting has helped uncover financial inconsistencies that have led to scandals such as the following:

Enron Collapse

Enron became one of the fastest-growing U.S. companies in the 1990s — thanks in large part to hidden debt and bad assets . The company collapsed following a thorough review of financial statements that uncovered fraud.

The Sarbanes-Oxley Act of 2022, which reformed corporate financial practices, was a response to the Enron scandal .

Lehman Brothers Bankruptcy

Once the fourth-largest investment bank in the United States, Lehman Brothers grew through heavy reliance on high-risk real estate investments and subprime mortgages. Fiscal accounting following the bank’s downfall in 2008 revealed the depth of the problem.

The Lehman Brothers scandal led to the financial crisis of 2008. In response, the Dodd-Frank Wall Street Reform and Consumer Protection Act became law in 2010, with the aim of protecting consumers and taxpayers against risky bank investments.

Bernie Madoff Ponzi Scheme

Forensic accounting evidence first presented to the SEC in 2000 led to the 2009 arrest and conviction of American financier Bernie Madoff. His low-risk, high-return investment scheme defrauded thousands of investors out of billions of dollars over more than 15 years.

Traditional, or British, accounting is a high-level approach to recording transactions that was predominantly used early in accounting’s history. The modern, or American, method of accounting is a more in-depth look at financial numbers that helps business leaders:

- Access data

- Analyze trends

- Develop forecasts

- Strategize to gain an advantage over competitors

Most developed countries now use modern accounting methods, which also typically rely on electronic processes for greater speed and accuracy .

Traditional Accounting vs. Modern Accounting

Different categories and tools define the two primary approaches to accounting. Below are some distinctions between traditional and modern accounting.

Traditional Accounting

Traditional accounting uses three categories for tracking transactions. Personal accounts relate to a person or organization, while real and nominal accounts are considered impersonal accounts that aren’t for a specific individual or firm.

- Personal — Transactions related to a person, firm, company, or other organization

- Real — Accounts whose balances carry from one accounting period to the next

- Nominal — Accounts whose balances close at the end of each accounting period, starting the next period with a zero balance

Modern Accounting

Modern accounting divides financial data into additional categories , including the following:

- Assets — Items of value that a company owns

- Liabilities — Debts payable to outside entities

- Capital — The value of assets minus liabilities

- Revenue — Cash coming into the company because of its primary business activities

- Expenses — Amount spent on items or activities to generate revenue

- Withdrawals — Funds withdrawn by the business owner for personal use

Technology and Modern Accounting

Various technological tools assist in tracking the various types of transactions that modern accounting captures. With these tools providing an efficient way of generating figures, today’s accountants have more time to focus on analyzing trends and providing guidance that informs corporate strategies.

Modern accounting methods increasingly use the following tools and processes:

- Digital payments and systems — Electronically calculating and sharing financial information and analysis

- Cloud storage — Maintaining accounting data off-site for access by multiple individuals in an organization

- Artificial intelligence and machine learning — Quickly and accurately analyzing large volumes of data

- Blockchain — Assists in maintaining a ledger and safely transferring asset ownership

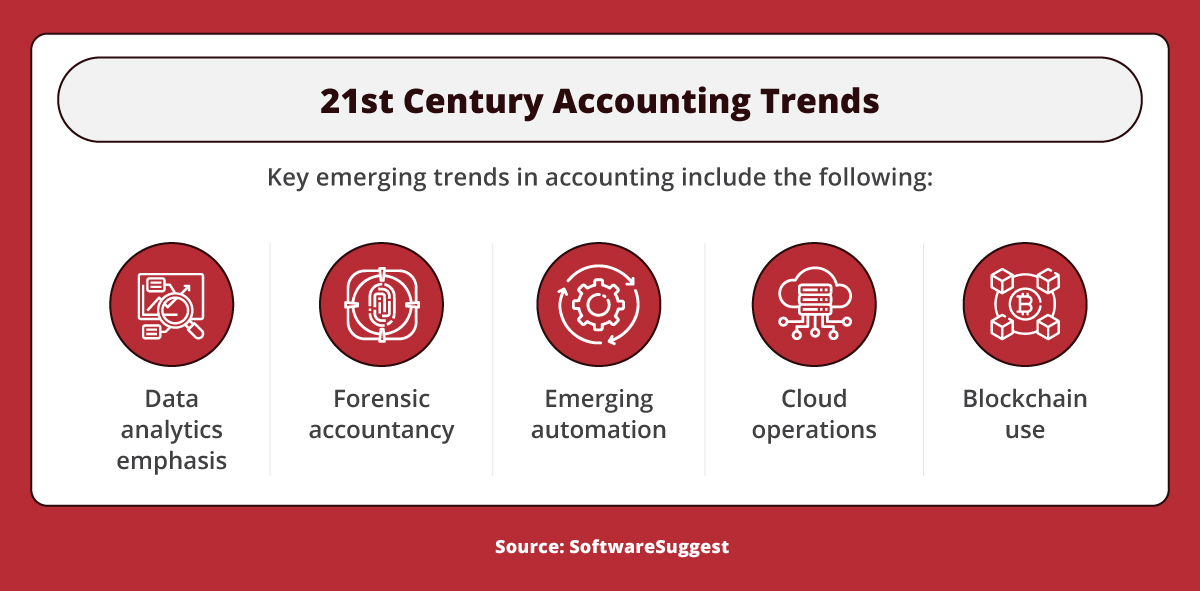

Key emerging trends in accounting, according to Software Suggest, include: data analytics emphasis, forensic accountancy, emerging automation, cloud-based operations, and blockchain use.

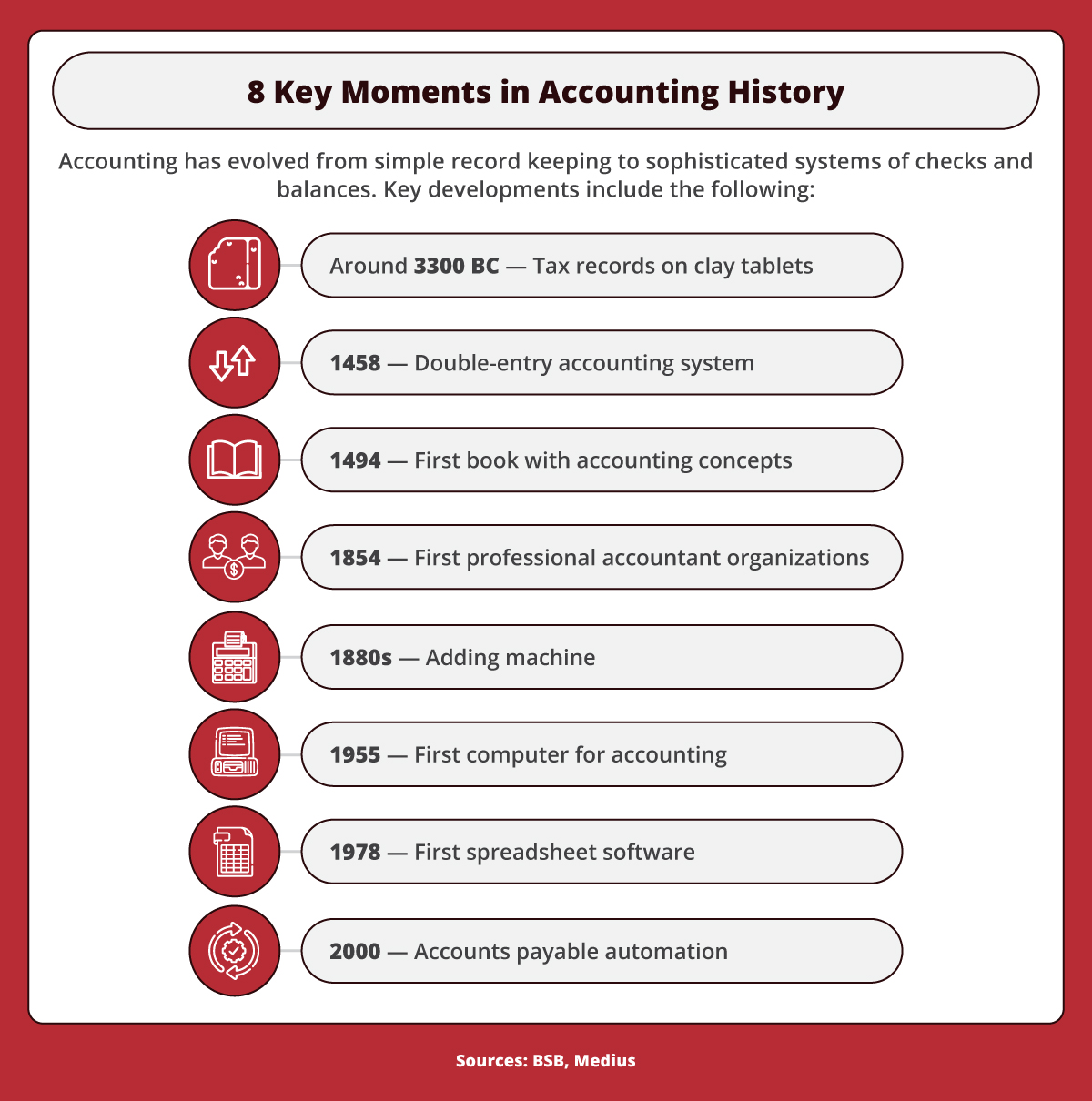

The history of accounting spans thousands of years, transforming from a simple recording of transactions to today’s complex system for recording, predicting, and investigating financial outcomes. The following history of accounting timeline includes highlights from the documented use of accounting:

- Circa 3300 B.C.: Earliest documented use of accounting . Artifacts show tax records on clay tablets.

- 1458: Invention of double-entry accounting method . Benedetto Cotrugli invented the double-entry accounting system, establishing the foundation for modern accounting.

- 1494: Publication of the first book describing the double-entry accounting method . Luca Bartolomeo de Pacioli, known as the father of accounting, published Summa de Arithmetica, Geometria, Proportioni et Proportionalita.

- 1854: Establishment of the first accounting professional organizations. The members of the Institute of Accountants and Actuaries in Glasgow and the Edinburgh Society of Accountants called themselves chartered accountants.

- 1880s: Invention of the adding machine. William Burroughs invented the adding machine, improving accounting’s speed and accuracy.

- 1930s: First high-profile use of forensic accounting. IRS accountant Frank Wilson uncovered financial irregularities that led to the arrest of Al Capone.

- 1955: First purchase of a computer for accounting use. General Electric made the first purchase of a computer to perform accounting functions such as payroll processing.

- 1978: Introduction of spreadsheet software. VisiCalc was the first spreadsheet software to allow financial modeling on the computer.

Accounting has evolved from simple record keeping to sophisticated systems of checks and balances. Key developments, according to BSC and Medius, include: Around 3300 B.C. — Tax records on clay tablets. 1458 — Double-entry accounting system. 1494 — First book with accounting concepts. 1854 — First professional accountant organizations. 1880s — Adding machine. 1955 — First computer for accounting. 1978 — First spreadsheet software. 2000 — Accounts payable automation.

Links to Learn More About Accounting

Accounting organizations offer resources that provide additional details about accounting and its background as well as jobs and certifications:

- Association of Chartered Certified Accountants — ACCA offers insights about the history and future of accounting for students, educators, and accountants.

- Association of Certified Fraud Examiners — The ACFE provides training, career resources, and the opportunity to pursue the Certified Fraud Examiner (CFE) designation.

- Association of International Certified Professional Accountants — AICPA offers exams for CPA and Chartered Global Management Accountant (CGMA) designations as well as resources on topics such as ethics, forensic services, and technology.

- American Accounting Association — The AAA caters to accounting professionals in the academic community by providing research, a newsletter, and a career center.

- Association of Nonprofit Accountants & Finance Professionals — ANAFP provides resources for accounting and finance professionals in the nonprofit sector, with materials about topics such as accounting and bookkeeping and tax returns.

- National Society of Accountants — NSA assists tax and accounting professionals with training, webinars, discount programs, and advocacy efforts.

From its earliest origins, accounting and the professionals who practice it have helped shape — and have been shaped by — some of the most influential events in global history. Those historical shifts continue today, with technology driving many of the latest developments in accounting, just as digital tools grow in importance throughout society. From maintaining balance sheets to investigating business records to analyzing financial data, accountants play a crucial role in business operations.

Infographic Sources

BSB, “Brief History of Accounting”

Medius, “The History of Accounting — from Record-Keeping to Artificial Intelligence”

Software Suggest, “13 Trends in Accounting for 2022 and Beyond”

TheStreet, “History of Accounting: Timeline”

Bring us your ambition and we’ll guide you along a personalized path to a quality education that’s designed to change your life.

Take Your Next Brave Step

Receive information about the benefits of our programs, the courses you'll take, and what you need to apply.

By using Homeworkdoer.org you agree to our use of cookies to improve your experience.

Call US: 1-646-453-6847

[email protected]

History of accounting

How did accounting come about, related service.

- Bookkeeping assignment help

- Financial accounting assignment help

- Managerial accounting assignment help

RELATED content

- What can you do with an Accounting degree?

- Tips on completing Accounting homework better

- Branches of Accounting

What is accounting?

Accounting is a profession that is used to make financial and business decisions or, if you like, a comprehensive and systematic recording of financial transactions that pertain to a business.

Origins of accounting

The art of accounting is said to have begun way back in time around 7,500 B.C when the Mesopotamians were using small clay objects to keep account of goods.

Accounting revolution

During the times of the Roman Empire, both military leaders and emperors were thought to have kept detailed records of all revenues and expenditures so as to better plan their activities with precision. However, come the medieval times, things change quite a bit with the emergence of the monetary economy hence making bookkeeping a tad more salient than ever before.

When medieval Europe moved toward a monetary economy in the 13th century, merchants at that time largely relied on bookkeeping to oversee multiple simultaneous financial transactions by bank loans. However, with the invention of the double entry system of accounting in 1458 by Benedetto Cotrugli accounting became even more revolutionised into an integral part of everyday business.

In the 19th century, the first modern accountants emerged as a sideline for solicitors and eventually as businessmen in their own rights.

Today, there is a plethora of professionals in the field with almost 150,000 chartered accountants in the UK alone who do just about any kind of financials from managing expenditures and incomes of large business enterprises to keeping track of their finances.

What does this mean for accountants in present-day age?

It's indubitable to see that accountants are now revolutionaries in the field and can strongly control the world. Here's how that paradigm shift has altered the lives of accountants and the lives of those touched by their brilliance.

- Accountants can now be able to establish their niche to target precise markets.

- There is now an evident symbiotic relationship between accountants and clients owing to the influence on business that has allowed them to flourish their businesses together.

Factors that accelerated the need for accounting

- The ability to accumulate personal wealth which then birthed the need to keep track of everything.

- The rise of ruling entities such as governments and royal families which brought about the need to have a consistent way of recording tax.

- The growth of global trade which could easily have led to losing track of activities without the help of detailed records

Thats all there is to accounting, if you would like to pay for accounting homework help, we are your best bet. You can submit your " do my college homework for me " request using the order now button below. Our services are genuine, affordable and reliable.

Dont compromise on quality. Our homework helpers can service all your academic needs perfectly.

The Brief History of Accounting [Notes with PDF]

What is the brief history of accounting.

If you want to learn something thoroughly, you must first learn about its past history. History provides a complete picture of every situation.

As a result, in this post, we will learn a brief history of accountin g so that you can quickly grasp and understand the history of accounting.

Accounting has evolved to its present state as a result of evolution and demand.

From the beginning of time until now, when the world’s civilization has developed and the method of production, trade and distribution of goods has been implemented, the accounting system has been introduced in its own unique way and context.

It is thought that sometime around 1340 , accounting was introduced between the ancient Chinese civilization, the Babylonian civilization, the Indian civilization, and the Egyptian civilization.

The origin and evolution of accounting have been divided into four stages:

1.Primitive Age or Development Period (Pre-1494):

The period from the dawn of civilization to 1494 has been classified as the development period or primitive age.

The era is further divided into four parts depending on the type of accounting system in use at the time:

People used to live in forests and mountain caves. Inside the cave, they collected the necessary food and carved it on the cave, or by drawing pictures or making marks on the rocks, to keep track of the number of fruits collected and the number of prey.

Basically, the foundation of accounting was laid from this calculation.

People left caves in the mountains and began living in a socialized environment in ancient times. As society grew, they did social work, farming, and other economic activities.

People used to cut the marks on the walls of their houses and tie the knots on the ropes, cut the marks on the bamboo, and save the accounts of their crops and livestock during this time period.

People began to adopt various occupations to earn a living as society evolved and the scope of human economic activities expanded.

Some chose farming as a profession, while others chose hunting or animal husbandry. The farmer requires meat, and the hunter requires grain. As a result, trade in goods began.

The exchange of goods marks a new milestone in the accounting process. This exchange was once saved by painting on earthen walls or carving on wooden doors.

In China at the time, a type of instrument known as an abacus was used in accounting.

During the hunting era, leather was used as currency. The professional merchant class did not emerge until after the invention of currency, and the currency was introduced as a medium of exchange.

2. Second Stage or Pre-Analytical Period (1494-1800):

The period from 1494 to 1800 is considered the Pre-Analytical Period. At the beginning of this century, trade flourished in the Italian port of Genoa.

With the expansion of trade and commerce comes the complexity of business trade and the need to apply specific policies in accounting.

In the last chapter of this book, he discovered the basic method of accounting or the formula for determining the debit credit of a transaction.

3. Third Stage or Analytical Period (1800-1950):

The period from 1800 to 1950 is considered the analysis phase. At this time the rationality of the working of the accountants was analyzed.

As a result, accounting research was started to solve these problems and new theories were discovered. Basically, the path of modern accounting started from this era.

4. Current or Modern Period (Post 1950):

The scope of accounting activities increases. In the changed situation, accounting is in great demand for information and various stakeholders are starting to rely on accounting for information.

You can also read:

Leave a Comment Cancel reply

History of Accounting From Ancient Times to Today

The Medieval and Renaissance Revolution of Bookkeeping

- Invention Timelines

- Famous Inventions

- Famous Inventors

- Patents & Trademarks

- Computers & The Internet

- American History

- African American History

- African History

- Ancient History and Culture

- Asian History

- European History

- Latin American History

- Medieval & Renaissance History

- Military History

- The 20th Century

- Women's History

Accounting is a system of recording and summarizing business and financial transactions. For as long as civilizations have been engaging in trade or organized systems of government, methods of record keeping, accounting, and accounting tools have been in use.

Some of the earliest known writings discovered by archaeologists are accounts of ancient tax records on clay tablets from Egypt and Mesopotamia dating back as early as 3300 to 2000 BCE. Historians hypothesize that the primary reason for the development of writing systems came out of a need to record trade and business transactions.

Accounting Revolution

When medieval Europe moved toward a monetary economy in the 13th century, merchants depended on bookkeeping to oversee multiple simultaneous transactions financed by bank loans.

In 1458 Benedetto Cotrugli invented the double-entry accounting system, which revolutionized accounting. Double-entry accounting is defined as any bookkeeping system that involves a debit and/or credit entry for transactions. Italian mathematician and Franciscan monk Luca Bartolomes Pacioli, who invented a system of record keeping that used a memorandum , journal, and ledger, wrote many books on accounting.

Father of Accounting

Born in 1445 in Tuscany, Pacioli is known today as the father of accounting and bookkeeping. He wrote Summa de Arithmetica, Geometria, Proportioni et Proportionalita ("The Collected Knowledge of Arithmetic, Geometry, Proportion, and Proportionality") in 1494, which included a 27-page treatise on bookkeeping. His book was one of the first published using the historical Gutenberg press , and the included treatise was the first known published work on the topic of double-entry bookkeeping.

One chapter of his book, " Particularis de Computis et Scripturis " ("Details of Calculation and Recording"), on the topic of record keeping and double-entry accounting, became the reference text and teaching tool on those subjects for the next several hundred years. The chapter educated readers about the use of journals and ledgers; accounting for assets, receivables, inventories, liabilities, capital, income and expenses; and keeping a balance sheet and an income statement.

After Luca Pacioli wrote his book, he was invited to teach mathematics at the Court of Duke Lodovico Maria Sforza in Milan. Artist and inventor Leonardo da Vinci were one of Pacioli's students. Pacioli and da Vinci became close friends. Da Vinci illustrated Pacioli's manuscript De Divina Proportione ("Of Divine Proportion"), and Pacioli taught da Vinci the mathematics of perspective and proportionality.

Chartered Accountants

The first professional organizations for accountants were established in Scotland in 1854, starting with the Edinburgh Society of Accountants and the Glasgow Institute of Accountants and Actuaries. The organizations were each granted a royal charter. Members of such organizations could call themselves "chartered accountants."

As companies proliferated, the demand for reliable accountancy shot up, and the profession rapidly became an integral part of the business and financial system. Organizations for chartered accountants now have been formed all over the world. In the U.S., the American Institute of Certified Public Accountants was established in 1887.

- Go Back in Time With This 1980s History Timeline

- Timeline of Invention Periods from the Middles Ages On

- Who Pioneered Robotics?

- Today in History: Inventions, Patents, and Copyrights

- History of Photography Timeline

- The History of the Odometer

- The Early History of Communication

- RADAR and Doppler RADAR: Invention and History

- The History of Early Fireworks and Fire Arrows

- History of the Bicycle

- Amazing 15th-Century Inventions

- History of Board Games, Playing Cards, and Puzzles

- Invention Highlights During the Middle Ages

- A Timeline of Events in Electromagnetism

- Timeline of IBM History

- History and Timeline of the Battery

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

The history of accounting in the United States The history of accounting in the United States Content

Jorge Yeshayahu Gonzales-Lara

Abstracts The objective of this article is to explain the historical development of accounting in the United States. Explain the changes during the twentieth century, and the twenty-first century with special emphasis on the last three decades. I hope this article illuminates the origins and consequences of these changes that collectively brought the profession to its current condition. This article reviews, examines and interprets events and developments in the evolution of the accounting profession of the USA UU. during the twentieth century so that one can judge "how we got where we are today. "While other historical works study the evolution of American accounting The history of accounting in the United States of America

Related Papers

Ezmir Shafiq

Prof. Oyedokun E M M A N U E L Godwin

History guides and shapes thinking in a particular phenomenon, evaluation of accounting thoughts has help in no small manner. Accounting theories which is the bed rock of accounting practice were also trace from the available works on history of accounting. This paper therefore seeks to review the history of accounting thoughts with respect to religion, numbers and economics using metal analysis methods. This study concluded that the place of numbers, religion and economics cannot be underestimated in functionality of accounting and accounting though. The higher institutions of learning, professional bodies and practicing accountants are encouraged to take the seriously the study of accounting history and development and the use of forensic accounting techniques is recommended for the prevention and detection of fraudulent accounting numbers.

Accounting, Business and Financial History

Alan Sangster

Research in Accounting Regulation

Rebecca Shortridge , Pamela Smith

Accounting History

Alan J . Richardson

Patrick Omagbon

This paper attempts to analyze the conceptual development of accounting vis-à-vis the evolution of cost accounting and management accounting from the general accounting system. It also looked into the evolution and promotion of international accounting bodies. The investigation so far revealed that the historical evolution of modern day accounting, from all evidence date to 1211 A.D. when Italian bank was said to have kept a complete double-entry books of accounts. In the light of this therefore, we concluded that the invention of double-entry bookkeeping cannot be ascribed to any individual.

Accounting, Organizations and Society, Vol. 38, 2013, pp. 72–91

Tim Murphy , Ciaran Hogartaigh

The International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB) recently published the final version of Chapter 1 of their joint Conceptual Framework for Financial Reporting (IASB/FASB, 2010). In this article, we focus on two of the key issues addressed in Chapter 1: stewardship and the definition of the primary user groups of financial statements. To address the discourses surrounding the evolution of Chapter 1, we introduce the concept of 'living law' from sociological jurisprudence into accounting scholarship. We first trace the role of stewardship/accountability in the evolution — from antiquity to the present day — of the living law of accounting. We then explore the origin, nature, and implications — from a living law perspective — of the moral traditions associated with stewardship/accountability. Our analysis suggests that stewardship has been, and continues to be, embedded in the living law of accounting — notwithstanding the formal pronouncements of standard setters. We also examine the social accounting project from a living law perspective and we suggest that such an analysis provides new possibilities for addressing core social accounting concerns. We conclude by arguing that, particularly in light of the far reaching impact of the neoliberal agenda, there is an urgent need for scholars in both contemporary 'social' and 'mainstream' accounting to recognize and build upon their shared living law heritage rooted in the age-old traditions of stewardship/accountability.

Michael Gaffikin

This paper describes the development of what has been regarded as accounting theory concentrating largely on that in the first 70 years of the 20th century. It demonstrates that a major motivation for this theory was the generally accepted belief in the need for greater conceptual rigour in accounting theory and research. A major part of this theorising was designed to solve a major accounting problem, viz accounting in periods of changing prices, notably inflation. In examining this early theorizing the paper describes the elements of theories and their use by academic theorists, practitioner theories and theories from various committees.

Journal of Accounting and Public Policy

Edward Ketz

Hamza Abubakar

Accounting frameworks follow stipulations of existing Accounting Theories. This exploratory research sets out to trace the evolution of accounting theories of Charge and Discharge Syndrome and the Corollary of Double Entry. Furthermore, it dives into the theories of Income Determination, garnishing it with areas of diversities in the use of Accounting Information while review of theories of recent growths and developments in Accounting are not left out. The method of research adopted is exploratory review of existing accounting literature. It is observed that the emergence of these theories exist to minimize fraud, errors, misappropriations and pilfering of Corporate assets. It is recommended that implementation prescriptions of these theories by International Financial Reporting Standard Committee and Practicing Accountants should be adhered to and simplified so as to avoid confusing and scandalous reporting of financial statements.

Loading Preview

Sorry, preview is currently unavailable. You can download the paper by clicking the button above.

RELATED PAPERS

AbdulFattah AbdulGaniyy

Nohora García

Yousef Abu Orabi

navjot kaur

chin sheyli

Ashish Khilnani

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

The global body for professional accountants

- Search jobs

- Find an accountant

- Technical activities

- Help & support

Can't find your location/region listed? Please visit our global website instead

- Middle East

- Cayman Islands

- Trinidad & Tobago

- Virgin Islands (British)

- United Kingdom

- Czech Republic

- United Arab Emirates

- Saudi Arabia

- State of Palestine

- Syrian Arab Republic

- South Africa

- Africa (other)

- Hong Kong SAR of China

- New Zealand

- Our qualifications

- Getting started

- Your career

- Sign-up to our industry newsletter

- Apply to become an ACCA student

- Why choose to study ACCA?

- ACCA accountancy qualifications

- Getting started with ACCA

- ACCA Learning

- Register your interest in ACCA

- Learn why you should hire ACCA members

- Why train your staff with ACCA?

- Recruit finance staff

- Train and develop finance talent

- Approved Employer programme

- Employer support

- Resources to help your organisation stay one step ahead

- Support for Approved Learning Partners

- Becoming an ACCA Approved Learning Partner

- Tutor support

- Computer-Based Exam (CBE) centres

- ACCA Content Partners

- Registered Learning Partner

- Exemption accreditation

- University partnerships

- Find tuition

- Virtual classroom support for learning partners

- ACCA Study Hub for learning providers

- Find CPD resources

- Your membership

- Member networks

- AB magazine

- Sectors and industries

- Regulation and standards

- Advocacy and mentoring

- Council, elections and AGM

- ACCA Foundation in Accountancy (FIA)

- Tuition and study options

- Study support resources

- Practical experience

- Our ethics modules

- Student Accountant

- Regulation and standards for students

- Your 2024 subscription

- Completing your EPSM

- Completing your PER

- Apply for membership

- Skills webinars

- Finding a great supervisor

- Choosing the right objectives for you

- Regularly recording your PER

- The next phase of your journey

- Your future once qualified

- Mentoring and networks

- Advance e-magazine

- Affiliate video support

- About policy and insights at ACCA

- Meet the team

- Global economics

- Professional accountants - the future

- Supporting the global profession

- Download the insights app

Can't find your location listed? Please visit our global website instead

- When did it all start?

- Student e-magazine

Everyone needs an accountant, or so the saying goes. But why would that be? Accounting’s history can be traced back thousands of years to the cradle of civilisation in Mesopotamia and is said to have developed alongside writing, counting and money. The early Egyptians and Babylonians created auditing systems, while the Romans collated detailed financial information

Some of the first accountants were employed around 300 BC in Iran, where tokens and bookkeeping scripts were discovered. Around the first millennium the Phoenicians invented an alphabetic system for bookkeeping, while the ancient Egyptians may have even assigned someone the role of comptroller.

Italian roots

But the father of modern accountancy is Italian Luca Pacioli, who in 1494 first described the system of double-entry bookkeeping used by Venetian merchants in his Summa de Arithmetica, Geometria, Proportioni et Proportionalita . While he was not the inventor of accounting, Pacioli was the first to describe the system of debits and credits in journals and ledgers that is still the basis of today's accounting systems.

With the onset of the industrial revolution in 1760, there was a proliferation of companies and the need for more advanced accounting systems. The development of corporations also created larger groups of investors and more complex structures of ownership, all requiring accounting systems to adapt.

Scotland modernises accounting

The modern profession also has its roots in Scotland in the mid-1800s when the Institute of Accountants in Glasgow petitioned Queen Victoria for a Royal Charter, so accountants could distinguish themselves from solicitors because, for a long time, accountants had belonged to associations of solicitors, which would offer accountancy in addition to a firm’s legal services. In 1854 the institute adopted ‘chartered accountant’ for its members, a term and demarcation that still carries legal weight globally today.

The petition was signed by 49 Glaswegian accountants and it argued that the accountancy profession had long existed in Scotland as a distinct profession of great respectability and that the small number of practitioners had been rapidly increasing. The petition further highlighted the varied skills required to be a professional accountant – in addition to mathematical skills, an accountant needed to be acquainted with general legal principles, as they were often employed by the courts to give evidence on financial matters – as they still are today.

Industrial revolution

By the mid-1800s, the industrial revolution in the UK was well under way and London was the financial centre of the world. With the growth of the limited liability company and large-scale manufacturing and logistics, demand surged for more technically proficient accountants capable of handling the growingly complex world of global transactions.

The increasing importance of accountants helped to transform accountancy into a profession, first in the UK and then in the US. In 1904 eight people formed the London Association of Accountants to open the profession to a wider audience of people than was available through the UK’s older associations. After several name changes the London Association of Accountants adopted the name the Association of Chartered Certified Accountants (ACCA) in 1996.

Importance of ethics

It’s not all been plain-sailing for the accountancy profession. The 21st century has seen some dubious actions by accountants causing large-scale scandals. The Enron scandals in 2001 shook the accountancy industry, for example. Arthur Andersen, one of the world’s largest accounting firms at the time, went out of business.

Subsequently, under the newly introduced Sarbanes-Oxley Act, accountants now face harsher restrictions on their consulting engagements. Yet ironically, since Enron and the financial crisis in 2008, accountants have been greatly in demand, as corporate regulations have increased and more expertise is required to fulfil reporting requirements.

"While he was not the inventor of accounting, Pacioli was the first to describe the system of debits and credits in journals and ledgers that is still the basis of today's accounting systems"

Related Links

- Student Accountant hub

Advertisement

- ACCA Careers

- ACCA Career Navigator

- ACCA Learning Community

Useful links

- Make a payment

- ACCA-X online courses

- ACCA Rulebook

- Work for us

Most popular

- Professional insights

- ACCA Qualification

- Member events and CPD

- Supporting Ukraine

- Past exam papers

Connect with us

Planned system updates.

- Accessibility

- Legal policies

- Data protection & cookies

- Advertising

- Library of Congress

- Research Guides

History of Accounting: A Resource Guide

Accounting practice.

- Introduction

- Accounting Industry and Profession

- Early History to 17th Century

- 18th and 19th Centuries

- Early 20th Century

- Accounting Firms and People

- Accounting and Auditing Periodicals

- Electronic Resources

- Search the Library's Catalog

- Using the Library of Congress

Another way to look at the history of accounting is to look at what has been written about the practice of accounting. There are many manuals, treatises, handbooks, and other similar material on accounting; and it is not possible to include them all. The focus here is on accounting much more so than bookkeeping and auditing, though some materials from both are included because they do overlap. If the goal is to see the advancement of accounting through these types of materials, doing a subject search and sorting by date may be a good way to see material in chronological order.

General Resources

The following general titles link to fuller bibliographic information in the Library of Congress Online Catalog . Links to digital content are provided when available. If you are looking for additional information also see the Search the Library's Catalog section of this guide .

- << Previous: Accounting Industry and Profession

- Next: Early History to 17th Century >>

- Last Updated: Jul 9, 2024 12:42 PM

- URL: https://guides.loc.gov/history-of-accounting

- Guide to Cost Accounting: History, ...

Guide to Cost Accounting: History, Purpose, and Examples

Table of Content

Join Our 100,000+ Community

Sign up for latest finance stories.

Key Takeaways

- Cost accounting is essential for businesses to analyze and control costs, enabling more informed decision-making and improved profitability.

- The primary purpose of cost accounting is to provide detailed cost insights that aid in budgeting, cost control, pricing strategies, and performance measurement.

- Automation helps businesses streamline their cost accounting processes, enhance accuracy, and improve financial decision-making.

Introduction

Cost accounting is a foundational aspect of financial management that plays a critical role in helping businesses understand and control their costs. By providing detailed insights into expenses incurred during production, operation, and other business activities, cost accounting helps businesses to make informed decisions, optimize processes, and enhance profitability.

In this blog, we will understand what cost accounting is, its key purposes, its formulas and types , with practical examples.

What is Cost Accounting?

Cost accounting is an accounting method that captures a company’s total production cost by assessing the variable and fixed costs involved in the production process. Utilized for internal purposes only, cost accounting assists the management in optimizing profitability through effective cost controls.

Cost accounting varies from financial accounting, which concentrates on the practice of preparing the reports to the shareholders, as it is internally focused and prepared for the management to aid them in decision-making pertaining to pricing, budgeting, and cost allocation.

It enables businesses to identify areas where costs can be reduced, efficiency can be enhanced, and hence profitability can be improved by analyzing costs incurred on different aspects of production. It is an essential tool for any company that wants to maintain competitiveness in a cost-sensitive market.

History of Cost Accounting

The early industrial revolution, when businesses were getting larger and more complicated, is where the origins of cost accounting lie. Cost accounting evolved over time to suit the dynamic needs of the expanding business enterprises. Early methods of cost accounting were a bit primitive, typically dealing with direct costs like materials and labor. However, this laid the foundation of more sophisticated methods of cost accounting.

During the 19th and 20th centuries, with the advent of mass production and the complexity of modern manufacturing processes, there was a demand for the development of more advanced techniques of cost accounting. With time, cost accounting underwent many innovations that helped businesses get better control over their operations and thus firmly established cost accounting as a crucial function within organizations.

What is the Purpose of Cost Accounting?

Cost accounting serves a broader role than merely tracing expenses. It gives a business an understanding of its underlying cost structure, which management may use to make a variety of decisions toward profitability. It provides detailed information about the spending of money and thus aids a company in improving its processes, developing proper pricing strategies, and ensuring efficient resource allocation. Some of the major areas where it plays an important role are:

Cost accounting provides detailed cost data that allows a business to arrive at an accurate scheme of budgeting. This ensures the efficient allocation of resources. It also helps in monitoring actual expenses against the budget, allowing for adjustments to be made in time.

Cost control

Cost accounting identifies areas for potential reduction in costs by analyzing them and helps the business put cost-saving measures in place. Constant monitoring of this nature makes sure that the organization remains competitive and profitable.

Profitability analysis

Cost accounting allows for the determination of profitability with respect to products, services, or business segments based on their revenues in relation to associated costs. This type of analysis will help a business concentrate on high-profitable areas and make appropriate decisions about resource allocation.

Performance measurement

It measures the efficiency of different departments, production processes, or business units by comparing the actual costs against standards or benchmarks. Hence, the evaluation allows the management to identify areas for improvement and achieve an increase in overall operational efficiency.

Cost accounting helps in the competitive and profitable pricing of products, as cost information is accurate. Therefore, it will ensure that the prices are such that they will cover all the costs while being attractive to customers.

Inventory valuation

Proper costing of inventory is needed for correct valuation in financial reporting and for purposes of taxation and this can be ensured through cost accounting. Accurate valuation aids in better financial statements and ensures compliance with the accounting standards.

Types of Costs in Cost Accounting

Proper knowledge of the various cost types in cost accounting forms the backbone of financial management in any business. Different types of costs are categorized based on their use and nature. . Classifying costs into direct, indirect, fixed, and variable costs allows organizations to have better knowledge of resource consumption and how to exercise better control over them.Some of the major types of costs are:

Direct costs

Any costs directly related to a particular product or service are considered direct costs; examples include raw materials and direct labor. Such costs, therefore, form the core base upon which the exact cost of production is to be calculated and priced appropriately.

Indirect costs

These are costs that cannot be traced directly to one particular product or service but are related to the general operation of the enterprise; hence, they have to be allocated among products or services for proper cost measurement to be made for profitability analysis.

Fixed costs

Costs that are relatively independent of the level of production; they remain constant even if nothing is produced. Examples include rent, salaries, and insurance. Knowing fixed costs helps a company know how much it has to sell to cover those expenses and maintain profitability, even when volumes vary.

Variable costs

These are costs that directly vary with the level of production. Examples of these include raw materials and direct labor. These differ from direct costs as they are variable in nature and are conditional to consumption. Variable costs must be managed if cost efficiency is to be maintained with increasing production.

Operating costs

Operating costs include both the fixed and variable costs that are crucial for the core business operations. It is therefore very important to monitor such costs in order to maintain operational efficiency and profitability.

Non-operating expenses

. Non-operating costs are not directly related to the core business operations but have an impact on the overall financial performance of any organization. Control over all these types of costs will ensure that the bottom line is healthy. Some examples of these costs are interest expenses and taxes.

Formulas for Cost Accounting

Cost accounting makes use of various formulas to quantify costs, assess profitability, and measure efficiency. These formulas are actually the fundamentals of cost analysis in the daily activities of a firm, facilitating businesses to make any decision with accuracy. From calculating the cost of goods sold to determining the break-even point, such knowledge is extremely necessary for the proper management of cost.

Cost of Goods Sold (COGS)

COGS = Opening Inventory + Purchases − Closing Inventory

Example: If a company starts with an inventory of $10,000, purchases $50,000 worth of goods, and ends with $5,000 in inventory, the COGS would be $55,000.

Overhead Rate

Overhead Rate = Total Overhead Costs / Total Direct Labor Hours

Example: If total overhead costs are $200,000 and the company has 10,000 direct labor hours, the overhead rate is $20 per labor hour.

Break-Even Point

Break-Even Point = Fixed Costs / Selling Price per Unit − Variable Cost per Unit

Example: If a product’s fixed costs are $100,000, the selling price per unit is $50, and the variable cost per unit is $30, the break-even point is 5,000 units.

Cost Accounting vs. Financial Accounting

Although important to a company’s financial management, cost accounting and financial accounting have different purposes and are used in different contexts. Cost accounting deals with the provision of internal information to top management about the detailed costs to help optimize operations. On the other hand, financial accounting is oriented more toward external reporting and gives only a summary of the organization’s overall financial performance for stakeholders like investors, regulators, and creditors. Some of the key differences between cost and financial accounting are:

| Aspect | Cost Accounting | Financial Accounting |

| Purpose | Cost accounting focuses on providing detailed cost information to help internal management make informed operational decisions and improve efficiency. | Financial accounting is geared towards producing financial statements that provide an overview of the company’s overall financial health for external stakeholders. |

| Focus | It delves deeply into the analysis of costs related to production, processes, and activities within the organization. | It emphasizes the broader financial performance and position of the company, summarizing revenues, expenses, and profitability. |

| Users | Primarily used by internal management for planning, controlling, and decision-making processes. | Used by external stakeholders like investors, creditors, and regulators to assess the company’s financial status and compliance. |

| Reporting Frequency | Reports can be generated as needed, often on a daily, weekly, or monthly basis, depending on the business’s requirements. | Reports are typically generated on a regular schedule, such as quarterly or annually, to meet external reporting and regulatory obligations. |

| Regulation | It is not governed by specific accounting standards, allowing flexibility to tailor reports to internal needs. | Strictly governed by accounting standards such as GAAP or IFRS to ensure consistency, accuracy, and comparability across financial statements. |

| Cost Classification | Provides a detailed breakdown of costs, including direct, indirect, fixed, and variable costs, to offer precise cost insights. | Generally categorizes costs into broad classifications like revenues, expenses, assets, and liabilities, providing an overall financial picture. |

| Inventory Valuation | Uses various costing methods like FIFO, LIFO, or weighted average to accurately allocate costs to inventory and assess profitability. | Typically follows standard inventory valuation methods to ensure consistency and comparability in financial reporting across periods. |

| Flexibility | Highly flexible, adapting to the specific needs of the business and its internal decision-making processes. | Less flexible due to the need to adhere to strict accounting standards and regulations, ensuring accurate and standardized financial reporting. |

Discover how AI can transform the record-to-report process for strategic insights!

Download Now

Examples of Cost Accounting

Cost accounting can be used in many industries and business contexts for accomplishing many tasks related to cost analysis and efficiency enhancement. Ranging from job order costing in manufacturing to activity-based costing in service industries, the examples of cost accounting denote its wide application. By examining these examples, businesses will be able to know exactly how cost accounting techniques can be tailored to their needs and operations.

Job order costing

Job order costing is applied to industries dealing with custom manufacturing and construction. For example, a manufacturer of custom furniture traces the cost of material, labor, and overheads to a particular job or piece of furniture. This way, the company will know the total amount of investment made in every piece of work and will set prices that will yield a profit while pinpointing cost overruns that are to be controlled.

Process costing

Process costing is adopted in those businesses where continuous goods are produced, generally in the food and beverage or chemical industries. For example, a soft drink company can employ the process costing technique over the various processes involved in its production process, beginning from processing the raw materials to bottling. It is then able to analyze the costs of every process, identify inefficiencies, reduce waste, and improve overall efficiency in its production.

Activity-based costing (ABC)

Activity-based costing is a costing method that is used to allocate overhead costs with a lot more accuracy by identifying the activities that drive the cost. For example, a technology company might want to understand the exact cost of its product lines using ABC. It will then attribute overheads on the use of resources by various activities like product design, marketing, and customer support. This is, therefore, a useful technique for the company for discovering high-cost problem areas and making strategic decisions to reduce costs and enhance profitability.

Standard costing

Standard costing refers to the development of expected costs of products based on predetermined standards of material, labor, and overhead. Therefore, a normal costing business may likely estimate standard costs for each of the products it manufactures. This will permit the business to compare the actual costs against such standards. Variances between standard and actual costs can then be analyzed to sift out areas where the company is overspending or underperforming, identifying areas that are crucial for more effective cost control.

Marginal costing

Another technique, marginal costing, is a variant of variable costing that focuses on those costs that change with output. It can be used to estimate the incremental cost of producing one more unit. This information is very useful for pricing decisions in very competitive markets, where it helps a company work out a minimum price that covers the variable costs and makes something toward covering fixed costs.

Minimizing Cost Accounting Efforts with Accounting Software

In today’s fast-moving environment, efficient cost accounting processes are required to drive efficiency and accuracy. Advanced accounting software automates a majority of cost accounting processes, reducing manual efforts required for data entry, and hence offering real-time insight into costs. This allows the accounts team to focus on strategic decision-making and higher-value activities.

Accounting software automates the tracking and classification of costs; hence, there is a minimal need for manual input and, this in turn, minimizes human errors. Automation enables organizations to use fewer resources to attain cost accounting accuracy.

Real-time reporting

Accounting software supports real-time reporting that provides the most updated cost data for use in decision-making enhancing its effectiveness. Such immediacy will enable businesses to proactively respond to changes in costs and help businesses keep control of their finances.

Integration

The advanced accounting software developed today integrates well with other business systems, like Enterprise Resource Planning, which gives an organization a single view of costs for better decision-making across all organizational levels. This enhances consistency in data and helps in thorough financial analysis.

Scalability

The accounting software is designed to expand proportionately with the business without any deterioration in performance and can, therefore, sustain the handling of increased volumes of data with a more complex cost structure. This way, scalability makes sure that the software remains relevant to an organization’s requirements while it evolves.

How HighRadius Can Help?

HighRadius offers a cloud-based Record to Report solution that helps accounting professionals streamline and automate the financial close process for businesses. We have helped accounting teams from around the globe with month-end closing, reconciliations, journal entry management, intercompany accounting, and financial reporting.

Our Financial Close Software is designed to create detailed month-end close plans with specific close tasks that can be assigned to various accounting professionals, reducing the month-end close time by 30%. The workspace is connected and allows users to assign and track tasks for each close task category for input, review, and approval with the stakeholders. It allows users to extract and ingest data automatically, and use formulas on the data to process and transform it.

Our Account Reconciliation Software provides an out-of-the-box formula set that can configure matching rules and match line-level transactions from multiple data sources and create templates to automate various transaction processing required for month-end close. Our solution has the ability to record transactions, which will be automatically posted into the ERP, automating 70% of your account reconciliation process.

Our AI-powered Anomaly Management Software helps accounting professionals identify and rectify potential ‘Errors and Omissions’ on a daily basis so that precious resources are not wasted during month close. It automates the feedback loop for improved anomaly detection and reduction of false positives over time. We empower accounting teams to work more efficiently, accurately, and collaboratively, enabling them to add greater value to their organizations’ accounting processes.

1) What do you mean by cost accounting?

Cost accounting is a financial process that tracks, analyzes, and reports a company’s production costs. It helps businesses understand their cost structures, optimize operations, and make informed decisions about pricing, budgeting, and resource allocation.

2) Explain what is cost accounting with an example?

Cost accounting involves assigning costs to specific activities, products, or services to determine profitability. For example, a custom furniture maker might use job order costing to track the materials, labor, and overhead costs for each piece, ensuring accurate pricing and cost control.

3) What are the four types of costs?

The four main types of costs in cost accounting are direct costs, which can be traced to specific products; indirect costs, such as overhead; fixed costs, which remain constant regardless of production levels; and variable costs, which fluctuate with production volume.

4) What are the advantages of cost accounting?

Cost accounting offers several advantages, including enhanced cost control, better decision-making through detailed cost analysis, improved pricing strategies, and increased profitability by identifying inefficiencies and areas for cost reduction within the organization.

5) What is accounting cost?

Accounting cost, also known as explicit cost, refers to the actual expenses a business incurs during its operations, including wages, rent, utilities, and materials. These costs are recorded in financial statements and are essential for determining profitability and budgeting.

Related Resources

6 Steps for Hassle Free Payroll Reconciliation in Accounting

6 Impactful Use Cases of Robotic Process Automation in Finance and Accounting

A CFO’s Guide to Maximizing Financial Success with SMART Goals

Streamline your order-to-cash operations with highradius.

Automate invoicing, collections, deduction, and credit risk management with our AI-powered AR suite and experience enhanced cash flow and lower DSO & bad debt

HighRadius Autonomous Accounting Application consists of End-to-end Financial Close Automation , AI-powered Anomaly Detection and Account Reconciliation , and Connected Workspaces. Delivered as SaaS, our solutions seamlessly integrate bi-directionally with multiple systems including ERPs, HR, CRM, Payroll, and banks. Autonomous Accounting proactively identifies errors as they happen, provides the project management specifically designed for month end close to manage, monitor, and document the successful completion of tasks, including posting adjusting journal entries, and provides a document repository to support each month’s close process and support the financial audit.

Please fill in the details below

Get the hottest Accounts Receivable stories

Delivered straight to your inbox.

- Order To Cash

- Collections Management

- Cash Application Management

- Deductions Management

- Credit Management

- Electronic Invoicing

- B2B Payments

- Payment Gateway

- Surcharge Management

- Interchange Fee Optimizer

- Payment Gateway For SAP

- Record To Report

- Financial Close Management

- Account Reconciliation

- Anomaly Management

- Accounts Payable Automation

- Treasury & Risk

- Cash Management

- Cash Forecasting

- Treasury Payments

- Learn & Transform

- Whitepapers

- Courses & Certifications

- Why Choose Us

- Data Sheets

- Case Studies

- Analyst Reports

- Integration Capabilities

- Partner Ecosystem

- Speed to Value

- Company Overview

- Leadership Team

- Upcoming Events

- Schedule a Demo

- Privacy Policy

HighRadius Corporation 2107 CityWest Blvd, Suite 1100, Houston, TX 77042

We have seen financial services costs decline by $2.5M while the volume, quality, and productivity increase.

Colleen Zdrojewski

Trusted By 800+ Global Businesses

IMAGES

VIDEO

COMMENTS

History of Accounting. Accounting has a long history. Double entry bookkeeping—debits on the left, credits on the right—began hundreds of years ago. It was first codified in the 15th Century by a Franciscan monk named Luca Bartolomes Pacioli. His work was built on that of another Italian scholar, Benedetto Cotrugli. The extent to which ...

A Japanese man writing in a ledger with the help of a soroban (abacus). Meiji period, 1914. The history of accounting or accountancy can be traced to ancient civilizations. [1] [2] [3]The early development of accounting dates to ancient Mesopotamia, and is closely related to developments in writing, counting and money [1] [4] [5] and early auditing systems by the ancient Egyptians and ...

Reading assignment - History of Accounting - Free download as Word Doc (.doc / .docx), PDF File (.pdf), Text File (.txt) or read online for free. Accounting originated over 5,300 years ago with ancient civilizations like Egypt and Mesopotamia keeping records of goods in warehouses and using early counting systems. Double-entry bookkeeping was established in 14th century Italy by Luca Pacioli ...

The origin of accounting began in the 15th century. An Italian monk, Luca Pacioli, is regarded as the father of accounting for his involvement in the origin of accounting. He recreated the common ...

Accounting has come a long way from its infancy, both in its practices and in the ways that it's helped shape society. Accounting's earliest days may have come 12,000 years ago, when people likely traded resources open_in_new while primarily surviving by hunting animals and gathering fruit. By comparison, accounting today involves various ...

Well, accounting is also as old as they come and can be traced back to thousands of years ago. In fact, the early development of accounting dates back to ancient Mesopotamia alongside other developments in money, writing, early auditing systems and counting. In this article, we are going to explore the origins of accounting and how it gradually ...

The origin and evolution of accounting have been divided into four stages: Primitive Age, or Development Period (Pre-1494) Second Stage, or Pre-Analytical Period (1494-1800) Third Stage, or Analytical Period (1800-1950) Current or Modern Period (Post 1950) The graphical presentation of the brief history of accounting is as follows:

In 1458 Benedetto Cotrugli invented the double-entry accounting system, which revolutionized accounting. Double-entry accounting is defined as any bookkeeping system that involves a debit and/or credit entry for transactions. Italian mathematician and Franciscan monk Luca Bartolomes Pacioli, who invented a system of record keeping that used a ...

Jan Ympyn Christoffel is considered to be the author of the second book in accounting published in English. This particular edition is a reprint. The first book was "A Profitable Treatyce" by Hugh Oldcastle. This book contains a reproduction of the second accounting book in English, as well as an explanation of Ympyn's other works and history.

History of Accounting: A Resource Guide. This guide provides access to materials for researching the history and development of the accounting profession and practice. It highlights print materials in the Library of Congress collections, subscription databases, and other online resources.

The rising public status of accountants helped to accounting into a powerful profession. In 1887, 31 accountants gathered in New York City to form the first accounting organization: the American Association of Public Accountants (AAPA). The. H I S T O R Y O F T H E A C C O U N T I N G P R O F E S S I O N.

Studying theories of accounting exposes students to various issues, including o How elements of accounting should be measured; o Motivation for organisations to provide certain types of accounting information; o Motivation for individuals to support or lobby regulators for some accounting methods in preference to others; o The implications for ...

History of Accounting - Free download as PDF File (.pdf), Text File (.txt) or read online for free. Accounting has evolved over thousands of years in response to social and economic needs. It began as simple record keeping of exchanges and evolved with developments like double entry bookkeeping in 14th century Italy. Major milestones included the French Revolution spurring accounting theory ...

This document provides a history and overview of the development of accounting and accounting theory. It discusses how accounting originated in ancient civilizations and the earliest surviving business records date back to 3000BC. It then covers key developments like the first description of double-entry bookkeeping in 1494 by Luca Pacioli. The document outlines the historical, normative, and ...

It also contains a brief summary of the history of accounting books and its authors. Editions were also printed in 1891, 1895, 1903, 1906, and 1911. Sourcebook on Accounting Principles and Auditing Procedures, 1917-1953 by Stephen A. Zeff & Maurice Moonitz (ed) Call Number: HF5616.U5 S68 1984.

Accounting theories which is the bed rock of accounting practice were also trace from the available works on history of accounting. This paper therefore seeks to review the history of accounting thoughts with respect to religion, numbers and economics using metal analysis methods.

A part of accounting that involves only the recording of economic events. 7000 BC. -Tiger Euphrates Valley. -stone tablets-> how basic arithmetic was done-> system. 600 BC. -Greeks-> created coins-> faster mode of exchange-> economic industry flourished-> nearing countries adapted. Middle Ages. -most contributions made-> merchants formed ...

It includes many general business titles including Business History Review (1954-2008) as well as a few accounting specific titles like The Accounting Historians Journal (1974-2010), The Accounting Review (1926-2008), and the Journal of Accounting Research (1963-2008).

Accounting's history can be traced back thousands of years to the cradle of civilisation in Mesopotamia and is said to have developed alongside writing, counting and money. The early Egyptians and Babylonians created auditing systems, while the Romans collated detailed financial information.

Assignment for History of Accounting - Free download as Word Doc (.doc / .docx), PDF File (.pdf), Text File (.txt) or read online for free. This document discusses the history of accounting. It begins with early civilizations using tokens to record commodities traded, establishing some of the earliest forms of accounting in Mesopotamia. It then discusses the evolution of accounting in ancient ...

Disclaimer: This assignment is provided as an example of work produced by students studying towards a degree, ... Accounting has the long history that runs over large number of past centuries. By now, the accounting profession has developed over those centuries and has a good status within the modern economy. Therefore, nowadays accounting ...